Why BitMine selling ETH would be a market shock

-

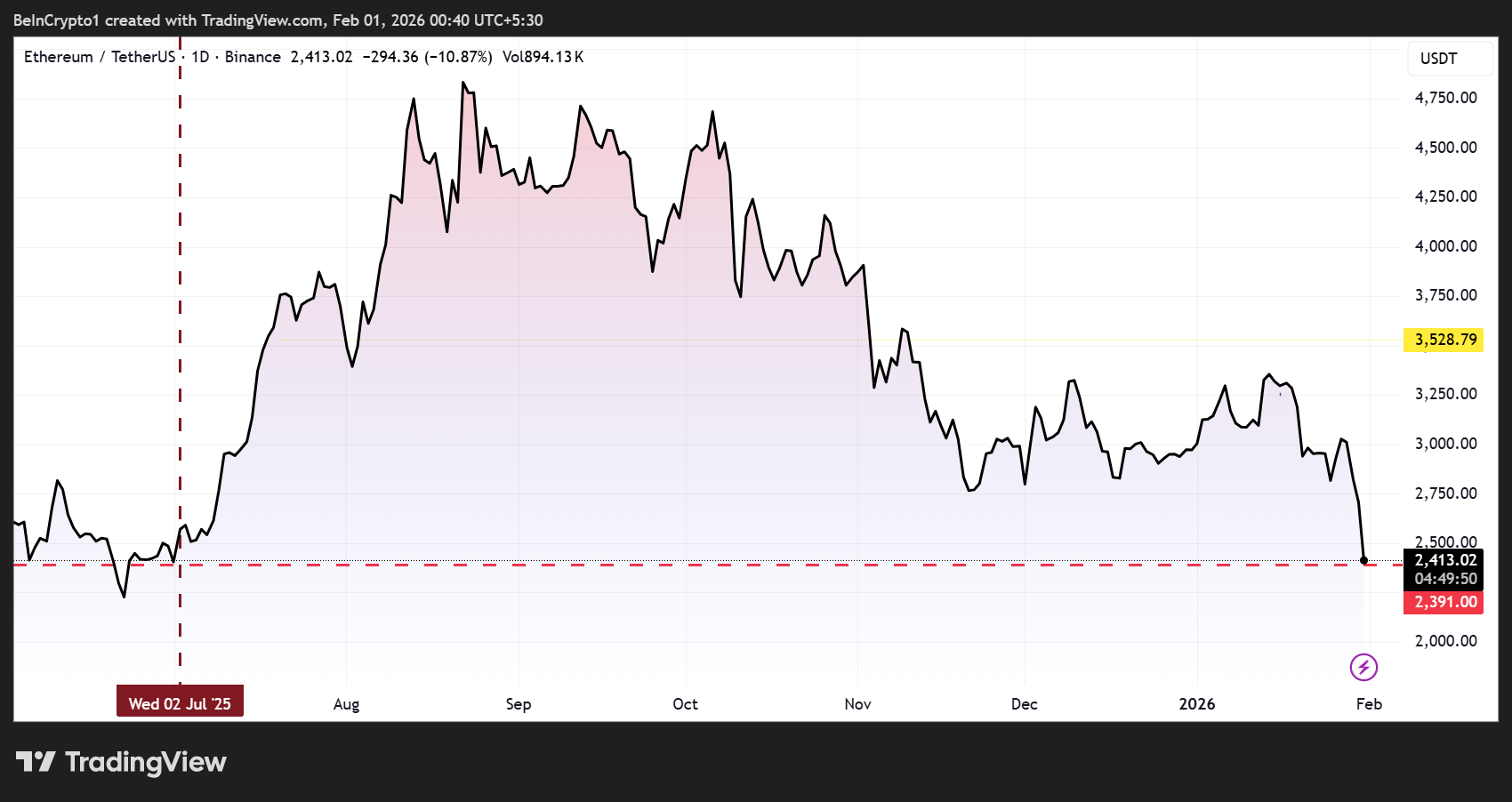

As Ethereum slides to multi-month lows, attention has turned to BitMine Immersion Technologies (BMNR), chaired by Fundstrat’s Tom Lee and now the largest corporate holder of ETH. The company holds roughly 4.24 million ETH, around 3.5% of total supply, worth about $10.2 billion at current prices—down sharply from an estimated $15–16 billion cost basis.

If BitMine attempted to sell, analysts warn it could become one of the most destabilizing events in Ethereum’s history. Even a gradual liquidation would overwhelm market depth, with historical precedent suggesting 20–40% downside risk from whale-sized exits far smaller than BitMine’s position.

Market estimates suggest slippage alone could reduce proceeds to $5–7 billion, effectively locking in multi-billion-dollar losses and amplifying volatility across the entire ETH ecosystem.