Arthur Hayes Sparks New Round of Tether Anxiety With Reserve Warning

-

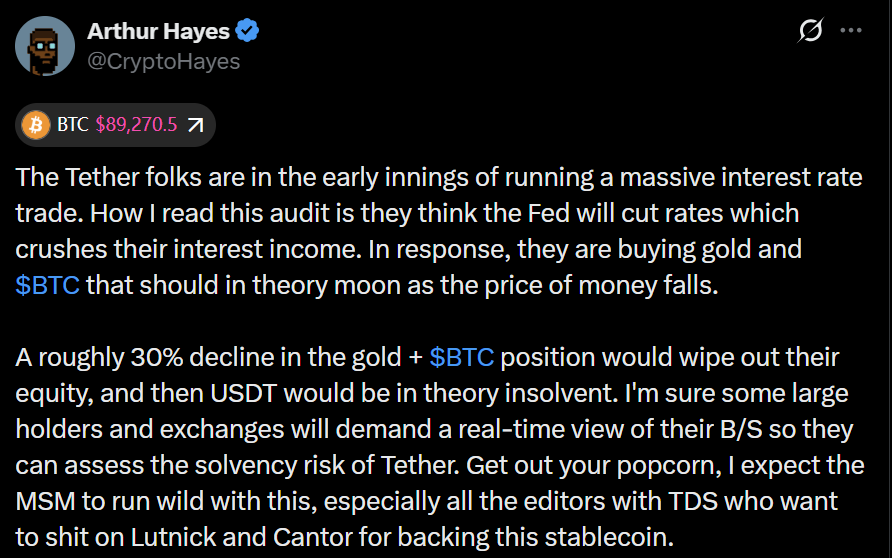

The latest wave of Tether worries appears to stem from fresh comments by BitMEX co-founder Arthur Hayes. Hayes argued that Tether is “in the early innings of running a massive interest-rate trade,” claiming a 30% drop in its Bitcoin and gold holdings could “wipe out their equity” and leave USDT technically insolvent.

Bitcoin and gold make up a significant portion of Tether’s reserves, and the company has been expanding its gold exposure in recent years. Hayes’ comments revived longstanding questions about the stability of the world’s largest stablecoin. -

Hayes’ warnings always move markets—this one adds fuel to ongoing Tether debates.

-

Even speculation around reserves can trigger massive stablecoin uncertainty.