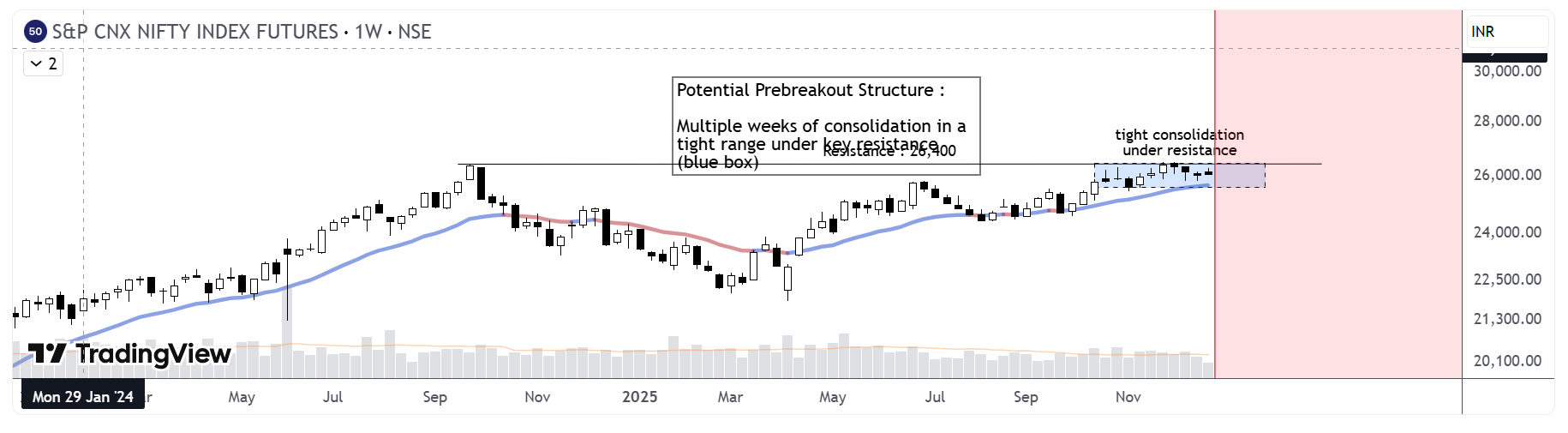

NIFTY: Reading the 10-week Silence Under Resistance

-

What I'm seeing: Tight, 'boring' consolidation under key resistance

For the past 10 weeks, NIFTY price action has been "boring" on the surface. Week after week, price has been heading nowhere. Weekly candle ranges are tight without much action. But if we look at the structure a bit more carefully—it's actually quite interesting.

What story is this silence in the price action telling?

Let's try to read the story that NIFTY has been telling for the past few months:

The Level: The last major high of around 26.4k was put in back in Sep '24. Since then, price has remained below this key level.

The Approach: Price finally returned to this resistance in late Oct '25.

The Reaction: One might have expected a strong sell-off given the history of this level. Instead, NIFTY is meandering in a tight range (25.5k - 26.5k) for 10 weeks and counting. This is a massive clue that supply is being absorbed.Pre-breakout structures:

This is a classic example of a "pre-breakout structure." This is the pattern I like to see most on higher timeframes.

Key Characteristics:

Defined Resistance: The 26.3k–26.4k area is a clear ceiling.

Higher Lows: We see a sequence of rising support—Aug '25, Sep '25, and early Nov '25.

The Buildup: A tight "squeeze" near resistance and above the 20-week EMA. This coiling action often precedes an explosive move.What’s next?

The way price action is shaping up, the odds for a bullish breakout are good within the next 1–3 months. Every tight weekly candle adds to the "squeeze."

Note: Bulls must defend the 20W EMA. We may see one more "test" of this average before the breakout attempt begins in earnest.

The Tradeable Setup:

The PreBreakout Entry: Building a position within the buildup, as close to the 20W EMA as possible.

The Breakout Entry: Waiting for a push above 26.4k (trigger), ensuring the entry isn't too far extended from the level.Invalidation Points:

Aggressive: Prior swing low from early Nov at 25.4k.

Conservative: Swing low from late Sep at 24.6k.Broader Market Context: The "North Star" Effect

While this analysis is focused on NIFTY Index Futures, its implications are much wider. The NIFTY 50 acts as the "North Star" for the Indian stock market.

The Tide Lifts All Boats: Bullish posturing in the NIFTY—and a successful breakout if/when it happens—provides the necessary "risk-on" environment for individual stocks to break out of their own bases.

A Bullish Filter: When the index is coiling like this, it’s often the best time to build a "watchlist of strength." If the NIFTY resolves this consolidation to the upside, the stocks that have been holding up best will likely be the first to fly.Use the NIFTY's price action as your broad-market filter. A breakout here isn't just a trade for futures players; it’s a green light for the entire Indian equity space.

Disclaimer

This post is for educational purposes only and does not constitute financial advice. Trading in the stock market involves significant risk. Please perform your own due diligence or consult with a SEBI-registered investment advisor before making any trading decisions.

-

first time hearing this token