🐳 Spoofy Whales Push Bitcoin Below $110K Ahead of PCE Data

-

Bitcoin slid nearly 3% on Friday, dipping to local lows of $109,436, as suspicious whale activity sent ripples through the market.

The Whale Playbook in Action

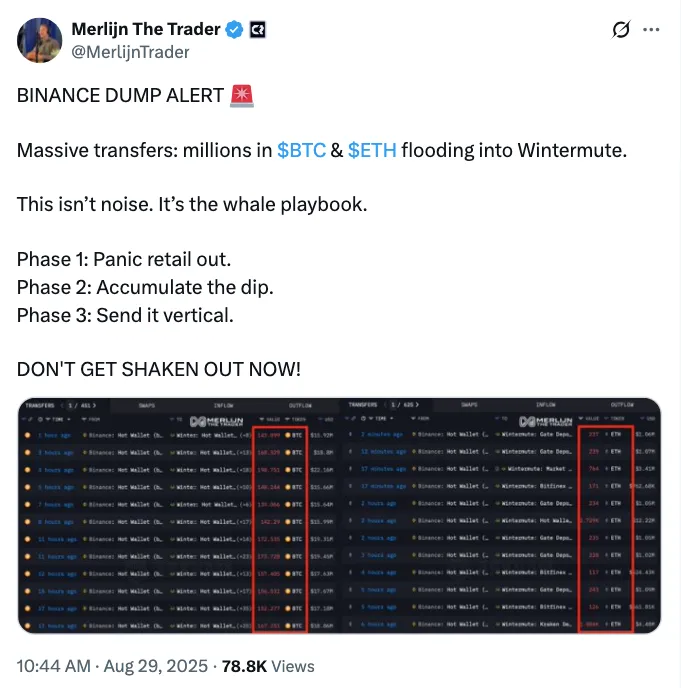

The Whale Playbook in ActionTraders point the finger at large whale inflows to market makers like Wintermute.

“This isn’t noise. It’s the whale playbook,” noted trader Merlijn, flagging coordinated BTC + ETH moves.

The pattern feels familiar: consolidation → capitulation → breakout → rally.

Right now? We’re sitting in the capitulation phase, which some argue could last weeks but also offer juicy entries.

Adding to the drama, Keith Alan of Material Indicators revived his old nemesis: “Spoofy the Whale.” This entity allegedly manipulates order books with fake liquidity to steer price action and trap over-leveraged traders.

Liquidations Pile Up

Liquidations Pile UpIn the past 24 hours, $350M in crypto longs were liquidated, amplifying volatility.

Bitcoin alone slid $3,000 within hours, flushing traders and triggering a sharp reset.

Macro Lens: PCE Inflation Incoming

Macro Lens: PCE Inflation IncomingBeyond whale games, traders now watch the US PCE Index — the Fed’s favorite inflation gauge.

A hotter-than-expected print could pressure risk assets further.

A cooler read might spark a relief rally heading into September’s anticipated rate cut.

As analyst Kyle Doops summed up:

“Fed’s favorite gauge could either fuel the dump… or light the relief rally.”

Takeaway

TakeawayBetween whale spoofing and macro headwinds, Bitcoin is wobbling under $110K. Whether this is a trap before the next breakout or the start of deeper pain may hinge less on whales… and more on Friday’s inflation data.

Question for the forum: Do you think “Spoofy the Whale” is really manipulating BTC, or are traders just using whales as a convenient scapegoat for macro-driven dips?

Question for the forum: Do you think “Spoofy the Whale” is really manipulating BTC, or are traders just using whales as a convenient scapegoat for macro-driven dips? -

@lingriiddd

This is a massive development. If AMBTS really pushes toward 1% of total BTC supply, that’s going to accelerate scarcity and could be a strong long-term bullish catalyst. Just like MicroStrategy, these dedicated treasuries reduce liquid supply and create upward pressure. The more companies treat BTC as a treasury reserve asset, the closer we get to true mainstream adoption.