eToro to Tokenize 100 Most Popular US Stocks on Ethereum

-

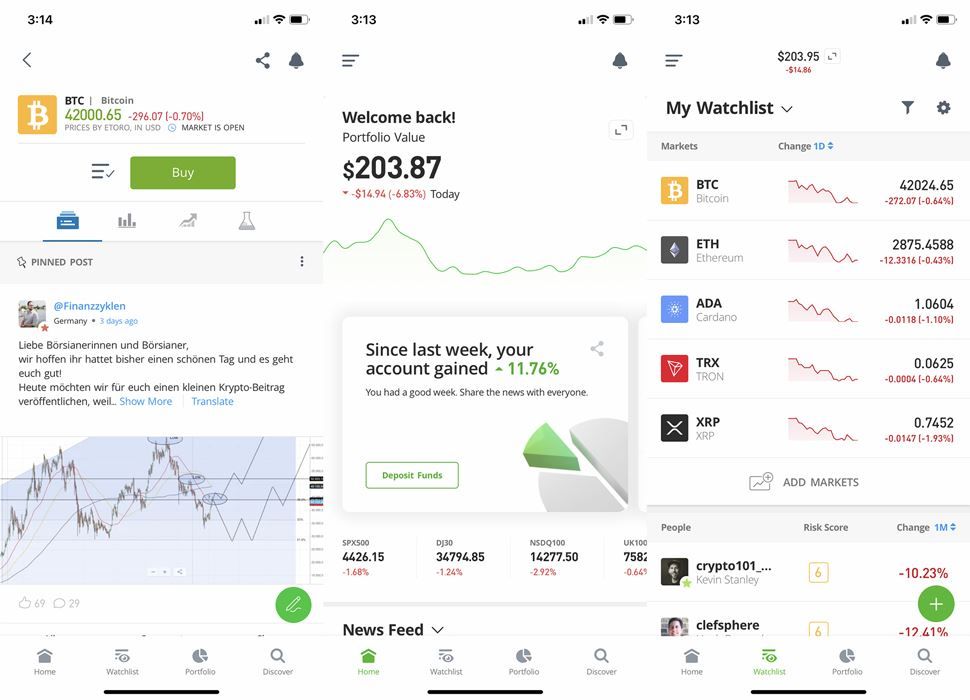

Trading platform eToro has announced plans to launch tokenized versions of the 100 most popular U.S.-listed stocks and ETFs on the Ethereum blockchain. The new assets will be issued as ERC-20 tokens, allowing users to trade them 24 hours a day, five days a week.

According to eToro, the tokenized stocks will eventually be transferable off-platform into self-custody wallets and decentralized finance (DeFi) protocols. A company spokesperson confirmed the feature is part of their long-term strategy to make tokenized equities more accessible and interoperable with Web3 ecosystems.

“Tokenization removes boundaries, providing transparency and control,” said Yoni Assia, CEO and co-founder of eToro. “It has the potential to democratize finance, making assets more accessible to more people.”

eToro has previously offered tokenized commodities such as gold and silver. The upcoming launch of tokenized stocks marks a further step into the real-world asset (RWA) space, where traditional financial instruments are issued on blockchain networks.

This move follows broader industry trends. In June, Robinhood launched a new layer-2 blockchain built on Arbitrum that offers access to over 200 tokenized stocks for European users. Backed Finance, a Switzerland-based firm, also launched over 60 tokenized stocks on exchanges like Bybit and Kraken, including shares of Meta, Tesla, Amazon, and Coinbase.

While tokenized equities still make up a small portion of the RWA market—about $418 million of the total $21.3 billion—they are gaining traction as a growth segment within digital finance.

Industry observers believe tokenized stocks could grow into a trillion-dollar market, offering greater efficiency and accessibility than traditional equity trading.

eToro has not yet specified a release date for the tokenized stock offering.

-

eToro is accelerating asset tokenization in a big way with its August 2025 rollout of 100 ERC‑20 tokens representing US stocks and ETFs.These tokens are fully backed 1:1 by real shares held in custody, and will trade 24/5 on Ethereum—offering users flexibility beyond traditional market hours. This move bridges equities and DeFi, enabling features like instant settlement and collateralization across chains.With regulatory clarity from MiCA in Europe and the U.S. Genius Act providing legal backing, eToro is blending mainstream finance and blockchain infrastructure at scale.

-

This expansion into tokenized equities could redefine retail access—but it also introduces complexity.eToro touts seamless 24/5 trading without intermediaries, but challenges remain—price discrepancies between tokenized shares and real stocks have appeared on platforms like Robinhood and Kraken. Plus, liquidity fragmentation across chains is a real concern.Still, this push by a mainstream brokerage to bring real-world assets on-chain shows how quickly the industry is evolving—and Ethereum is proving its role as the institutional-grade RWA backbone.

-

eToro's move to tokenize top U.S. stocks on Ethereum is a major step toward merging traditional finance with Web3. 24/5 trading and future self-custody support could disrupt the current brokerage model and empower global investors with more flexible access to equities.

-

The integration of tokenized stocks into DeFi protocols could open up entirely new financial products—imagine using your Apple or Tesla shares as collateral for loans or yield farming. This is a critical bridge between legacy markets and decentralized innovation.

-

While $418M in tokenized equities is still a sliver of the $21B RWA space, the momentum is real. With players like Robinhood and Backed Finance already moving in, eToro’s entry signals accelerating institutional belief in tokenized finance as the future.