🚦Bitwise ETF: Approved... Then Immediately Put in Time-Out by the SEC??

-

Well folks, in what can only be described as classic SEC theater, we’ve got another episode of “Now You See It, Now You Don’t”—this time starring Bitwise and its crypto index fund.

Here’s the tea:

Approved!

Approved!The SEC’s Division of Trading and Markets gave Bitwise’s application to convert its 10 Crypto Index Fund (BITW) into a legit exchange-traded fund (ETF) the green light. Bitwise had been waiting since November to make this move, and it finally looked like liftoff.

But wait...

️ Just Kidding—Paused!

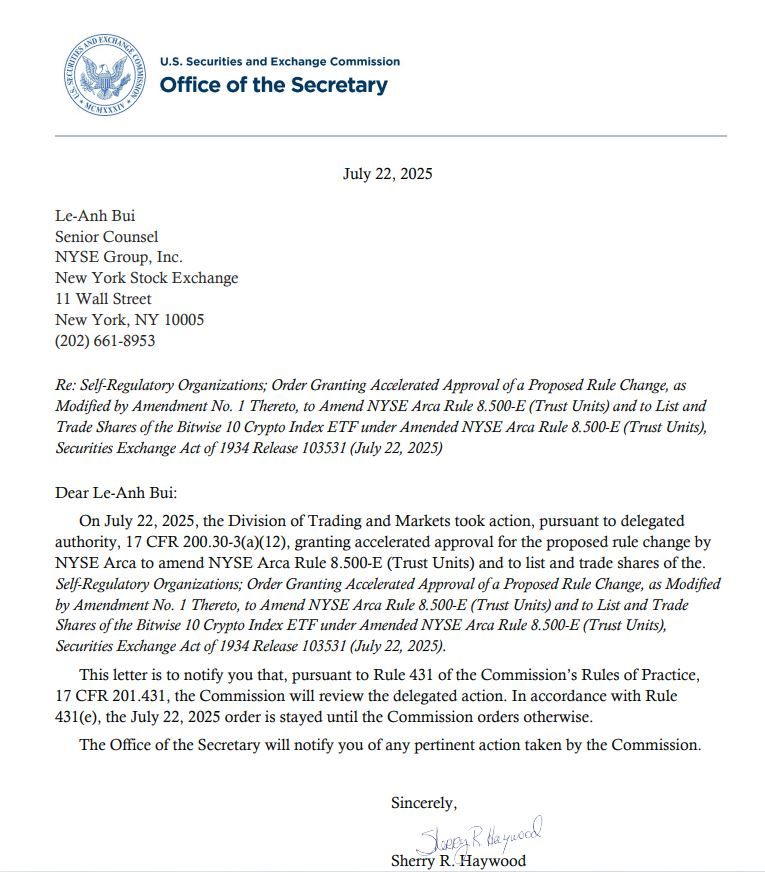

️ Just Kidding—Paused!Literally the same day, SEC assistant secretary Sherry Haywood slammed the brakes with a letter saying:

“The order is stayed until the Commission orders otherwise.”Translation: “We said yes... but not that kind of yes.”

The ETF is now chilling in regulatory limbo while the Commission re-reviews its own delegated approval. Bureaucracy at its finest.

🧠 What’s Inside This Fund?The Bitwise 10 Crypto Index Fund (BITW) includes exposure to the usual suspects like Bitcoin ($118,564) and Ether ($3,709), along with other top-cap cryptos. So, it’s basically a basket of blue-chip digital assets wrapped in ETF clothing—if it ever gets to wear it.

🧩 So What’s Actually Going On?Bloomberg analyst James Seyffart said the pause likely came from one or more SEC commissioners stepping in at the last second. Nate Geraci (NovaDius Wealth) called it a “bizarre situation,” comparing it to the Grayscale ETF déjà vu, where something similar happened earlier this month. Scott Johnsson from Van Buren Capital suspects “political maneuvering” behind the scenes—possibly to sidestep interference from SEC commissioner Caroline Crenshaw, or to wiggle around the 240-day deadline rule.Bloomberg’s Eric Balchunas has another theory:

“SEC may be holding off until they roll out standardized listing rules for crypto ETFs. Probably aiming to tidy things up before October.”🧩 Bonus Chaos: In-Kind Redemption Delay

Meanwhile, the SEC just extended its deadline for decisions on in-kind redemptions for Bitwise’s Bitcoin and Ether spot ETFs.

Oh, and apparently there’s talk of automating the ETF approval process for certain crypto vehicles to cut out red tape and the dreaded 19b-4 filings. (We’ll believe it when we see it.)

TL;DR:

TL;DR:Bitwise's ETF: Approved then immediately paused. SEC: Still allergic to moving fast. Crypto Twitter: Mildly melting down. Everyone else: Watching this slow-motion regulatory rollercoaster with popcorn.Thoughts? Conspiracy theories? Betting on the next ETF approval fake-out? Drop your takes below