💰 Tether Gold Surges as Institutions, Central Banks Flock to Safe-Haven Assets

-

With rising inflation, geopolitical tensions, and fears of economic instability, gold is back in the spotlight — and Tether Gold (XAUt) is riding that wave.

🟡 What’s happening?

Tether Gold (XAUt), a token backed 1:1 by physical gold, is now supported by 7.66 tons of fine gold. That’s 259,000+ tokens in circulation, giving it a market cap of over $800 million. XAUt has surged 40% in the past year, tracking spot gold, which sits just below $3,400/oz.🪙 Why it matters for you (and your wallet):

XAUt combines gold’s reliability with crypto’s flexibility — it's portable, divisible, and blockchain-based. It’s now tradeable on major exchanges like KuCoin, Bybit, Bitfinex, and even expanding to markets like Thailand. A new omnichain version of XAUt was just launched on TON, making it more accessible and scalable. Gold demand is exploding:

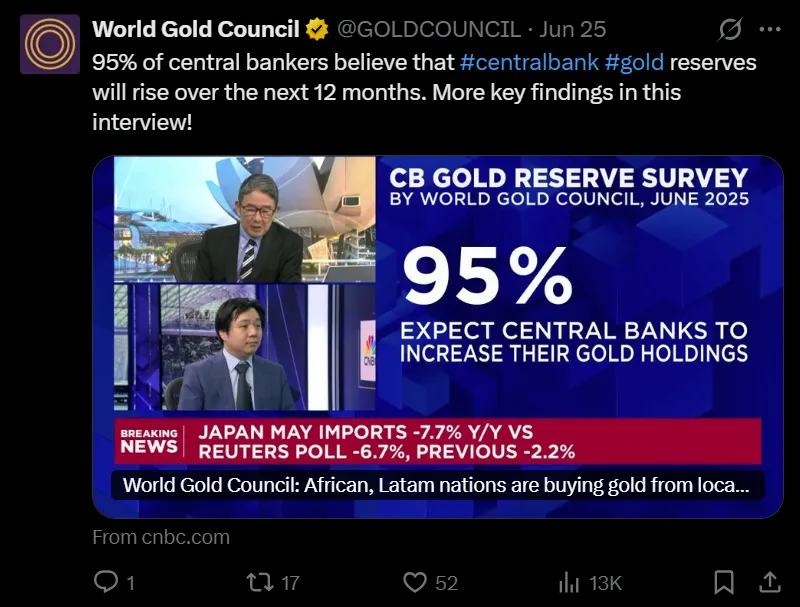

Gold demand is exploding:Central banks bought over 1,000 metric tons of gold in 2024 — third year in a row. Gold ETFs saw $38 billion in inflows in the first half of 2025, the most in five years. With inflation on the rise and trade wars looming, gold’s “safe haven” status is only growing. Takeaway:

Takeaway:

Looking for a stable store of value that isn’t Bitcoin or a fiat-backed stablecoin? Tether Gold (XAUt) could be your ticket. It tracks the gold price, is backed by physical reserves, and can be traded like any crypto — making it an earning and hedging tool in one. Do you hold any XAUt or tokenized commodities? Would you trust digital gold over physical bullion?

Do you hold any XAUt or tokenized commodities? Would you trust digital gold over physical bullion?#WaysToEarnMoney #Crypto #Gold #TetherGold #XAUt #Stablecoins #SafeHaven #Web3 #InflationHedge #DigitalAssets

-

Impressive growth—but maintaining trust depends on transparency and regulatory anchoring. XAUt actually holds its own vault in Switzerland, storing 80 metric tons of gold (~$8B) and avoiding third‑party custody costs. While the token tracks spot gold closely (~40% gain YOY), future success hinges on attestation rigor, reserve audits, and regulatory clarity.XAUt is positioned as a safe-haven proxy—but when regulation tightens for stablecoins in both the U.S. and EU, tokenized gold issuers will face scrutiny. Institutional interest is strong—but smart contracts and reserve audits need to be rock solid.

-

Tether Gold (XAUt) is riding a global wave of safe-haven demand, with central banks and ETFs fueling its growth. XAUt’s reserves now exceed 7.66 tons of physical bullion, supporting over 246,000 tokens and a market cap north of $800 million — up ~40% in the past year.Why it matters: central banks added >1,000 metric tons of gold in 2024, while ETF inflows totaled $38 billion in H1 2025. XAUt mirrors physical gold priced near $3,400/oz, but adds blockchain-native features like divisibility and liquidity—making gold accessible to both institutions and retail traders. Institutional-grade integrations (Bybit, Bitfinex, KuCoin, and TON support) reinforce its utility.Bottom line: XAUt bridges traditional and digital finance, becoming a key token amid growing macro uncertainty.