Sub-Saharan Africa Emerges as the World’s 3rd-Fastest Growing Crypto Market

-

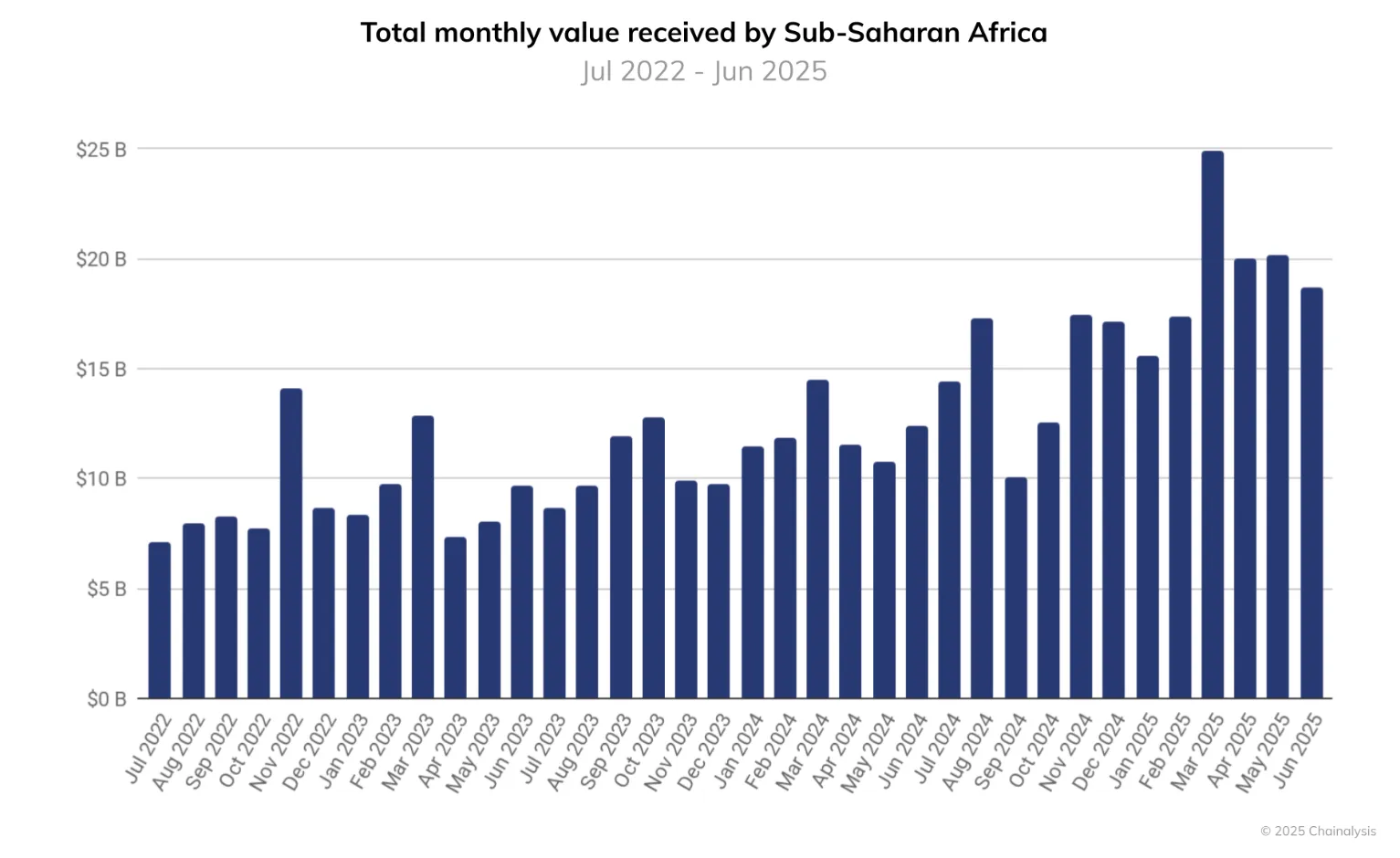

Crypto adoption in Sub-Saharan Africa is accelerating at a remarkable pace, driven by practical, real-world use cases that go well beyond speculation. According to a new Chainalysis report, the region received $205 billion in onchain value between July 2024 and June 2025 — a 52% jump from the previous year — making it the third-fastest growing crypto region globally, behind only Asia-Pacific and Latin America.

Institutional Adoption: Stablecoins Lead the Charge

Institutional Adoption: Stablecoins Lead the ChargeNigeria tops the list with $92.1 billion in value received, powered by a tech-savvy youth demographic and chronic inflation that makes stablecoins an appealing alternative to the local naira.

South Africa’s regulated market has attracted institutional players, who are expanding beyond trading into custody and broader crypto product offerings.

Million-dollar stablecoin transactions now flow between Africa, the Middle East, and Asia, highlighting the continent’s growing role in international settlement.

Stablecoins are not just speculative tools here — they are a functional substitute for scarce U.S. dollars and a shield against persistent currency devaluation.

Retail Growth Outpaces the World

Retail Growth Outpaces the WorldChainalysis found that 8% of all crypto transfers in the region are $10,000 or less, compared with 6% globally, underscoring how crypto is being used day-to-day rather than only for large trades.

Drivers of this adoption include:

Limited banking access across rural and urban areas

Rapidly devaluing local fiat currencies

High inflation and dollar shortages

The report suggests that crypto here serves as a financial lifeline, not just an investment.

Beyond Finance: Broader Blockchain Use Cases

Beyond Finance: Broader Blockchain Use CasesAfrica is also becoming a testing ground for non-financial blockchain applications. StarkWare co-founder Eli Ben-Sasson noted the continent’s role in using decentralized tech to tackle issues like energy insecurity and infrastructure gaps — signaling that Africa could be key to global crypto mass adoption.

Why This Matters

Why This MattersFor investors: The next wave of crypto growth may come from utility-driven adoption, not just speculative trading.

For builders: Africa offers fertile ground for real-world Web3 applications — from remittances and payments to energy and supply-chain solutions.

For policymakers: South Africa’s regulatory framework shows that clear rules can coexist with innovation, attracting serious institutional capital.

Bottom line:

Bottom line:

Sub-Saharan Africa isn’t just joining the crypto economy — it’s redefining it, showing how decentralized technologies can thrive where traditional finance falls short. With $205 billion in annual onchain value and surging retail use, the region is rapidly becoming one of crypto’s most important frontiers.