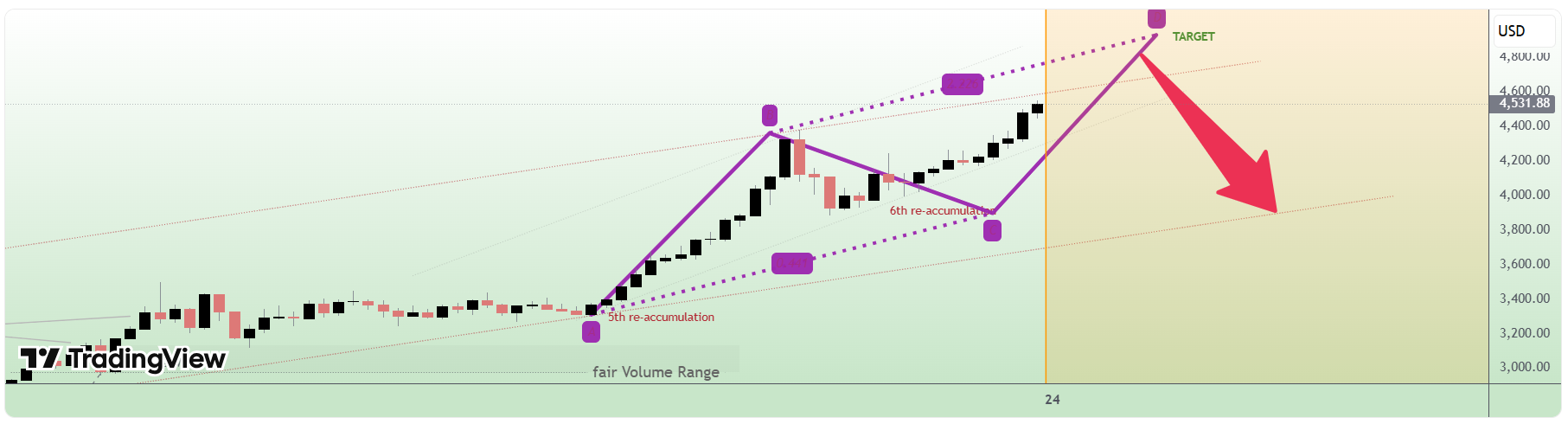

Bulls in Full Control, but Reversal Risks Rise Near Record Highs

-

Gold continues to dominate the market after surging to a fresh all-time high at $4536.74, reinforcing strong bullish control despite a modest intraday pullback toward the $4515–$4525 zone. With no overhead resistance in sight, upside momentum remains intact, but the speed and vertical nature of the rally increase the risk of a short-term reversal, particularly if profit-taking accelerates into the close.

-

In this environment, the concept of a “dip” has fundamentally changed: the key 50% retracement level of the current swing now sits near $4350.27, almost $200 below recent highs, reflecting the expanding volatility typical of a parabolic market.

-

A critical technical level to monitor is $4479.41, any daily close below this price would confirm a bearish daily reversal top, potentially triggering a 2–3 day corrective move toward value areas.

-

Fundamentally, gold remains supported as strong U.S. economic growth and persistent inflation expectations keep demand underpinned, while mixed Treasury yields and a weakening U.S. dollar add further tailwinds. The dollar’s vulnerability below the 97.814 support level could accelerate downside pressure toward 96.218, a move that would likely fuel another leg higher in gold. Until a confirmed reversal materialises, the broader trend favors continued strength, with any pullbacks viewed as strategic buying opportunities.

-

-

gold had a great year