Ether Price Under Pressure From ETFs and Network Activity

-

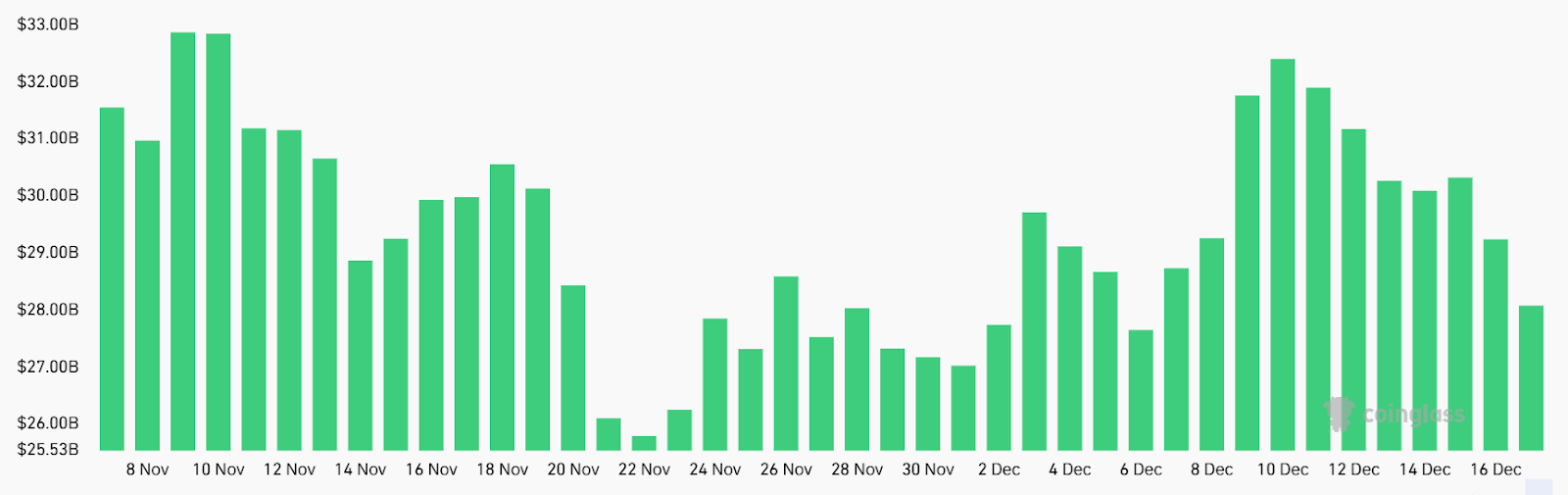

ETH futures aggregate open interest, USD. Source: CoinGlassEther underperformed the broader crypto market by 6% over the past week, pressured by ETF outflows and declining onchain activity. US-listed Ether ETFs, holding $17.5 billion in ETH, have reversed inflows, while aggregate open interest in ETH futures dropped to $28.1 billion.

Monthly futures premiums remain weak at 3%, signaling limited long-position demand. Meanwhile, weekly fees on Ethereum DApps fell to $68 million from $98 million a month ago, and total ETH staked dipped to 35.69 million, reflecting reduced long-term holding incentives. Weak network usage and ETF outflows are keeping bearish pressure on Ether’s price.

-

ETF flows are clearly impacting ETH in the short term.