Bitcoin Cash Aligns With Broader Crypto Upside Momentum

-

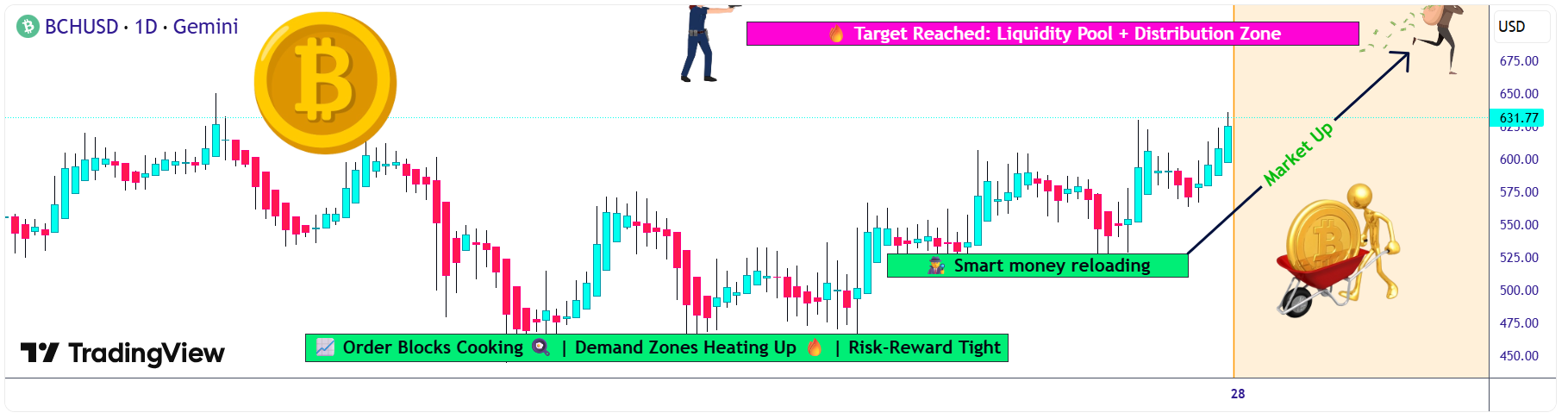

BCH/USD CRYPTO PROFIT PATHWAY SETUP

BCH/USD CRYPTO PROFIT PATHWAY SETUP  | Bitcoin Cash Bull Trap Escape Strategy

| Bitcoin Cash Bull Trap Escape Strategy ASSET: BCH/USD (Bitcoin Cash vs U.S. Dollar)

ASSET: BCH/USD (Bitcoin Cash vs U.S. Dollar)

Market: CRYPTO | Strategy Type: SWING TRADE | Plan: BULLISH

BULLISH CURRENT MARKET DATA (Real-Time Verified)

CURRENT MARKET DATA (Real-Time Verified)

Current Price: $614.41 USD

24H Volume: $365.33M USD

Market Cap Rank: #11

24H Change: +1.49%

YTD Performance: +35% (Strong Bullish Momentum) "THIEF STRATEGY" - LAYERED ENTRY SYSTEM

"THIEF STRATEGY" - LAYERED ENTRY SYSTEM

Entry Zones (Layer Your Positions):

Entry Zones (Layer Your Positions):

The "Thief Strategy" uses multiple limit orders to scale into positions strategically:

Layer 1: Entry @ $560 (20% of position)

Layer 2: Entry @ $580 (25% of position)

Layer 3: Entry @ $600 (30% of position)

Layer 4: Entry @ $610 (25% of position) Alternative: Market entry at ANY PRICE LEVEL for aggressive traders (current: ~$614)

Alternative: Market entry at ANY PRICE LEVEL for aggressive traders (current: ~$614) ️ Note for Thief OG's: You can adjust layers and increase entry points based on your own risk tolerance and capital allocation strategy.

️ Note for Thief OG's: You can adjust layers and increase entry points based on your own risk tolerance and capital allocation strategy. STOP LOSS MANAGEMENT

STOP LOSS MANAGEMENT

Thief's SL: @ $550 CRITICAL REMINDER - Dear Ladies & Gentlemen (Thief OG's):

CRITICAL REMINDER - Dear Ladies & Gentlemen (Thief OG's):

This is MY stop loss based on MY strategy

Adjust YOUR stop loss according to YOUR risk management rules

Consider your position sizing and portfolio allocation

This is NOT a recommendation—it's reference data

YOUR money = YOUR decisions = YOUR risk ️ TARGET: POLICE FORCE RESISTANCE ZONE

️ TARGET: POLICE FORCE RESISTANCE ZONE

Primary Target: @ $690

Why $690?

Why $690?

POLICE FORCE acts as strong resistance + oversold bounce zone

POLICE FORCE acts as strong resistance + oversold bounce zone

Historical correlation support at this level

Historical correlation support at this level

Accumulation zone before potential breakout

Accumulation zone before potential breakout

Smart money trap escape point

Smart money trap escape point ️ CRITICAL REMINDER - Dear Ladies & Gentlemen (Thief OG's):

️ CRITICAL REMINDER - Dear Ladies & Gentlemen (Thief OG's):

This is MY take profit target based on MY analysis

Set YOUR targets according to YOUR trading plan

Scale out at multiple levels if preferred

Take profits when YOU are comfortable

NOT a recommendation—trade at YOUR own risk CORRELATED PAIRS TO WATCH

CORRELATED PAIRS TO WATCH

Monitor these pairs for market correlation and confirmation signals:

Primary Correlations:

BTC/USD - Current: $87,900.93 | BCH follows Bitcoin's macro direction

ETH/USD - Current: $2,936.87 | Layer-1 competition indicator

BCH/BTC - Direct correlation ratio trackingKey Correlation Points:

BCH hashrate above 7.71 EH/s (above 2017 peak) = Network strength confirmation

Bitcoin correlation shows BCH experiencing 61,561% liquidation imbalance, suggesting price decoupling potential

Watch Bitcoin dominance levels—currently at 59.5% FUNDAMENTAL & ECONOMIC FACTORS (Latest Updates)

FUNDAMENTAL & ECONOMIC FACTORS (Latest Updates)

Recent Bullish Catalysts:

Recent Bullish Catalysts:-

Major Technology Upgrades (2025):

NEAR Integration (Dec 23, 2025) - Cross-chain swaps with 120+ assets across 25+ chains

Cashinals Launch (Dec 18, 2025) - BCH-20 token standard debuts, expanding NFT ecosystem

May 2025: VM Limits & BigInt Support activated - enabling Ethereum-like smart contracts -

Network Strength Indicators:

Hashrate at 7.71 EH/s, surpassing 2017 peak

Circulating supply: 19,972,656 BCH (approaching 21M max supply)

Over 2,550 merchants now accepting BCH -

Institutional & Whale Activity:

Whale Activity Peaks (Dec 24, 2025) - Record transaction sizes signal accumulation

$482M moved by large holders in July 2025

Grayscale's rumored BCH ETF filing -

Technical Price Action:

Confirmed double bottom pattern near $300 region

BCH testing critical $600 zone for breakout to $800-$1,000

Strong buy signal on technical indicators

Upcoming Events to Monitor:

Upcoming Events to Monitor:

2026: Quantum-resistant cryptography development

2026: Enhanced VM Limits & BigInt CHIPs for DeFi integration

Ongoing: Cross-chain liquidity expansion via NEAR Protocol KEY RESISTANCE & SUPPORT LEVELS

KEY RESISTANCE & SUPPORT LEVELS

Immediate Resistance:

R1: $620-$630 (Current test zone)

R2: $650 (Breakthrough target)

R3: $680-$690 (Major resistance—TARGET)

R4: $800-$1,000 (Extended targets)Support Levels:

S1: $580-$600 (Strong buyer accumulation)

S2: $560 (Layer entry zone)

S3: $520-$560 (Pullback cushion)

S4: $445-$450 (50W-EMA support) PRICE PREDICTIONS & ANALYST CONSENSUS

PRICE PREDICTIONS & ANALYST CONSENSUS

2025 Outlook:

Bullish scenario: BCH could reach $701 with increased hype

Bearish scenario: Support around $450-$507

Year-end target: Potential $799Medium-Term (2026-2027):

2026 maximum: $1,160

Bullish targets: $1,200-$1,597 by end 2025/early 2026

Potential retest of $4,300 ATH if smart money accumulates TRADING STRATEGY SUMMARY

TRADING STRATEGY SUMMARY

Setup Type: Swing Trade (Multi-day to Multi-week hold)

Risk Level: Medium-High (Crypto volatility)

R:R Ratio: Approximately 1:2.5 (depending on entry)

Timeframe: Daily/4H chart focus

Strategy: Layered entry + correlation monitoring + fundamental backing FOLLOW FOR MORE SETUPS

FOLLOW FOR MORE SETUPS

If this analysis helps YOUR trading journey, smash that and follow for more Profit Pathway Setups!

and follow for more Profit Pathway Setups!

Drop a if you're entering this trade!

if you're entering this trade!Thief Strategy Squad: Make money, manage risk, escape the trap!

️

️

-

-

thats what im talking about BCH to the mooooooooon