🔍 Bitcoin Bulls on the Brink? $120K Rejected, Eyes on $110K and Below 🐻📉

-

Bitcoin just pulled a fake-out.

After flirting with $119K earlier today, BTC failed to hold the $120K resistance and has now slipped below $117,500 — back under the daily open. Some traders are bracing for a sharp move downward. So… are we about to dive into the “C wave”?

Bearish signs are stacking up:

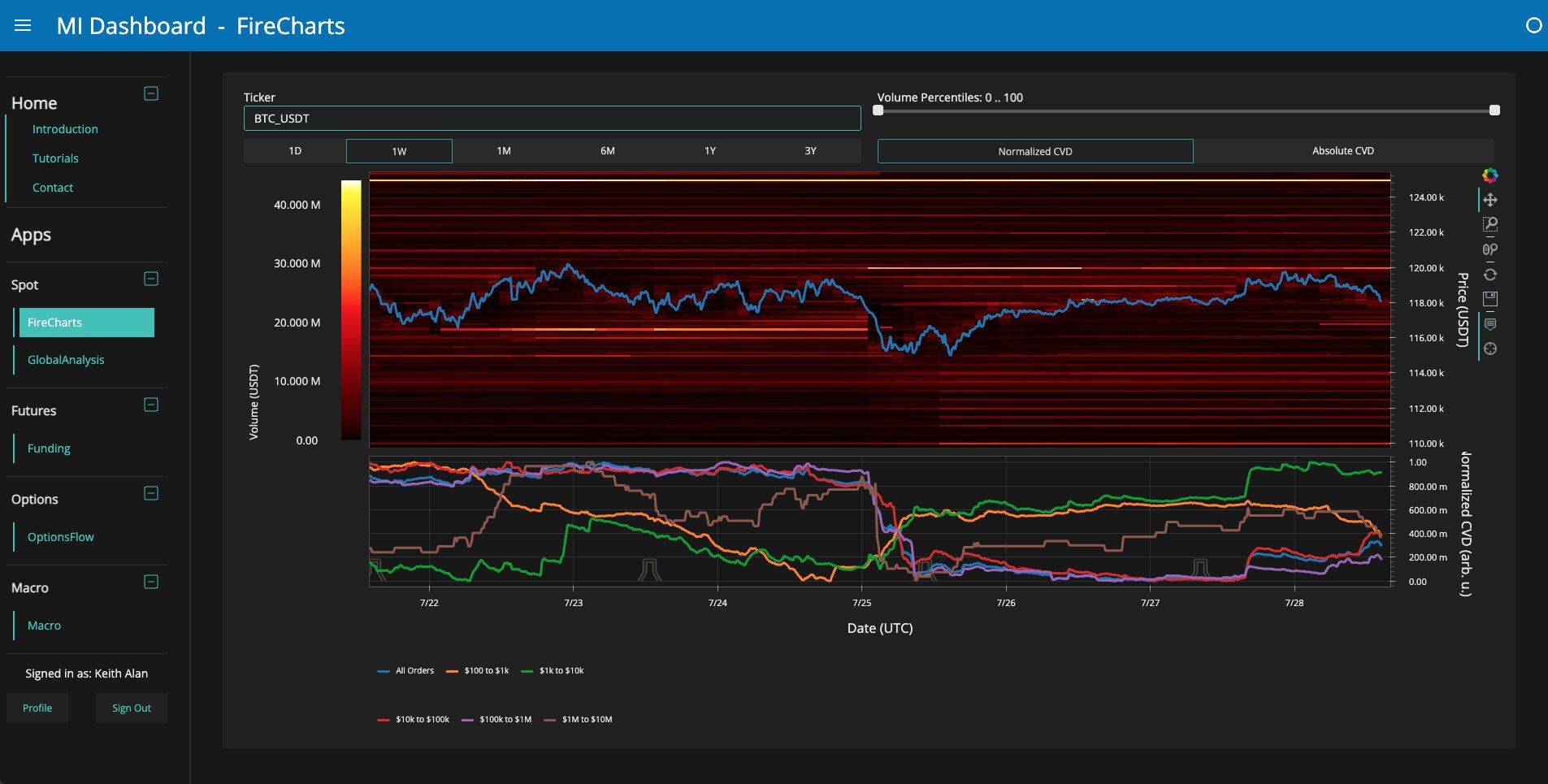

Bearish signs are stacking up:Whales are distributing at local highs — this is creating headwinds for further price movement. Momentum is slowing and several popular traders are now openly discussing targets in the $110K–$108K range. $116,750 is a key level to watch — if it breaks, we could be staring down the barrel of a sub-$110K leg.As Material Indicators put it:

“If $116,750 doesn't hold, the $110k range may come into focus quickly.” Meanwhile, Credible Crypto warns of a clean triple tap forming, and trader Roman is eyeing $108K. But it's not all doom and gloom... yet:

But it's not all doom and gloom... yet:Despite the dip, CryptoQuant says we’re not seeing massive profit-taking on-chain. That’s a bullish divergence from typical local tops.

🧠 Their key takeaways:

No major profit realization spike in Net Realized Profit/Loss (NRPL) — suggesting investors are still confident. Short-term holder cost bases at ~$115.7K and ~$105K may act as strong support zones if we correct further. Improving U.S. economic data (JOLTS + Consumer Confidence) is creating a “risk-on” environment for assets like BTC. TL;DR:

TL;DR:🟥 Bears in control for now; rejection at $120K could drag us to $111K or lower 🟩 Bulls still have hope — no mass exits, and support zones are holding 📉 Next 48 hours are crucial: if $116.7K fails, we might test $110K fast 📆 FOMC + White House crypto policy release could shift sentiment midweekAre you hedging, DCA’ing, or waiting for blood on the charts?

Let’s hear your playbook. ️

️