Why Banks Are Nervous About DeFi

Pulse of the market

2

Posts

2

Posters

2

Views

-

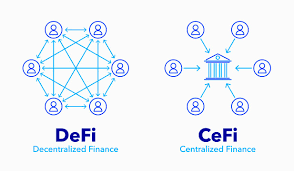

At the heart of the pushback is concern over the CLARITY Act, a crypto market structure bill now moving through the US Senate Banking Committee. Banking lobbyists fear provisions that could allow stablecoin issuers to offer yield-bearing products — potentially competing directly with bank deposits.The U.S. Treasury has previously estimated that as much as $6.6 trillion in bank deposits could leave the traditional system if stablecoins achieve widespread adoption. For banks, DeFi represents not just innovation, but a direct threat to their funding base.