Kerrisdale Says ‘Tom Lee Is No Michael Saylor’

Pulse of the market

3

Posts

3

Posters

9

Views

-

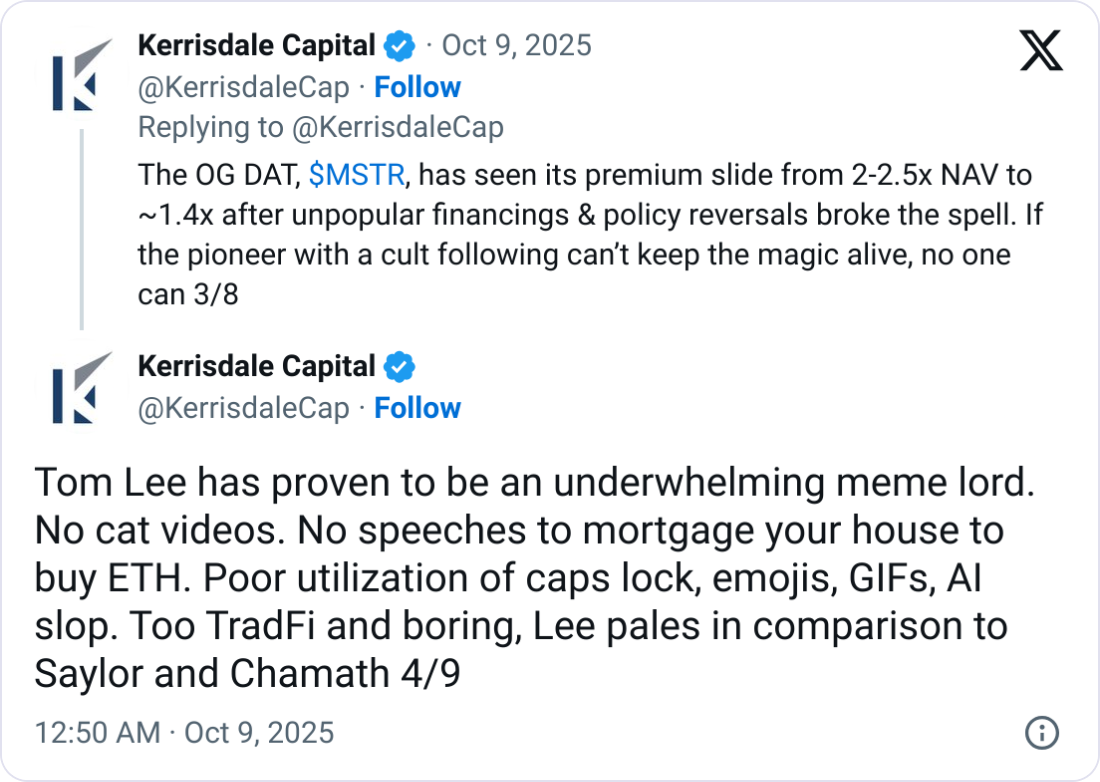

Kerrisdale also took aim at BitMine’s chair Tom Lee, arguing he lacks the cult-like following of MicroStrategy’s Michael Saylor, whose persona has helped sustain investor enthusiasm.The firm added that BitMine’s ETH-per-share growth is slowing, disclosures are becoming opaque, and its premium to net asset value has collapsed from 2.0x in August to 1.2x by September.

Kerrisdale stressed its position is not a bet against Ethereum, but against paying a market premium for BitMine.