SOL: Selling Pressure Rises After Fed Signals

-

Hi everyone,

Hi everyone,The Fed’s decision to cut rates by 0.25% raised hopes for renewed capital inflows into the crypto market, but the Fed’s statement that no further cuts are expected in 2026 keeps sentiment cautious. This caused sharp volatility in Bitcoin and Ethereum, spilling over as selling pressure into altcoins, particularly SOL — which is highly sensitive to BTC corrections. Short-term capital continues to favor AI and meme coins, leaving SOL temporarily lacking momentum, even though its ecosystem remains solid in the medium term.

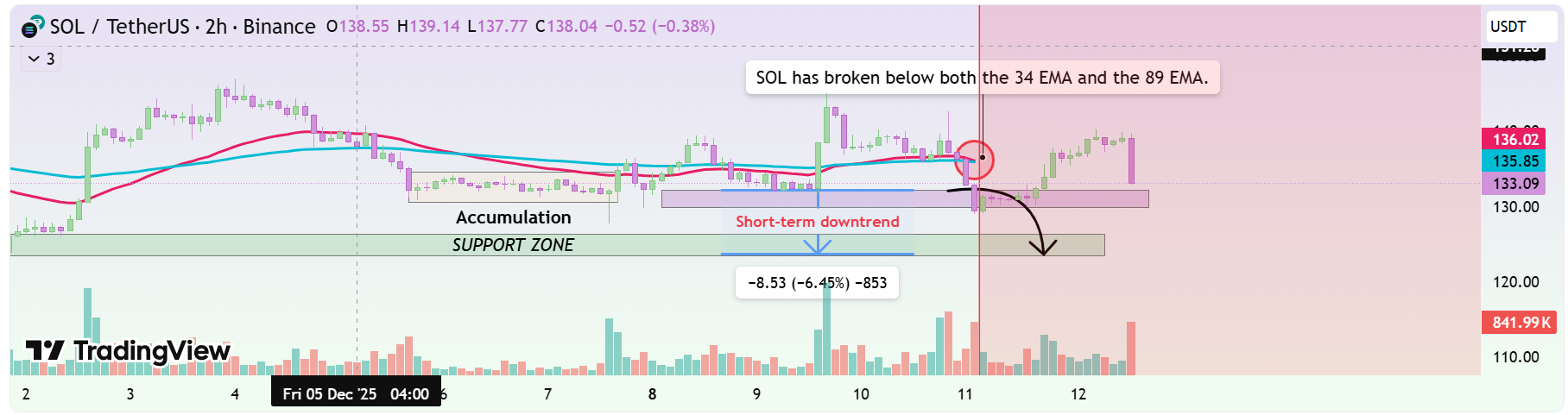

On the 2H chart, SOL has officially lost its uptrend structure as price closed strongly below both the 34 EMA and 89 EMA. Closing below these EMAs signals that the bullish momentum is broken and the short-term trend has turned bearish. The breakdown of the $134–135 support zone confirms a bearish Break of Structure, accompanied by a spike in selling volume — indicating that this is a real sell-off, not noise.

Currently, price is approaching the $127–129 support zone, seen as the first buffer that could trigger a reaction. However, if selling pressure persists, the $122–124 zone is likely to become the market’s next target.

Wishing you successful trading!

-

Macro sentiment hitting SOL harder than expected.

-

Need to see if demand steps in around key intraday levels.