🐋 Bitcoin Struggles at $108K as OG Whales Keep Selling

-

Bitcoin is trading in rocky waters around $108,080, and so far, dip buyers are showing up — but they’re still getting steamrolled by sellers in both spot and futures markets.

️ Short-Term Headwinds

️ Short-Term HeadwindsLabor Day market closure (US): With Wall Street shut down and ETFs inactive, liquidity is thinner, making BTC more vulnerable to volatility.

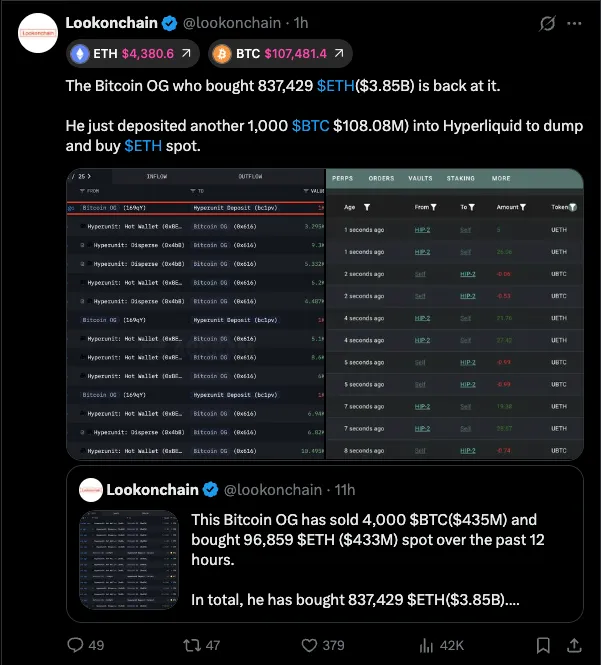

Whale pressure: Dormant whale wallets have been unloading large tranches of BTC (some proceeds even converted to ETH), adding billions in potential sell pressure.

ETF inflows cooling: Spot BTC ETFs have seen declining demand, further dampening sentiment.

Macro noise: US President Trump’s tariff talk and attempts to influence the Federal Reserve board are weighing on broader risk assets.

Futures vs. Spot: Who’s Winning?

Futures vs. Spot: Who’s Winning?Data from Binance + Coinbase shows futures sellers (10K–10M size cohorts) heavily outweighing spot buyers.

Each bounce attempt faces shorts stacking up at resistance flips, suppressing breakouts.

Retail-sized spot buyers (100–10K BTC order sizes) are scooping dips — but their bids are still too small to offset whale + futures selling.

Key Levels to Watch

Key Levels to Watch$112K–$111K zone: Strong bids were seen here in mid-August.

$107.2K: Buyers defended this level last weekend.

$105K cluster: Major liquidity sitting here — could be the next magnet.

$104K: Biggest 30-day liquidation cluster.

Below $100K: Some bids already placed down to $92K, suggesting deep-pocketed players are planning for worst-case scenarios.

️ The Bigger Picture

️ The Bigger PictureMarket still expects the Fed to start cutting rates in late September or October — potentially bullish longer-term.

But in the short-term, OG whales + weak ETF inflows + futures selling keep sellers firmly in control.

Takeaway

TakeawayDip buyers are back, but sellers are writing the script for now. With thin holiday liquidity and whale overhang, a trip to $105K (or lower) is firmly on the table before bulls get another real shot.

Question: Are you seeing this whale-driven dip as an accumulation opportunity, or is it safer to stay sidelined until after September’s Fed decision?

Question: Are you seeing this whale-driven dip as an accumulation opportunity, or is it safer to stay sidelined until after September’s Fed decision? -

Whales unloading during thin holiday liquidity is a brutal combo. Until ETF inflows pick up again, retail buying alone won’t stop the bleed. $105K looks like the magnet here before any real bounce attempt.

The whale unloading plus ETF cooling really explains why every bounce is getting stuffed. Personally, I’m leaning toward waiting for confirmation near the $105K liquidity pocket before scaling in.

The whale unloading plus ETF cooling really explains why every bounce is getting stuffed. Personally, I’m leaning toward waiting for confirmation near the $105K liquidity pocket before scaling in.