💔 Citibank Sued Over $20M Crypto Romance Scam — Victim Says Red Flags Were Ignored

-

Another chapter in the Pig Butchering saga — but this time, a bank is in the hot seat.

A man just sued Citibank, claiming it failed to stop scammers from draining him of $20 million in a crypto romance scheme.

🧑

The victim, Michael Zidell, says:

The victim, Michael Zidell, says:It all started with a Facebook DM from “Carolyn Parker” in 2023. After a friendly-turned-romantic chat, she convinced him to invest in NFTs via a platform called OpenrarityPro (spoiler: it wasn’t real). Over months, he sent 43 transfers totaling $20M, with $4M routed through Citibank accounts linked to a shell company. Zidell’s lawsuit claims:

Zidell’s lawsuit claims:Citibank ignored red flags, like large, round-number transactions from personal trusts. It failed to monitor suspicious accounts and essentially enabled the fraud. The bank had a duty to investigate but "turned a blind eye." The bigger picture:

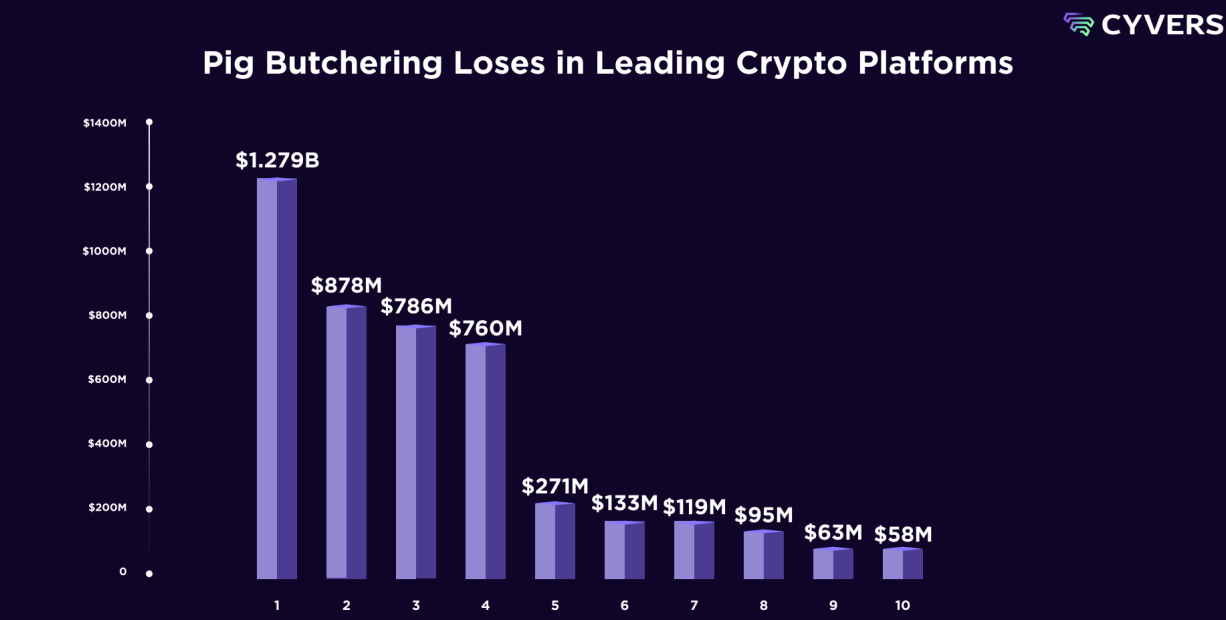

The bigger picture:Romance scams like this stole $5.5B in 2024 alone. Total crypto scams in 2024? Nearly $10B+, per Chainalysis. U.S. Secret Service recently seized $225M from pig butchering scams — the largest crypto recovery in its history.TL;DR:

Love hurts — especially when it’s fake, and your bank doesn't care. Always verify platforms, don’t trust strangers with NFT tips, and never skip due diligence… no matter how flirty the DMs get. -

A $20M loss in a crypto romance scam isn’t just tragic — it’s a massive wake-up call. The fact that a major institution like Citibank is being sued for allegedly ignoring red flags raises serious questions about how banks handle suspicious crypto-related activity.

A $20M loss in a crypto romance scam isn’t just tragic — it’s a massive wake-up call. The fact that a major institution like Citibank is being sued for allegedly ignoring red flags raises serious questions about how banks handle suspicious crypto-related activity.

When legacy systems fail to catch obvious signs of fraud — especially involving large transfers and offshore accounts — it highlights the gap between compliance checkboxes and real risk management.

When legacy systems fail to catch obvious signs of fraud — especially involving large transfers and offshore accounts — it highlights the gap between compliance checkboxes and real risk management.

🧠 Whether or not Citibank is found liable, this case sets a precedent. Financial institutions can't keep pointing fingers at “crypto risks” while failing to protect users in obvious scam setups. Education and smarter monitoring need to evolve — fast. -

$20 million lost to a romance scam, and now Citibank’s under fire for ignoring multiple warnings? That’s more than a crypto issue — it’s a system failure.

$20 million lost to a romance scam, and now Citibank’s under fire for ignoring multiple warnings? That’s more than a crypto issue — it’s a system failure.

It’s easy to blame the victim or even crypto itself, but where were the safeguards for large suspicious transfers? When red flags were raised and allegedly dismissed, it shows how outdated TradFi's fraud detection still is.

It’s easy to blame the victim or even crypto itself, but where were the safeguards for large suspicious transfers? When red flags were raised and allegedly dismissed, it shows how outdated TradFi's fraud detection still is.

This isn’t just about one case — it’s about the need for banks to upgrade their understanding of modern scams. Until then, users remain the weakest link — and scammers know it.

This isn’t just about one case — it’s about the need for banks to upgrade their understanding of modern scams. Until then, users remain the weakest link — and scammers know it.