Overbought But Still Ripping

-

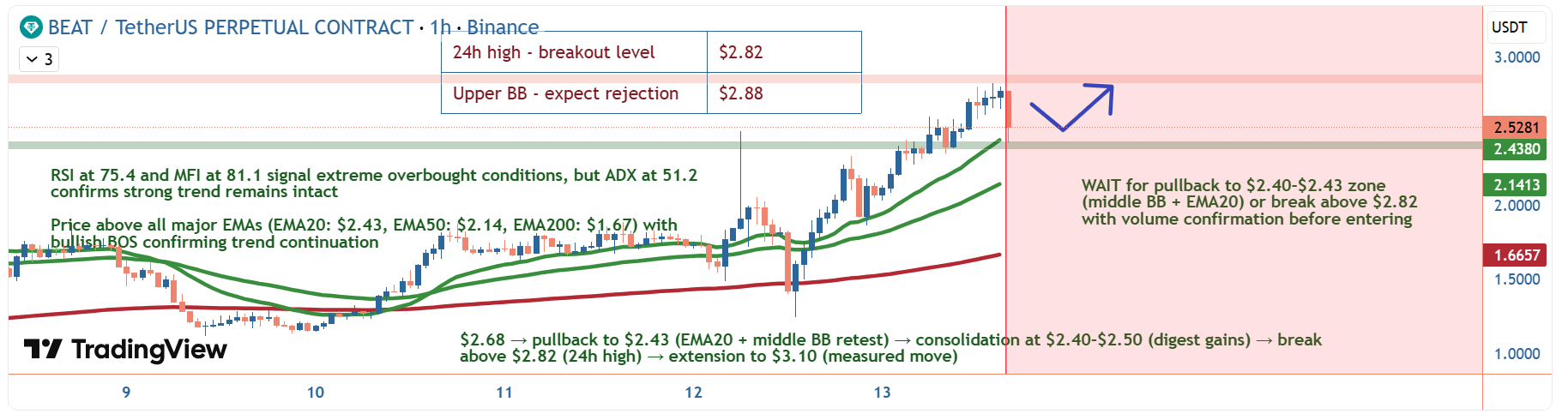

Hey guys, BEAT just delivered a monster +47.49% rally in 24 hours and is now trading at $2.68, sitting about 5% below the session high of $2.82. This thing has been absolutely ripping, but now we're at a critical juncture where the technicals are giving us mixed signals and we need to be smart about our next move. Let me break down what's happening and where the opportunities might be.

Hey guys, BEAT just delivered a monster +47.49% rally in 24 hours and is now trading at $2.68, sitting about 5% below the session high of $2.82. This thing has been absolutely ripping, but now we're at a critical juncture where the technicals are giving us mixed signals and we need to be smart about our next move. Let me break down what's happening and where the opportunities might be.First off, this is a relatively new asset with limited historical data, so we're focusing purely on recent price action and intraday structure. Price is currently in PREMIUM territory according to Smart Money Concepts, trading well above the equilibrium at $1.53 and deep into the sell zone above $1.81. When you're buying premium, you're essentially buying from smart money who accumulated lower, so the risk/reward gets tricky up here.

The bullish order block sits at $2.14-$2.03, which was the last major demand zone before this explosive leg up. We've also got an unfilled bullish Fair Value Gap (FVG) between $2.14-$2.20 that could act as a magnet if we see any profit-taking. These imbalances often get filled as price retraces to find more buyers before continuing higher.

Now let's talk about the elephant in the room - the overbought conditions. RSI is at 75.4, firmly in overbought territory, and the Money Flow Index (MFI) is even more extreme at 81.1. These readings tell us that buying pressure has been intense, but also that we might be due for a breather. The Stochastic at 78.1 is also elevated, though not quite as extreme.

But here's where it gets interesting - the ADX is reading 51.2, which confirms this is a STRONG trend, not just a random spike. ADX above 25 indicates a trending market, and above 50 is considered very strong. This means the momentum behind this move is real and substantial. The MACD is also bullish with the MACD line at 0.2032 above the signal line at 0.1847, showing positive momentum continuation.

Moving average alignment is textbook bullish right now. Price is above EMA20 ($2.43), EMA50 ($2.14), and EMA200 ($1.67), which is the classic bull stack you want to see. The Hull Moving Average at $2.60 is providing dynamic support right underneath current price. As long as we hold above these EMAs, the path of least resistance remains upward.

Bollinger Bands are showing price above the middle band at $2.40, with the upper band at $2.88 acting as the next resistance ceiling. We're currently in the upper half of the BB range, which typically indicates bullish momentum but also warns of potential mean reversion back toward the middle band.

Here's a concern though - volume is below average. Current volume is $12M compared to the average of $15M, and the massive 24h volume of $835M was clearly front-loaded earlier in the session. When price is rising but volume is declining, that's a momentum divergence that often precedes consolidation or pullbacks. We need to see volume pick up again to confirm any breakout above $2.82.

The wick analysis is telling us something important too. We've got a 32.1% lower wick showing buyers defended lower levels aggressively, but also a 26.6% upper wick showing sellers pushed back hard at the highs. That upper wick at $2.82 is a rejection signal - there's supply waiting up there.

Price structure shows a lower high formation, which is technically bearish, but we've also got a confirmed bullish Break of Structure (BOS) according to Smart Money Concepts. This BOS indicates trend continuation upward is still in play. No Change of Character (CHoCH) has occurred, so the bullish market structure remains intact for now.

The key resistance is crystal clear - $2.82 is the 24h high and the level we need to reclaim. Above that, the upper Bollinger Band at $2.88 becomes the next target, and then we're in price discovery mode potentially heading toward $3.00-$3.20. The swing high at $2.50 from earlier has already been taken out, which was a bullish development.

On the support side, immediate support is the HMA55 at $2.60, then the EMA20 at $2.43 which coincides with the middle Bollinger Band at $2.40. This $2.40-$2.43 zone would be an ideal pullback entry for anyone who missed the initial move. Stronger support sits at the EMA50 and bullish order block high at $2.14, and then the order block low at $2.03. A 4H close below $2.03 would break the bullish structure and invalidate the continuation thesis.

The bearish order block sits at $2.05-$1.87, which is now acting as support after being flipped. This is actually bullish - when you reclaim a supply zone and turn it into demand, that's a sign of strength. The strong low at $1.24 is way down there and would require a major shift in market structure to reach.

So what's the trade setup here? If you're not already in, I wouldn't chase at $2.68 in premium territory with overbought indicators. You've got two cleaner plays: wait for a pullback to the $2.40-$2.43 zone (EMA20 + middle BB) where you get better risk/reward, or wait for a confirmed breakout above $2.82 with volume exceeding that 15M average.

For a pullback entry around $2.42, you could set stops below the bullish order block at $1.99 (roughly 18% risk) and target $2.82 as TP1 (16% gain), then $3.10 as TP2 (28% gain). That gives you a 1:1 to 1:1.5 risk/reward ratio. For a breakout entry at $2.85, stops could go below $2.60 (9% risk) with targets at $3.20 (12% gain), giving you better than 1:1 R/R.

If you're already holding from lower prices, this is a reasonable spot to take some partial profits - maybe 30-40% off the table - and let the rest ride with a trailing stop below $2.43 or $2.14 depending on your risk tolerance. You've already captured a massive move, so locking in some gains while keeping exposure to further upside is the prudent play.

The primary scenario I'm watching (55% probability) is a pullback to $2.43 where we consolidate and digest these gains for a bit, then a push back up to challenge $2.82 with proper volume behind it. If we break $2.82 on strong volume, the measured move projects to around $3.10-$3.20. The alternative scenario is an immediate rejection here or at $2.75-$2.82, leading to a sharper correction down to the $2.14 EMA50 and bullish order block for a reaccumulation phase.

Invalidation is clear - a 4H close below $2.03 breaks the bullish order block and demand structure, which would signal the trend is losing steam and a deeper correction toward $1.81 or even $1.53 equilibrium is likely.

Bottom line: this is a powerful trend with strong momentum, but it's overextended in the short term. The structure is still bullish with BOS confirmed and price above all major EMAs, but overbought indicators and declining volume are flashing caution signs. Don't FOMO into premium zones on a parabolic move. Wait for your pitch - either the dip to support or the confirmed breakout with volume. Patience here will likely reward you with a much better risk/reward entry. What's your take on this setup - are you waiting for the pullback or looking to catch the breakout?

-

Revenue-backed buybacks are becoming the new narrative.

-

This is a strong example of stablecoins solving real financial problems.

-

DAO-led strategies test whether decentralization really works under pressure.