Equity Flows May Drive Crypto Volatility in the Short Term

Pulse of the market

1

Posts

1

Posters

1

Views

-

As investors favor lower-beta sectors like healthcare, financials, and consumer discretionary, high-beta tech trades cool.

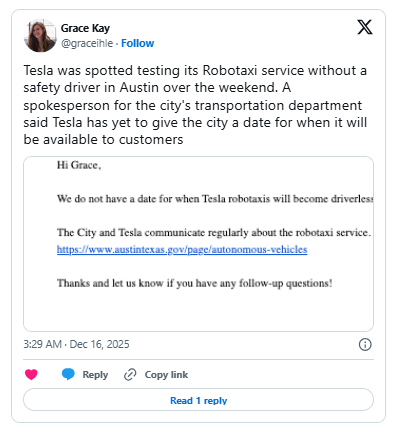

Tesla’s Robotaxi tests highlight how short-term equity moves can ripple into crypto via correlated risk flows.

Year-end positioning creates range-bound markets and increased volatility, offering potential opportunities for traders who monitor sector rotation.

Crypto traders should watch how Wall Street reallocates for 2026—it may set the tone for early gains or losses.