Bitcoin ETFs Just Crossed $50B — And BlackRock’s Raking It In

-

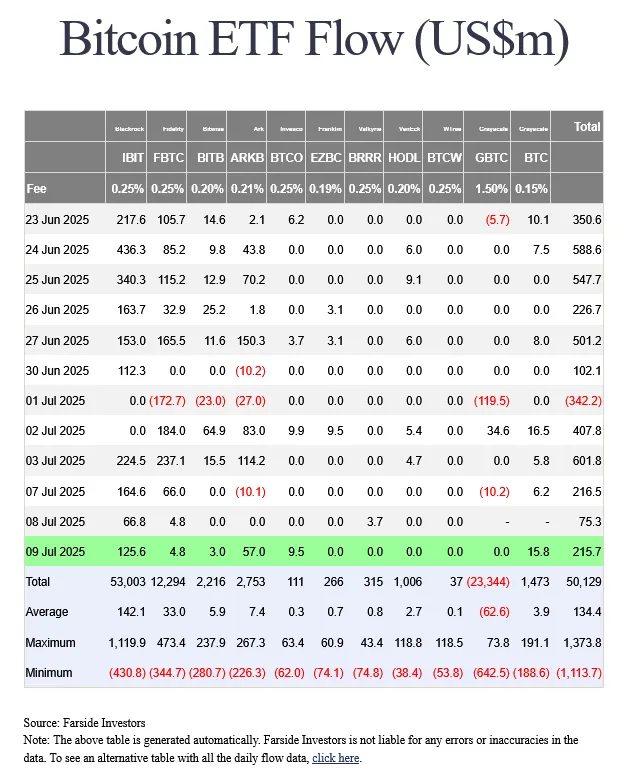

Welp, it's official — Bitcoin investors in the U.S. have poured over $50 billion into spot ETFs, and it only took 18 months since their launch in January 2024. That’s one serious flex for Team BTC.

Who’s Leading the Pack?

Unsurprisingly, the titans are crushing it:

BlackRock’s IBIT has pulled in a massive $53B (yes, more than the entire sector combined)

BlackRock’s IBIT has pulled in a massive $53B (yes, more than the entire sector combined)

Fidelity’s FBTC came in second with a solid $12.29B

Fidelity’s FBTC came in second with a solid $12.29BMeanwhile…

Grayscale’s GBTC saw a net outflow of $23.34B, as many investors bailed ship and moved to cheaper, more flexible ETFs.

Grayscale’s GBTC saw a net outflow of $23.34B, as many investors bailed ship and moved to cheaper, more flexible ETFs.And here’s the kicker: IBIT is now the first ETF ever to hold over 700,000 BTC, accounting for more than half of the total BTC held across all U.S. spot ETFs. Absolute dominance.

Oh, and fun fact — BlackRock’s IBIT is now bringing in more revenue than its own S&P 500 ETF. Who would've thought Bitcoin would outshine the boomer basket?

By the Numbers:

By the Numbers:Digital asset products have attracted nearly $19B in 2025 alone Bitcoin made up 83% of that Ethereum brought in 16% ETH is currently trading at $2,778, up 6.6% in the last 24 hours BTC? It just hit $112K, a new all-time high 🥳And of course, short sellers got torched — nearly $200M liquidated.

Bitcoin Treasuries Go Corporate

Bitcoin Treasuries Go CorporateBig money isn’t just coming from ETFs — companies are going in hard too.

Japan’s Metaplanet snagged $237M in BTC, now holding 15,500+ coins

Japan’s Metaplanet snagged $237M in BTC, now holding 15,500+ coins

France’s Blockchain Group added $12.5M

France’s Blockchain Group added $12.5M

UK’s Smarter Web Company grabbed $24.3M

UK’s Smarter Web Company grabbed $24.3M

Remixpoint (Japan) raised $215M and aims to stack another 3,000 BTC

Remixpoint (Japan) raised $215M and aims to stack another 3,000 BTCBasically: corporate FOMO is real.

So here we are. Bitcoin’s making Wall Street and corporate boardrooms bow down, ETFs are overflowing, and ETH’s trying to sneak its way back to $3K. The game’s changed.

Where do you see BTC and ETH heading next? Are ETFs the future of crypto investing or just another bubble waiting to pop?

Let’s hear it below

#crypto #USD #BTC #Spot #ETF #Trading #BlackRock