Why Stablecoins Are Solving a Major Problem in Global Investing

-

According to Interactive Brokers, stablecoins directly address one of the biggest obstacles in global markets: slow and expensive cross-border funding. CEO Milan Galik explained that stablecoins provide near-instant settlement, lower transaction costs, and uninterrupted access—advantages that traditional fiat systems struggle to match, especially for international investors.

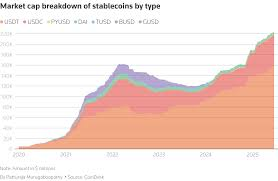

The move fits into a broader trend. Since launching crypto trading in 2021 with assets like Bitcoin and Ether, the firm has steadily expanded its digital asset offerings. Meanwhile, the stablecoin market itself has surged past $310 billion in total value, driven largely by USDC and Tether, with data tracked by DefiLlama—underscoring how quickly stablecoins are becoming a foundational layer of modern finance.