💰 Stablecoins Are Booming — And That Means Earning Opportunities

-

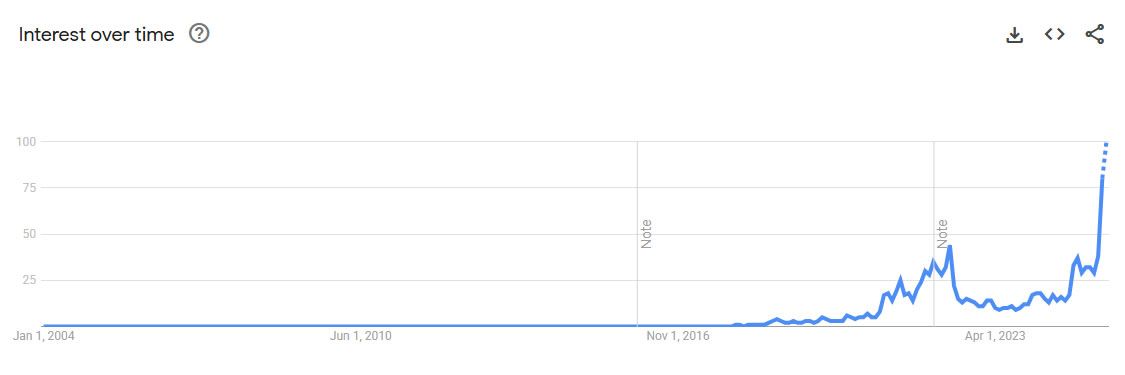

Google searches for stablecoins just hit an all-time high. Why? Because people are waking up to the fact that these "boring" tokens might be the bridge to mainstream crypto adoption — and a solid way to make money.

What’s Going On:

What’s Going On:Stablecoin market cap just hit $272B — an all-time high. The GENIUS Act, passed in July, gave legal clarity to USD-backed stablecoins. Global search interest for “stablecoins” is at its peak. Institutions are launching their own stablecoins. This is getting real. So, How Can You Make Money?

So, How Can You Make Money?Yield farming with stablecoins — earn 4–15% APY without major volatility. Providing liquidity on DeFi platforms like Curve, Uniswap, or Aave. Staking on stablecoin protocols (low risk, steady returns). Running a stablecoin business (accepting stablecoin payments for goods/services). Investing early in tokenized fiat projects launching under new US regulations. Why Stablecoins Matter:

Why Stablecoins Matter:They’re less volatile than BTC/ETH, ideal for:

Saving during down markets Getting exposure to DeFi without high-risk assets Moving money globally in minutesAs one analyst put it:

“Stablecoins are the product that can onboard the first billion people on-chain.”🧠 Final Thought:

We’re entering a “parabolic phase” for stablecoins — and that means plenty of opportunities to earn, build, and invest smart.

Are you earning passive income with stables? What’s your favorite strategy?

-

Stablecoins are definitely becoming a cornerstone for mainstream crypto adoption. Their lower volatility and steady yields make them attractive for both new and experienced investors. Yield farming with stables feels like a smart way to earn without excessive risk.

-

The legal clarity from the GENIUS Act could be a real game-changer. With institutions launching their own stablecoins, we might see even more growth and innovation in this space. It’s a solid time to explore liquidity provision or staking opportunities.