Gold Bull Market Outlook And Targets: 5000 USD/7500 USD

-

Gold Bull Markets Long Term Overview and 2025 Market Update

Gold Bull Markets Long Term Overview and 2025 Market Update

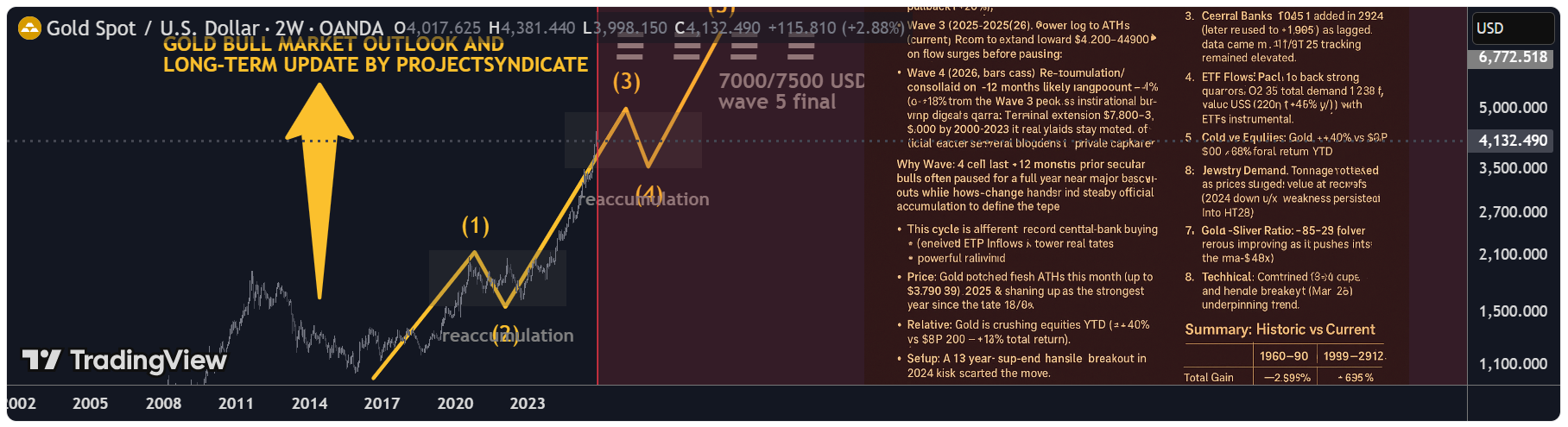

Five-Wave Roadmap — Targets & Timing

Five-Wave Roadmap — Targets & Timing• Wave 1 (2016–2020): From ~$1,050–1,200 to the COVID-era spike; established secular up-trend.

• Wave 2 (2020–2022): Consolidation/corrective pullback (~–20%).

• Wave 3 (2023–2025/26): Power leg to ATHs (current). Room to extend toward $4,200–$4,500 on flow surges before pausing.

• Wave 4 (2026, base case): Re-accumulation/consolidation ~12 months; likely range-bound –10% to –15% from the Wave-3 peak as institutional buying digests gains.

• Wave 5 (2027–2030/32): Final thrust to the cycle’s terminal zone:

– First objective: $5,000–$5,500 (consistent with 2026 Street “bull wave” scenarios).

– Terminal extension: $7,500–$8,000 by 2030–2032 (our desk’s stretch path if real yields stay muted, official-sector demand persists, and private capital rotation broadens).

Why Wave-4 can last ~12 months: prior secular bulls often paused for a full year near major breakouts while flows “change hands.” Expect lower realized vol, fading retail FOMO, and steady official accumulation to define the tape. Top 10 Stats of the Current Bull 2025

Top 10 Stats of the Current Bull 2025- Price & ATHs: Spot ~$3.75–$3.79k; fresh ATH $3,790.82 on Sep 23, 2025.

- 2025 YTD: Roughly +40–43% YTD

- Central Banks: 1,045 t added in 2024 (later revised to ~1,086 t as lagged data came in). H1/Q1’25 tracking remained elevated.

- ETF Flows: Back-to-back strong quarters; Q2’25 total demand 1,249 t, value US$132bn (+45% y/y) with ETFs instrumental.

- Gold vs Equities: Gold ≈+40% vs S&P 500 ≈+13% total return YTD.

- Jewelry Demand: Tonnage softened as prices surged; value at records (2024 down y/y; weakness persisted into H1’25).

- Gold–Silver Ratio: ~85–88 (silver torque improving as it pushes into the mid-$40s).

- Macro Link: Safe-haven bid + expected policy easing keep real-yield headwinds contained.

- Technical: Confirmed 13-yr cup-and-handle breakout (Mar ’24) underpinning trend.

- Street Forecasts: GS baseline $4,000 by mid-’26; bulled-up houses (HSBC/BofA) flag $4.9–$5.0k potential into 2026 if private/ETF rotation persists.

• This cycle is different: record central-bank buying + renewed ETF inflows + lower real rates = powerful tailwind.

• Price: Gold notched fresh ATHs this month (up to $3,790.82). 2025 is shaping up as the strongest year since the late 1970s.

• Relative: Gold is crushing equities YTD (≈+40% vs S&P 500 ≈+13% total return).

• Setup: A 13-year “cup-and-handle” breakout in 2024 kick-started the move.

• Outlook: Street base cases cluster near $4,000 by mid-’26; several houses now publish $4,900–$5,000 stretch targets into 2026 as flows accelerate. -

Gold’s resilience under inflation pressure makes higher valuation targets increasingly realistic.