Taxes Complicate Crypto Payments for Freelancers

Freelancing/Online work exchange

3

Posts

3

Posters

11

Views

-

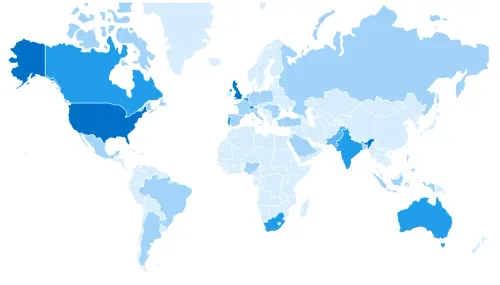

Freelancers accepting crypto must navigate a tricky tax landscape. Payments must be reported at fair market value, and this can trigger income, self-employment, and capital gains taxes. In the U.S., Form 1099-NEC is required for independent contractors, while other countries have their own reporting rules. Tools like CoinTracking and CryptoTrader.tax can help freelancers manage tax obligations and avoid penalties. -

This is the biggest reason freelancers hesitate with crypto — tax clarity is still missing.