How to Use Google Gemini AI as Your Crypto Day-Trading Co-Pilot

-

Day trading crypto is brutal: prices swing 24/7, order books flip in minutes, and narratives rotate by the hour. Google’s Gemini AI can help you stay disciplined, filter noise, and turn scattered market data into actionable setups — without ever handing it your exchange keys.

Key Takeaways

Key TakeawaysResearch & Plan, Don’t Auto-Trade

Gemini AI can analyze, summarize, and structure trade ideas, but it cannot execute trades.Turn Data Into Discipline

Build repeatable loops — Watchlist → Catalysts → Levels → Plan → Order Flow → Post-Mortem — so you trade rules, not emotions.Pair It With Real Data

Gemini Flash 2.5 lacks live market feeds. Combine it with TradingView, Glassnode, Nansen or other analytics for real-time prices and on-chain stats.1️⃣ Set Up Your Gemini Workspace

Choose how you’ll access Gemini:

Google Sheets / Docs: Summaries, dashboards, and structured analysis.

Google AI Studio or Gemini API: For coders who want to prompt programmatically.

Google AI Pro (Advanced): Larger context windows for multi-asset intraday notes.

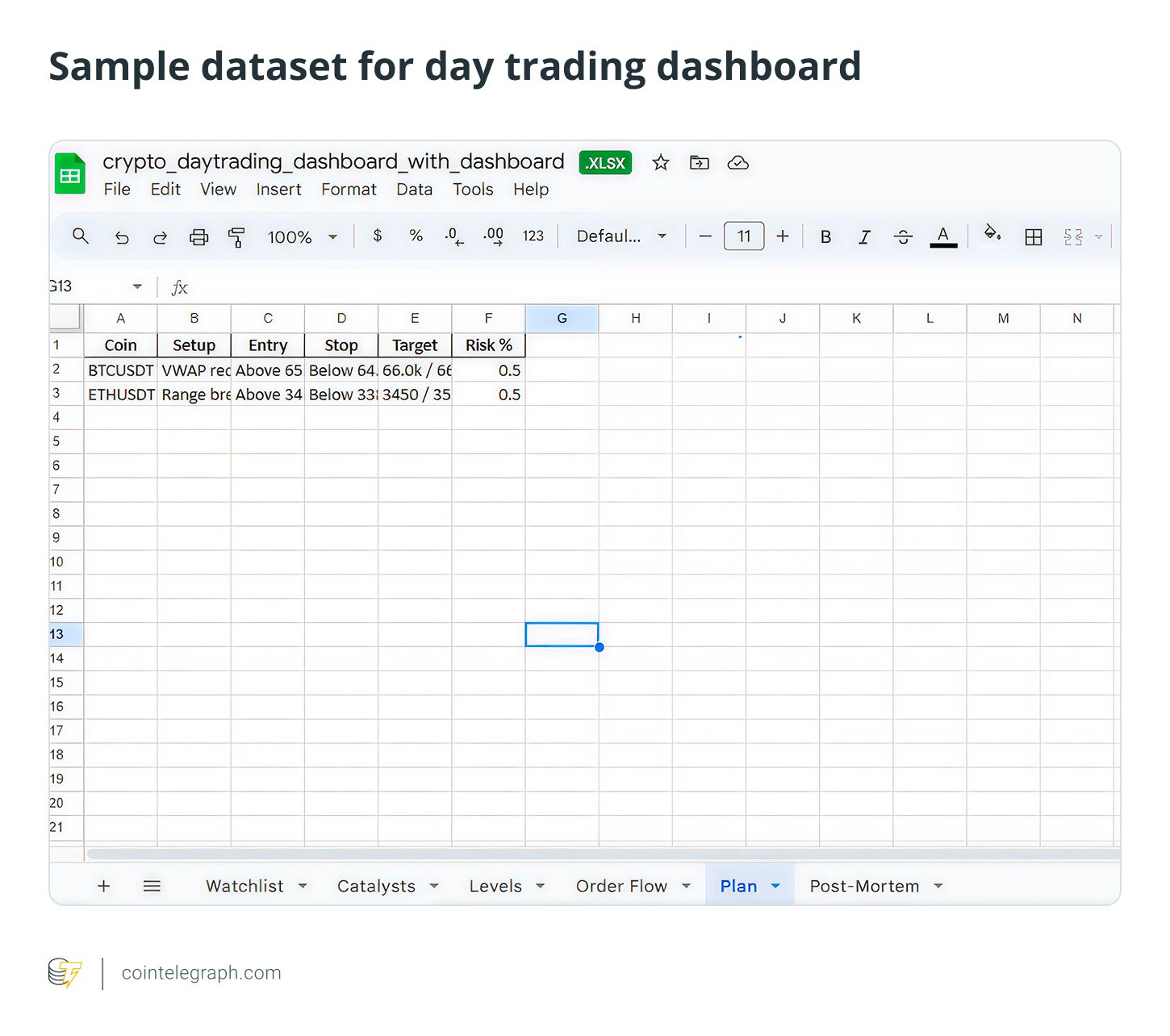

Create a trading notebook in Sheets with tabs like:

Watchlist

Catalysts (upgrades, unlocks, macro reports)

Levels (support, resistance, liquidity pockets)

Order flow (funding rates, on-chain flows)

Plan

Post-mortem

2️⃣ Gemini in Action — Practical Prompts

Use Gemini to reason over large context and produce structured insights.

Watchlist Ranking

“Summarize the top three coins by 24-hour price change from this dataset and rank them by shorting risk.”

Catalyst Filtering

“Flag which headlines are most likely to impact ETH and SOL in the next 12 hours based on past price reactions.”

Liquidity Mapping

“Identify key price clusters where ETH was rejected multiple times this week.”

Daily Trade Plan

“Draft three intraday scenarios using today’s Watchlist, Catalysts and Levels, with triggers and invalidations.”

Post-Mortem Review

“Analyze my last five trades and identify recurring mistakes or strengths.”

3️⃣ Build a Risk Firewall

Gemini helps you stay within safe limits:

Position sizing & leverage checks

Bearish and sideways scenario planning

Risk/reward ranking across all setups

Capital exposure summaries (e.g., too much ETH beta)

Bottom Line

Bottom LineGemini AI won’t (and shouldn’t) trade for you — but it supercharges your research, organization, and discipline. By combining Gemini’s structured reasoning with live market data and strict risk management, you can react faster and trade smarter in crypto’s 24/7 battlefield.