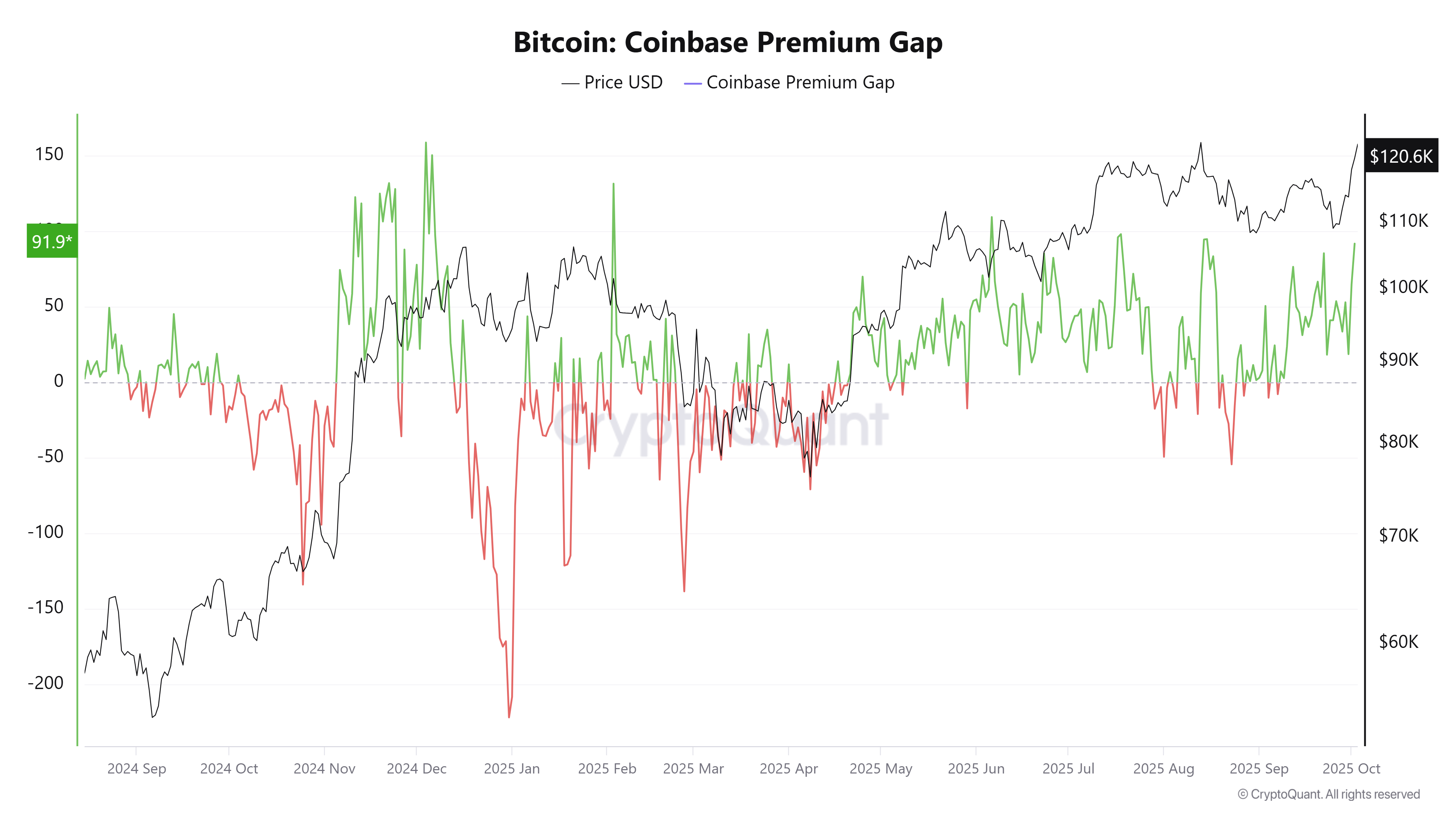

Coinbase Premium Hits $92 as US Demand Drives Bitcoin Rally

-

Onchain analytics show Bitcoin buying pressure surging to new highs. A one-hour taker buy volume spike surpassed $1.6 billion across exchanges. Meanwhile, the Coinbase Premium Gap reached $91.86 — its highest since mid-August — reflecting aggressive US buying activity.

Analysts caution that previous peaks in the premium have preceded short-term pullbacks, but inflows into BTC spot ETFs continue to offer a tailwind.

-

Onchain data reveals intense Bitcoin accumulation, with taker buy volume spiking over $1.6 billion in just one hour across major exchanges.

The Coinbase Premium Gap jumped to $91.86 — its highest level since mid-August — signaling strong U.S. demand and institutional buying pressure driving the market upward. -

Bitcoin’s onchain metrics show powerful buying momentum: a $1.6 billion taker buy surge hit within an hour, pushing the Coinbase Premium Gap to $91.86.

Analysts say this reflects heightened U.S. institutional activity, suggesting bulls are reasserting control as liquidity concentrates on major exchanges.