Golden Visas Are Drying Up — And Crypto Investors Are Feeling It

-

If you were planning to stack passports like NFTs, here’s your heads-up: Golden Visa programs — the go-to residency path for the ultra-wealthy (including crypto whales) — are getting chopped left and right.

Golden visas once offered a fairly simple play: invest six or seven figures, secure residency or citizenship, and enjoy the tax/regulatory perks of your new crypto-friendly homeland.

But now? That loophole is closing fast.

Governments Are Cracking Down

Governments Are Cracking DownIn just the past few years, nine countries — including the UK, Ireland, Spain, the Netherlands, and Malta — have scrapped or severely tightened their golden visa schemes.

In Spain, the program got nuked this April over housing crisis concerns.

In Spain, the program got nuked this April over housing crisis concerns.

In Malta, the EU literally ruled their golden passport program illegal.

In Malta, the EU literally ruled their golden passport program illegal.

Even Portugal, the darling of crypto expats, is making its program stricter.

Even Portugal, the darling of crypto expats, is making its program stricter.Why? A mix of:

💸 Fears of money laundering (hi, crypto skeptics) 🏠 Rising local housing costs from wealthy foreign buyers ⚖️ Post-Ukraine war security politics 🔍 EU pressure to curb “citizenship for sale” programs But Why Do Crypto People Love Golden Visas?

But Why Do Crypto People Love Golden Visas?Simple: flexibility, tax strategy, and freedom to exit stage left if regulators get weird.

Most golden visa programs ask for only a few days/year of residency

Most golden visa programs ask for only a few days/year of residency

Many don’t require renouncing your original passport

Many don’t require renouncing your original passport

Some even accept crypto investments directly

Some even accept crypto investments directlyCheck these out:

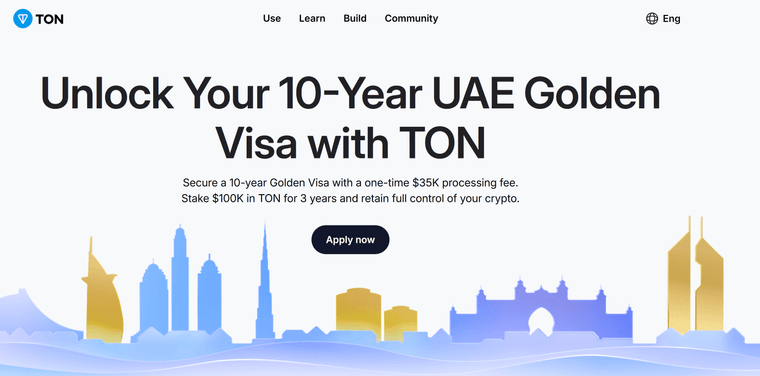

🇵🇹 Portugal’s Bitcoin Eco Golden Visa – exposure to BTC + residency 🇮🇹 Bitizenship’s Italian Startup Visa – invest €250K in a local Bitcoin startup 🇸🇻 El Salvador – drop $1M in BTC or USDT, get citizenship 🇦🇪 TON Foundation’s UAE visa scheme – (oops, announced prematurely, not official… yet) The Trend: Scarcity & Speed

The Trend: Scarcity & Speed“What’s possible today may become legally impossible within months — or weeks.” — Alessandro Palombo, BitizenshipTL;DR: If you’re eyeing a golden visa with crypto, don’t sleep on it.

Even programs that are still open are becoming more selective, slower, or adding extra hoops (background checks, stricter KYC, minimum holding periods).

And yes, it’s very “DYOR,” because premature launches (like the UAE-TON drama) are adding confusion to an already shifting landscape.

So What Now?

So What Now?Are golden visas worth chasing anymore for crypto investors?

Should countries embrace them or ditch them? Would you drop $250K+ for a second passport tied to BTC exposure?

Would you drop $250K+ for a second passport tied to BTC exposure?

Should more countries offer crypto-backed golden visa schemes?

Should more countries offer crypto-backed golden visa schemes?

Or is this just a regulatory time bomb waiting to explode?

Or is this just a regulatory time bomb waiting to explode?Sound off below

Let’s debate it.

Let’s debate it.