💰 BTC Holds Steady After $450M Galaxy Sale – What It Means for Your Profits

Pulse of the market

4

Posts

4

Posters

37

Views

1

Watching

-

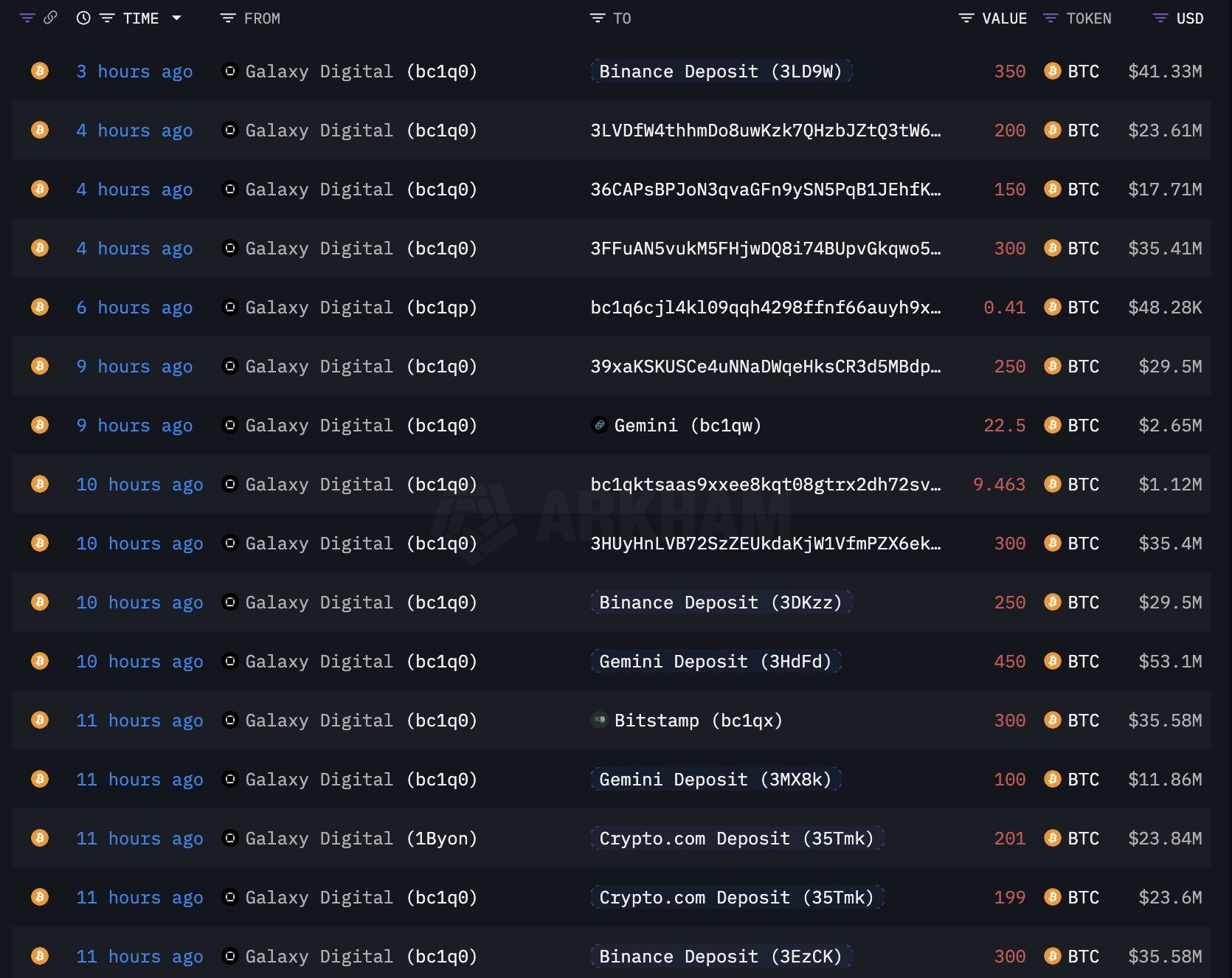

Despite another massive Bitcoin move by Galaxy Digital, the price of BTC bounced right back to $119K — and that’s a big deal for traders looking to make money in this market.

Quick Recap:

Quick Recap:Galaxy Digital shifted 3,782 BTC (~$450M) to exchanges. Market reaction? Minimal. BTC dipped briefly to $117K and bounced back. Compare that to last week’s 80,000 BTC sale that dropped prices to $114.5K. Yet again, Bitcoin filled the CME futures gap — for the sixth week in a row.🧠 What This Means for Earning Money with Crypto:

Buy-the-Dip Still Works Dips from large sales or exchange flows are short-lived. Smart traders set limit buys at technical levels like the 21-day SMA or gap support zones. Example: $117K-$115K range has acted as a solid bounce zone. CME Gap Trading = Predictable Opportunities The consistent gap fills each week give a reliable trade setup for scalpers and swing traders. Watch Friday-to-Monday price movement for entry/exit signals. Price Resilience = Confidence Booster The fact that $450M in BTC didn’t crash the market signals strong buy-side liquidity. This kind of stability opens up safer plays for margin traders or options sellers. What to Watch:

What to Watch:Resistance near $120K is key. A clean breakout could send BTC flying. Downside risk remains — traders like Roman expect possible dips to $108K. Volatility will increase with the monthly close approaching. Money-Making Tips:

Money-Making Tips:DCA around dips if you're a long-term holder. Use stop-limit orders near moving averages for safer entries. Explore CME gap strategies for consistent weekly trades. Be cautious of flash pullbacks during high-volume sell-offs.Bitcoin is shrugging off big whale moves — that’s bullish for disciplined traders and anyone looking to grow their portfolio. The key is having a plan and sticking to it.

Got a gap strategy or trade setup that worked for you this week? Drop it below