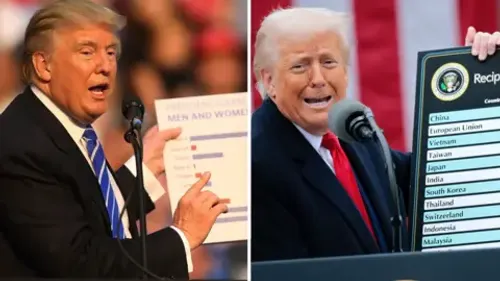

Trump’s 100% China Tariff Sparks Crypto Stock Sell-Off

-

US President Donald Trump’s announcement of a 100% tariff on Chinese products starting Nov. 1 triggered a sharp market reaction, hitting crypto-related stocks hard.

The S&P 500 fell 2.7% as investors reacted to escalating trade tensions. Leading digital-asset companies posted steep declines: Coinbase (COIN) dropped 7.75% to $357.01, Bullish (BLSH) fell 9.42% to $60.37, and MARA Holdings (MARA) lost 7.67% to $18.65.

Analysts warn that the sell-off highlights the vulnerability of crypto-linked equities to macroeconomic shocks, particularly amid ongoing global trade volatility.

-

Macro shocks like this show how tied crypto still is to traditional markets

until decoupling truly happens, volatility’s here to stay

until decoupling truly happens, volatility’s here to stay

-

Well put

crypto’s still in its adolescence — global integration before independence seems inevitable

crypto’s still in its adolescence — global integration before independence seems inevitable

crypto’s independence from global macro forces is still a work in progress — decoupling won’t come easy

crypto’s independence from global macro forces is still a work in progress — decoupling won’t come easy