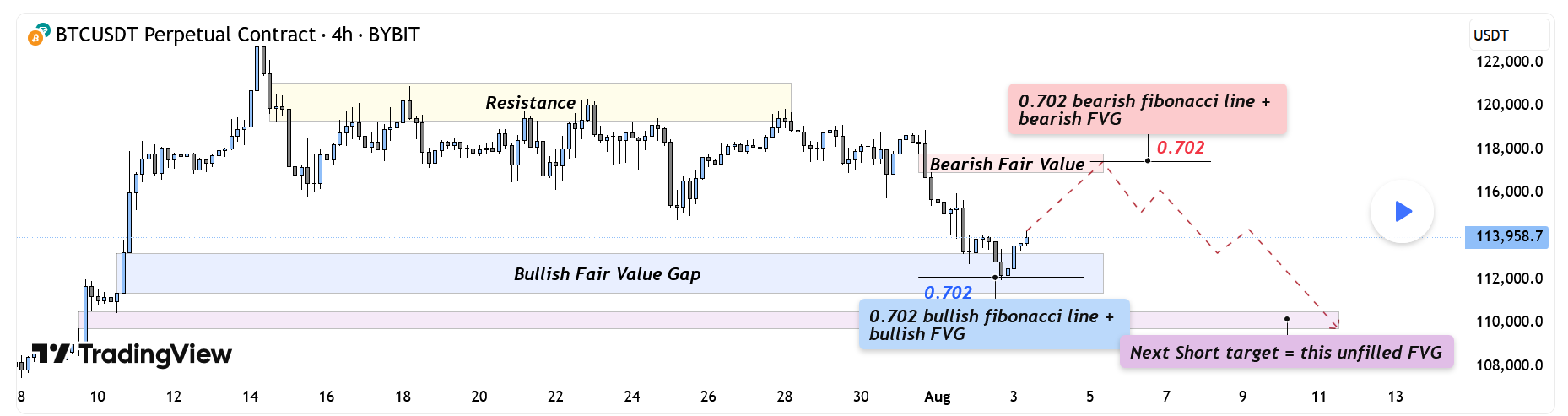

BTC - Short Setup at 0.702 Fibonacci & Fair Value Gap

-

Market Context

Bitcoin recently rejected from a major resistance area and has since been retracing downward, finding temporary support inside a bullish Fair Value Gap. The market is currently in a corrective phase, with buyers attempting to defend lower levels while sellers look for optimal positions to reload shorts. This environment shows a classic tug-of-war between these two forces as price moves between supply and demand zones.Consolidation and Current Phase

Although the prior consolidation has been broken, the current price action can still be described as corrective, with intraday structure forming lower highs. The bullish Fair Value Gap beneath price has been respected so far, creating a temporary base. However, the path remains complex, as the market has unfilled imbalances both above and below.Bearish Retest Scenario

One key scenario involves a retracement toward the bearish Fair Value Gap near 117K, which also aligns with the 0.702 Fibonacci retracement level. This confluence makes it a high-probability area for sellers to step in again. A rejection from that zone would likely resume the downtrend, with the next logical target being the deeper unfilled bullish Fair Value Gap around 110K. This zone acts as a magnet for price due to the inefficiency left behind during the last rally.Bullish Defense Scenario

For bulls to regain control, the current Fair Value Gap at 114K must hold, followed by a strong move that invalidates the lower-high structure. Such a move would need to break above the 117K bearish FVG with conviction. Only then could momentum shift back to the upside, opening the door for another challenge of the higher resistance zones.Final Words

Patience and precision are key when dealing with setups like this. Let the market come to your level — and react with intent.If you found this breakdown helpful, a like is much appreciated! Let me know in the comments what you think or if you’re watching the same zones.

-

This is one of the cleaner BTC short setups I’ve seen lately. Using the 0.702 Fibonacci retracement along with a Fair Value Gap adds serious confluence to the idea. What stands out most is the patience in waiting for price to reach a high-probability rejection zone, rather than forcing a trade.

In this market, especially with BTC's recent volatility, planning around inefficiencies like FVG and using fib levels that go beyond the usual 0.618 shows you're thinking in terms of smart money concepts — not just retail indicators. I'll definitely be watching price action as it approaches that zone. Great setup and even better discipline! 🧠

🧠

-

Really solid breakdown — love how you integrated the 0.702 fib with the FVG zone instead of just relying on basic TA levels. Shows a deeper understanding of market structure and where liquidity tends to sit.

BTC has been known to fake out near those fib zones, so your call to wait for a confirmation candle before shorting is key. A lot of people just blindly jump in. This plan feels calculated, not impulsive — which is what successful trading is all about. Thanks for putting this out there; I’m adding this zone to my watchlist too.