Gold next week: Key S/R Levels and Outlook for Traders

-

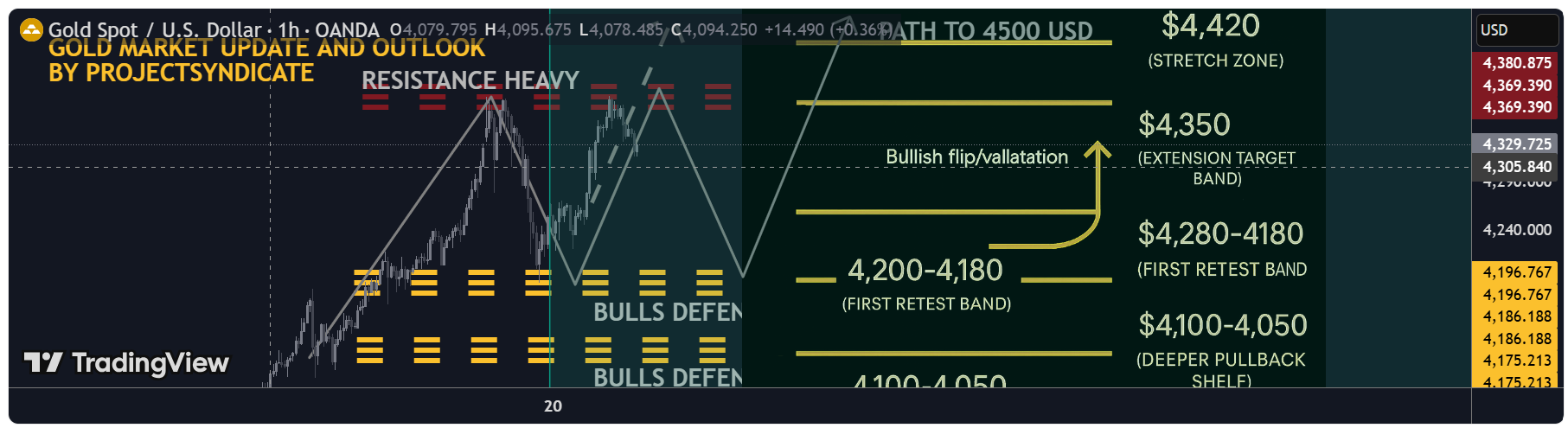

GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE

GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE High/Close: $4,379 → ~$4,252 — higher close vs. last week’s pullback finish.

High/Close: $4,379 → ~$4,252 — higher close vs. last week’s pullback finish.

Trend: Uptrend intact > $4,000; dip buyers continue to control rhythm.

Trend: Uptrend intact > $4,000; dip buyers continue to control rhythm.

Supports: $4,180–$4,140 → $4,100–$4,050 → $4,000 must hold.

Supports: $4,180–$4,140 → $4,100–$4,050 → $4,000 must hold.

Resistances: $4,260 / $4,300 / $4,350 → stretch $4,380–$4,420.

Resistances: $4,260 / $4,300 / $4,350 → stretch $4,380–$4,420.

🧭 Bias next week: Buy-the-dip > $4,140–$4,200; momentum regain targets $4,300–$4,380+. Invalidation < $4,050 → risk $4,000/3,980. Macro tailwinds:

Macro tailwinds:• Fed: Markets lean to another cut into Oct 28–29; softer real yields buoy gold.

• FX: DXY under pressure = constructive backdrop.

• Flows: ETF interest & CB buying remain supportive on dips.

• Geopolitics: Tariff/trade and regional risks keep safe-haven bids live. Street view: Several houses float $5,000/oz by 2026 scenarios on easing policy & reserve diversification narratives

Street view: Several houses float $5,000/oz by 2026 scenarios on easing policy & reserve diversification narratives

Key Resistance Zones

Key Resistance Zones• $4,260–$4,280 near-ATH supply / immediate ceiling from close

• $4,300–$4,350 extension target band

• $4,380–$4,420 stretch zone toward prior spike high and measured extensions Support Zones

Support Zones• $4,220–$4,200 first retest band just below close

• $4,180–$4,140

• $4,100–$4,050 deeper pullback shelf; $4,000 remains the big psych

️ Base Case Scenario

️ Base Case ScenarioExpect shallow pullbacks into $4,220–$4,140 to be bought, followed by rotation back into the $4,260–$4,300 resistance stack for an ATH retest.

Breakout Trigger

Breakout TriggerA sustained push/acceptance > ~$4,280 unlocks $4,300 → $4,350, with room toward $4,380–$4,420 if momentum persists.

Market Drivers

Market Drivers• Fed cut expectations into late Oct(lower real yields = gold tailwind

• USD softness / DXY sub-100 tone supports metals

• Ongoing central-bank bullion demand; ETF inflows stabilizing

• Geopolitics & trade/tariff headlines keeping safety bids active Bull / Bear Trigger Lines

Bull / Bear Trigger Lines• Bullish above: $4,140–$4,200

• Bearish below: $4,100–$4,050 risk expands under $4,000🧭 Strategy

Accumulate dips above $4,140–$4,200.

On breakout > $4,280, target $4,300–$4,350+. Maintain tight risk under stepped supports; invalidate momentum below $4,050–$4,000. -

Traders should watch macro catalysts like U.S. CPI data for momentum in gold’s next swing move.