🧠 ETH Staking Approval Could Supercharge Spot ETFs – Here's Why Institutions Are Watching Closely 🧠

-

It looks like Ethereum might be on the edge of a massive institutional unlock.

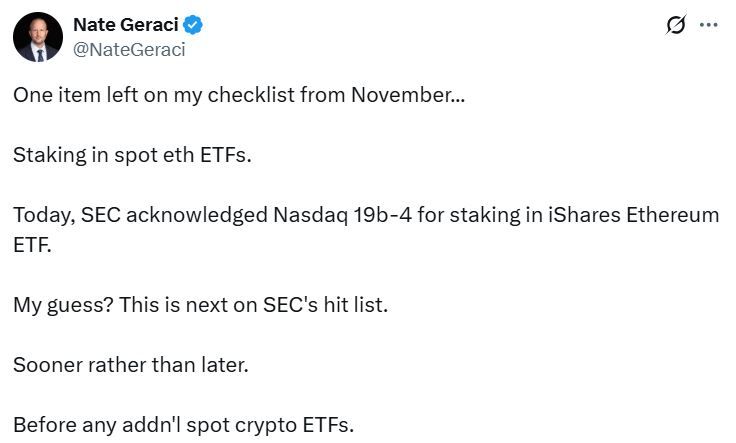

The SEC recently acknowledged Nasdaq’s request to add staking functionality to BlackRock’s iShares Ethereum ETF — and if it gets approved, we could be entering a new era for ETH-based ETFs.

What does this mean?

What does this mean?

According to Markus Thielen from 10x Research, staking could reshape the market dynamics entirely. Here’s how:Spot Ether ETFs currently offer around 7% annualized return when arbitraging against futures. Add staking rewards (~3%) into the mix, and you’re looking at 10% unleveraged yield. With 2–3x leverage, some institutions could target 20–30% annualized returns on a relatively low-risk basis trade.Now that’s alpha.

Why institutions will care

Why institutions will care

Ryan McMillin (Merkle Tree Capital) notes that yield is everything for institutions like pension funds. They want predictable income — not just moonshots. And ETH staking offers: Steady returns

Steady returns

Diversification from Bitcoin (ETH as stablecoin & DeFi infrastructure)

Diversification from Bitcoin (ETH as stablecoin & DeFi infrastructure)

Exposure to an asset with real network activity and revenue

Exposure to an asset with real network activity and revenueA 3–5% yield + growth potential? ETH is shaping up as the first real “yield + upside” play in the crypto ETF space.

🧩 More liquidity, more onchain action

Kronos Research CEO Hank Huang puts it simply: ETH ETFs with staking open up compliant, hands-off onchain yield access for big money.“This flips the switch on demand,” he said. “We’re about to see a wave of capital drive valuations higher across the Ethereum ecosystem.” TL;DR:

TL;DR:

If ETH spot ETFs get staking approved, we could see:A rush of institutional inflows Explosive demand for yield-bearing ETH exposure Deeper liquidity across DeFi and ETH derivatives A serious challenge to BTC’s ETF dominanceETH isn't just ultrasound money — it might be ultrasound yield soon, too.

If BlackRock pulls this off, it’s not just bullish for ETH — it’s a wake-up call for institutions that crypto yields can be compliant and scalable. Don’t sleep on this.

If BlackRock pulls this off, it’s not just bullish for ETH — it’s a wake-up call for institutions that crypto yields can be compliant and scalable. Don’t sleep on this.