💸 Payments & 🤖 AI: The Two Crypto Trends You Can’t Ignore in 2025

-

If you’ve been wondering what’s really driving crypto forward this year — spoiler: it’s not just memecoins or speculative DeFi farms — a new report by Reown & YouGov has some answers.

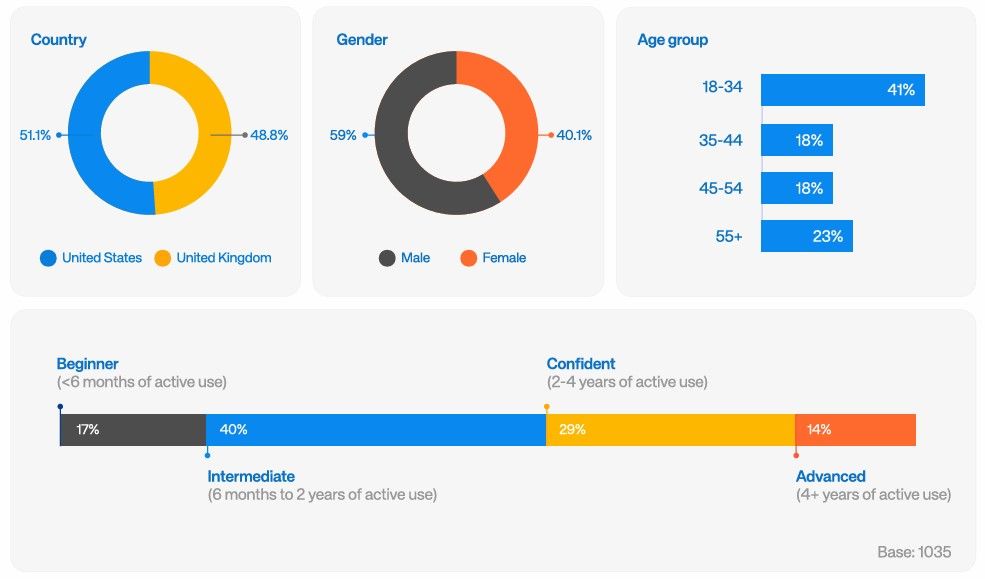

They surveyed over 1,000 active crypto users in the US and UK and found that Payments and Artificial Intelligence are the two biggest adoption pillars right now. Combined, they captured the attention of 37% of users.

Let’s break down what that actually means

Payments Are Going Mainstream (Finally)

Payments Are Going Mainstream (Finally)34% of participants are actively using crypto for real-world payments — think remittances, gig economy wages, and employee salaries. 27% believe that payments will become the dominant onchain experience within the next 3–5 years. Real-world use cases are finally outpacing the hype. It’s not “future potential” anymore — it’s real-life infrastructure.From international paychecks to stablecoin rails embedded in apps, crypto is finally walking the talk on peer-to-peer value transfer.

“Payments are no longer just a crypto demo — they’re becoming real-life infrastructure.” – Jess Houlgrave, Reown CEO AI Isn’t Competing With Payments — It’s Powering Them

AI Isn’t Competing With Payments — It’s Powering ThemHoulgrave points out that AI and payments are solving different sides of the same problem: making crypto useful, intuitive, and trusted.

AI is boosting personalization, fraud detection, and customer support. For developers, it speeds up onboarding, auditing, and automation.So, AI isn’t here to replace payments — it’s here to enhance the crypto UX and help bring it to the next billion users.

Trading Still Rules, But Payments Are Catching Up

Trading Still Rules, But Payments Are Catching Up36% of users say trading is still their favorite onchain activity. But payments are now in second place, with 10% saying it’s the most enjoyed — and 14% say it’s what they’re most excited about going forward.This isn’t surprising. We’re seeing tools catch up to crypto’s original vision:

A borderless, trustless, peer-to-peer payment system.Bitcoin wasn’t born for yield farming — it was built for global transactions. And we’re finally circling back to that core.

Who Owns What: Stablecoins on the Rise

Who Owns What: Stablecoins on the RiseThe survey also dropped some juicy stats on ownership:

63% own Bitcoin 48% own Ethereum 38% now hold stablecoins, overtaking Solana (37%) Among 18–34-year-olds, 51% own stablecoins — Gen Z is clearly on the USDT train 🚂This shows that stablecoins are now mainstream crypto money — especially for those prioritizing utility over volatility.

“The need for embedded, multichain UX is becoming clear: Users want to transact from wherever they already hold assets.” – Reown Report TL;DR

TL;DRCrypto isn’t just about trading anymore.

Payments are gaining traction as an everyday tool.

Payments are gaining traction as an everyday tool.

AI is making crypto easier to use and safer.

AI is making crypto easier to use and safer.

Stablecoins are winning trust and adoption across generations.

Stablecoins are winning trust and adoption across generations.So, whether you’re building, investing, or just vibing onchain — keep an eye on the payment rails and the bots behind them. The next wave of adoption is already rolling in.

What are you most excited about in crypto right now — payments, AI, or something else?

Drop your thoughts below ️

️

#crypto #coin #USDT #payments