Insider Trading Risks in Prediction Markets Spark Calls for KYC

-

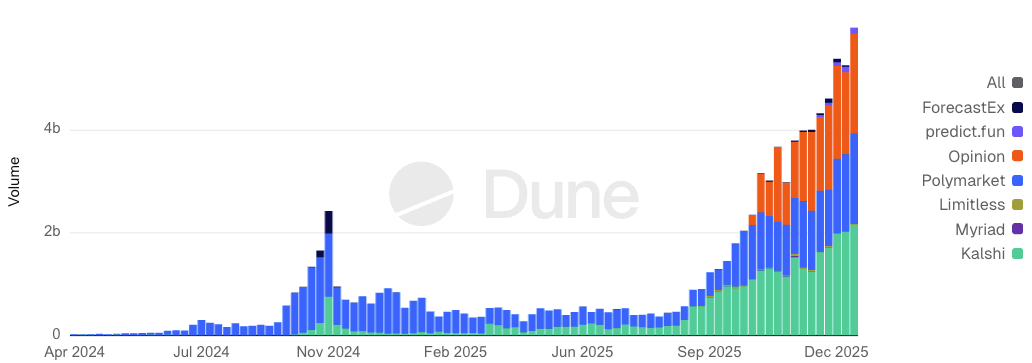

Trading volumes in prediction markets hit almost $6 billion by mid-January 2026. Source: DuneConcerns over insider trading on prediction markets have intensified after a series of high-profile bets on geopolitical outcomes raised questions about market integrity and fairness. Research analysts say that preventing insider abuse is realistically feasible only on platforms that enforce Know Your Customer (KYC) measures, because linking wallets to verified identities allows platforms to restrict access and raise enforcement standards — even if it can’t eliminate all abuse.

For fully onchain prediction markets that don’t require identity verification, experts argue that enforcement is “nearly impossible,” since wallet addresses aren’t tied to real-world persons and there’s no reliable way to prove whether someone acted on material nonpublic information. While platforms can try to detect unusual trading behavior or cap positions, these mitigations are easily circumvented without identity checks — leaving an ongoing debate about how much regulation is necessary to protect market integrity.

-

kyc sucks but pretending anon markets can police this feels delusional