🚨 Big Stages, Bigger Scams? 5 Shady Crypto Projects That Got the Spotlight

-

Just because a crypto project has flashy sponsorships and throws massive parties doesn’t mean it’s legit.

️ Some of the shadiest coins in the game have strutted across major conferences, backed by millions in marketing — but offer little to no real value.

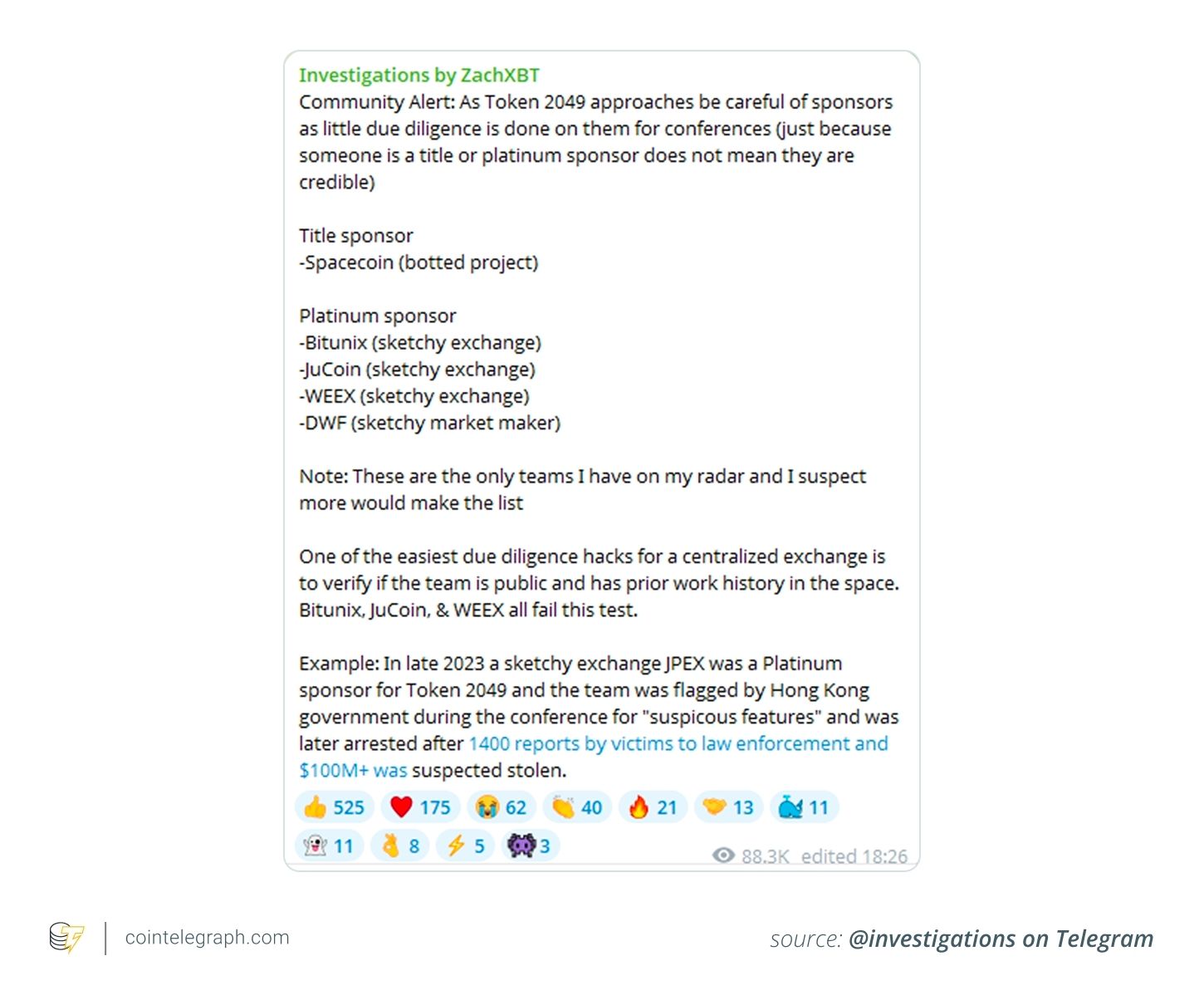

️ Some of the shadiest coins in the game have strutted across major conferences, backed by millions in marketing — but offer little to no real value. Here’s the warning: Sponsorship ≠ trustworthiness. According to on-chain investigator ZachXBT, several platinum sponsors at Token2049 — one of the biggest crypto events — had sketchy pasts or outright fraud allegations.

Here’s the warning: Sponsorship ≠ trustworthiness. According to on-chain investigator ZachXBT, several platinum sponsors at Token2049 — one of the biggest crypto events — had sketchy pasts or outright fraud allegations.Let’s unpack the red flags and name names.

️ Why Scammy Coins Survive

️ Why Scammy Coins SurviveDespite poor fundamentals, some tokens refuse to die — because:

They’re backed by speculative hype. They build cult-like communities. They manipulate liquidity for price control. They exploit influencer marketing and social media buzz.If it looks too good to be true, it probably is.

5 Shady Projects You Should Watch Out For

5 Shady Projects You Should Watch Out ForSpacecoin (SPACE) 🛰️ "Decentralized satellite internet for the world". Sounds cool, right? 🚩 No audit transparency, no satellite proof, and flagged as botted. 🧲 Still lives off hype, flashy booths, and wild promises. JuCoin 🪙 A rebranded exchange with a long history of pivots and questionable compliance. 🚩 No U.S. or EU licenses, despite aggressive token shilling. 🧲 Survives on promo campaigns and CeDeFi buzz. Weex 📉 A futures platform offering anonymous trading and high bonuses. 🚩 Unregulated, complaints of frozen accounts and sudden KYC blocks. 🧲 People still flock for the leverage, ignoring the risks. DWF 🧯 A "market maker" with accusations of wash trading and rug pulls (see: Vite Labs). 🚩 Operating across 60+ exchanges but little transparency. 🧲 Sponsorships give them credibility, not fundamentals. Bitunix 🏝️ Registered in Saint Vincent — red flag already. 🚩 Investigated in South Korea for serving customers illegally. 🧲 Lives off niche altcoin listings and speculative traders.🧨 Previous Big Scams That Bought the Spotlight

JPEX — Paid $70K for a premium sponsor slot at Token2049.

JPEX — Paid $70K for a premium sponsor slot at Token2049.

But after regulatory heat from Hong Kong, they vanished, froze withdrawals, and left over $127M in losses. HyperVerse — Lavish megayacht parties and celeb endorsements (Rick Ross, really?).

HyperVerse — Lavish megayacht parties and celeb endorsements (Rick Ross, really?).

But behind the scenes? A $1.89B Ponzi scheme. SEC charged key promoters.

️ How to Protect Yourself

️ How to Protect Yourself Research every project.

Research every project.Who’s behind it? Are they licensed or regulated? Any independent audits? Is the hype backed by real use cases? Watch for red flags like anonymous teams, only being listed on obscure exchanges, or insane promised returns. Bots can fake volume — don’t fall for it.

Watch for red flags like anonymous teams, only being listed on obscure exchanges, or insane promised returns. Bots can fake volume — don’t fall for it.Just because it made it to a conference stage or has a slick promo video doesn’t mean it’s safe. Crypto is still the Wild West — and sometimes, the loudest coins are the most dangerous.

Stay sharp. 🧠

-

This post should be mandatory reading for anyone new to crypto. The fact that some of these shady projects made it onto big stages — complete with influencers, media coverage, and flashy branding — shows how easily hype can drown out due diligence.It’s a reminder that not every trending token or well-marketed project is trustworthy. Even high-profile listings don’t guarantee legitimacy. We need more content like this that names names, shows patterns, and helps people learn how to spot red flags before it’s too late.

🧠

🧠

-

Scams like these thrive in the shadows of spotlight. It’s frustrating how some of the most dangerous projects manage to gain traction simply by using aggressive PR and tokenomics that look appealing on the surface.But the damage they cause goes beyond financial loss — they destroy trust, especially among new entrants. Posts like this are essential to keep the community alert and informed. If we want crypto to go mainstream responsibly, we need to start treating education like armor.

️

️