🐋 Bitcoin Whales Dump $12.7B, But Institutions Are Absorbing the Pressure

-

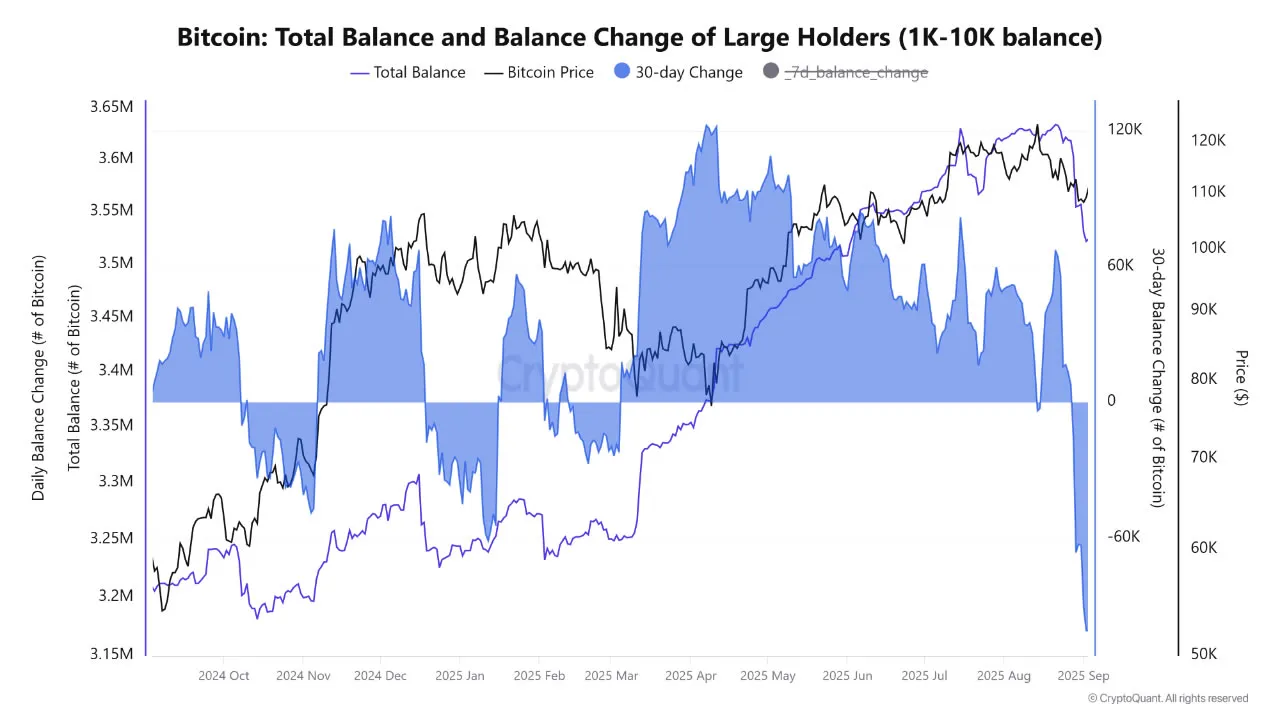

Bitcoin whales have sold more than 100,000 BTC — worth roughly $12.7 billion — over the past 30 days, marking the largest whale distribution since July 2022, according to on-chain data from CryptoQuant.

Short-Term Pressure

Short-Term PressureWhale reserves dropped by 114,920 BTC in a month, signaling risk aversion among large holders.

This selling pressure pushed BTC below $108,000, creating volatility and liquidations.

Analysts warn the trend may continue to weigh on price in the coming weeks.

️ Whale vs. Institutions

️ Whale vs. InstitutionsDespite the sell-off, institutional buyers and ETFs have stepped in as a structural counterbalance.

“Institutional accumulation during the same period has helped stabilize the market,” said Nick Ruck of LVRG Research.

This tug-of-war suggests whales may cap near-term upside, but corporate dip-buying could keep BTC resilient.

Whale Activity Slowing?

Whale Activity Slowing?The 7-day whale balance change peaked at +95,000 BTC on Sept. 3, the highest since March 2021.

As of Sept. 6, weekly outflows slowed to 38,000 BTC, while BTC traded between $110K–$111K.

Bigger Picture Still Bullish

Bigger Picture Still BullishZooming out, Bitcoin has corrected just 13% from its mid-August ATH — a shallow pullback compared to past cycles.

The 1-year SMA has nearly doubled from $52K last year to $94K today, and is expected to cross $100K in October, according to analyst Dave the wave.

Takeaway: Whales are cashing out, but institutions are quietly buying the dip. Short-term turbulence remains, but long-term metrics suggest Bitcoin’s bull trend is still intact.

Takeaway: Whales are cashing out, but institutions are quietly buying the dip. Short-term turbulence remains, but long-term metrics suggest Bitcoin’s bull trend is still intact.