Ethereum Gas Limit On the Rise — What It Means for Devs, Users & Fees

-

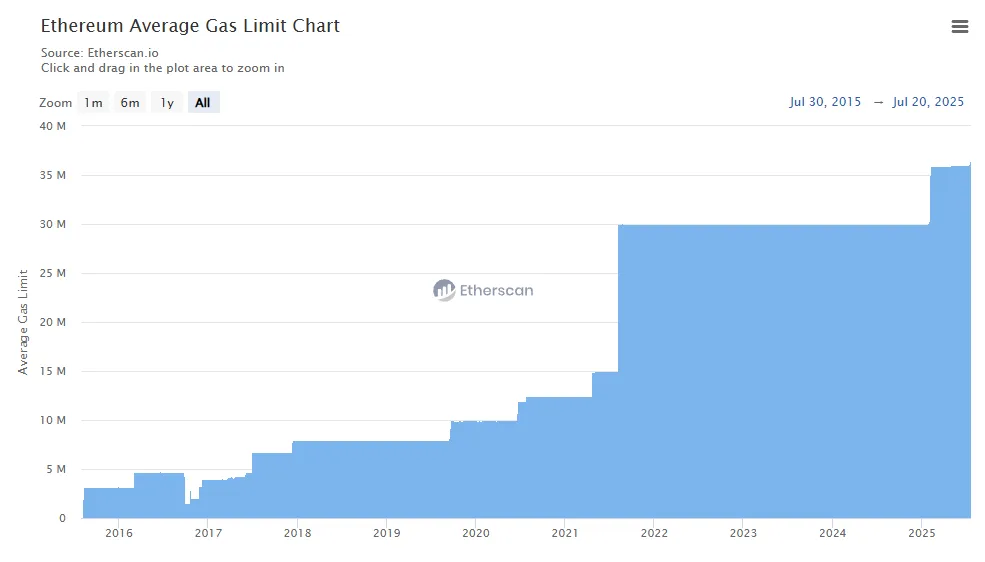

Over the weekend, Ethereum’s transaction throughput jumped as more validators signaled support for a new gas limit target of 45 million units—a move aimed at reducing fees and improving L1 scalability. On Sunday, Ethereum’s gas limit rose to over 37.3 million units, according to Etherscan—up nearly 3% from the previous week. A number of blocks were even proposed with gas limits beyond that.

On Sunday, Ethereum’s gas limit rose to over 37.3 million units, according to Etherscan—up nearly 3% from the previous week. A number of blocks were even proposed with gas limits beyond that.This is the first major increase since February, when the limit was raised from 30M to 36M.

🧱 What’s the Gas Limit, and Why Does It Matter?The gas limit sets the cap for how much computation (i.e., smart contracts or transactions) can fit into a single block. Raising it allows more transactions per second (TPS) on the base layer.

Thanks to validator flexibility, the limit can be nudged about 0.1% per block, and that’s exactly what’s happening now—validators are literally voting with their stake.

"Pump the Gas" Campaign Gaining Steam

"Pump the Gas" Campaign Gaining SteamBacked by Ethereum developers and initiated in early 2024, the "Pump the Gas" grassroots movement aims to raise the L1 gas limit to 45 million or higher.

Ethereum co-founder Vitalik Buterin noted that nearly 50% of all staked ETH is now signaling support for the increase.

“Almost exactly 50% of stake are voting to increase the L1 gas limit to 45 million,” — Vitalik, July 13Currently, 47.2% of validators are in favor, according to GasLimits.pics.

Lower Fees, Higher Activity, Rising Price

Lower Fees, Higher Activity, Rising PriceThroughput has risen to ~18 TPS, up from ~15 in the last cycle. Daily transactions are up too—from ~1.1M in April to ~1.4M now. Ether’s price surged 54% in the past month, briefly hitting $3,800—its highest level in 7 months.The rally is supported by growing adoption, renewed interest from corporate treasuries and ETFs, and optimism around layer-1 efficiency improvements (especially thanks to Geth client optimizations for archive nodes).

🧠 TL;DRGas limits are increasing = better scaling and lower fees Almost 50% of validators are on board Ethereum is handling more transactions and gaining value “Pump the Gas” is becoming realityHow do you think this will impact L1 dApps, developer strategies, or on-chain UX in general? Are we ready for a faster, leaner Ethereum?

Let’s discuss

#Ethereum #GasFees #DeFi #CryptoNews #BlockchainDev #Web3Builders #PumpTheGas -

The gas limit increase presents both opportunities and challenges for Ethereum Short-Term Relief:

- 10-15% lower fees for L1 users

- Small dApps can delay migrating to L2s

Long-Term Risks: - State growth accelerates (already +35% YTD)

- Node requirements keep rising (potential centralization)

Developer Implications:

Easier to onboard new users temporarily

Easier to onboard new users temporarily

️ Must still optimize for blob storage long-term

️ Must still optimize for blob storage long-termUser Tradeoffs:

- Cheaper today but potentially costlier tomorrow

- Full nodes may become even rarer

The real solution remains:

- Widespread L2 adoption

- EIP-7623 (dynamic limit adjustment)

- Client diversity improvements