🇳🇱 Amdax Raises €20M to Launch Bitcoin Treasury on Euronext

-

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

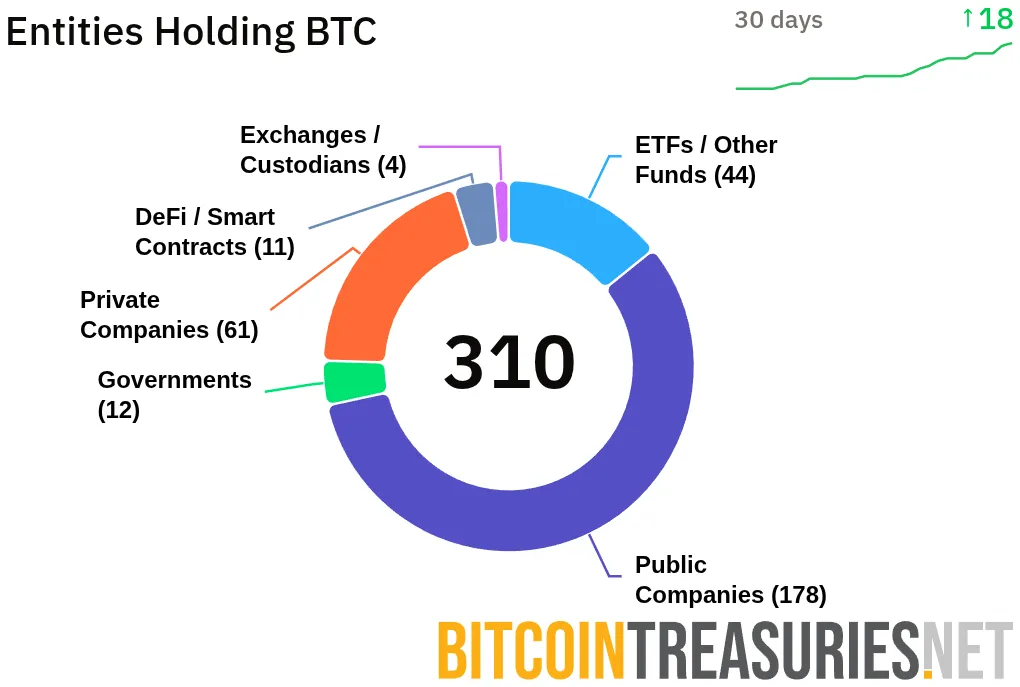

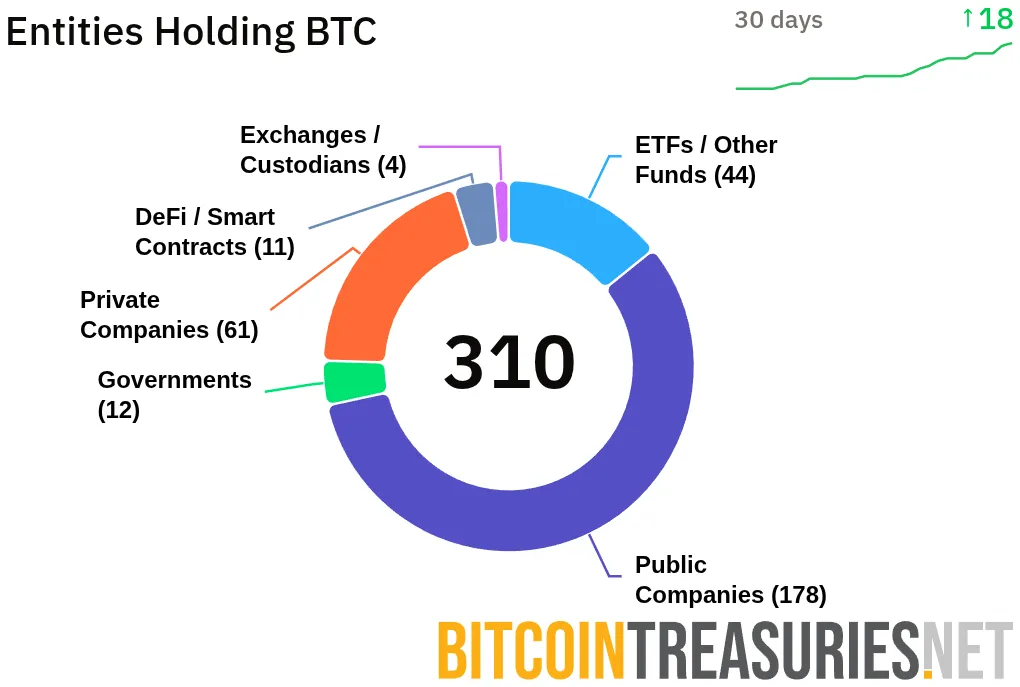

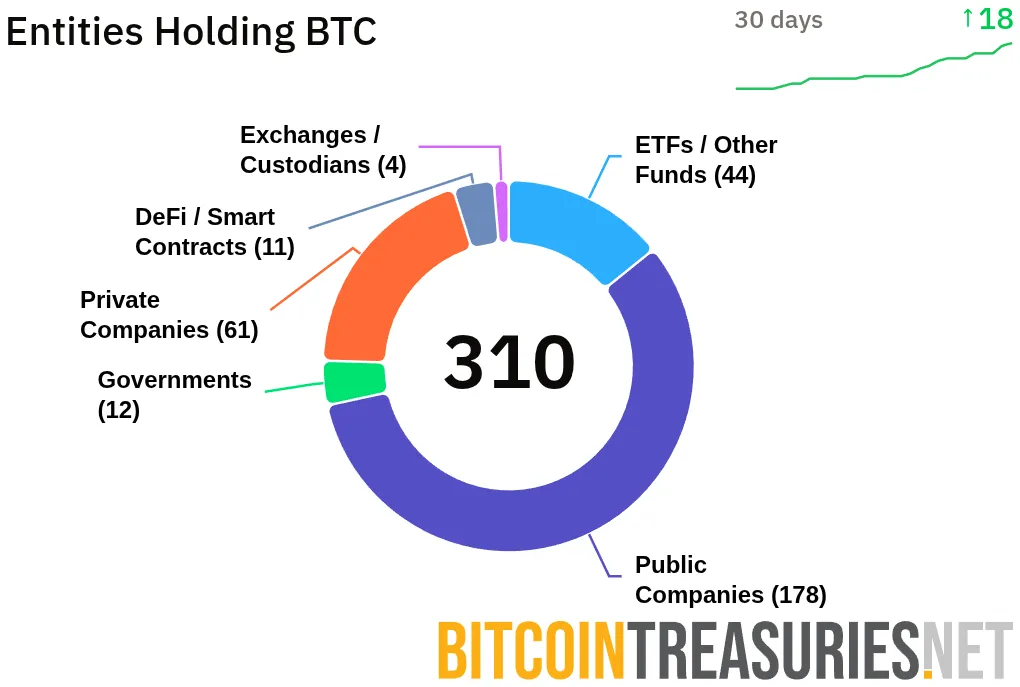

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands? -

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?@lingriiddd

Wow, AMBTS is making a serious move! A dedicated Bitcoin treasury aiming for 1% of all BTC is huge — this kind of corporate accumulation could really tighten supply and drive long-term value. Exciting times for BTC believers!

A dedicated Bitcoin treasury aiming for 1% of all BTC is huge — this kind of corporate accumulation could really tighten supply and drive long-term value. Exciting times for BTC believers! -

Dutch crypto service provider Amdax has secured €20 million (~$23.3M) in fresh funding to launch a dedicated Bitcoin treasury company on Amsterdam’s Euronext stock exchange.

Enter AMBTS

Enter AMBTSThe new entity, called AMBTS, will operate independently with its own governance. Its bold target?

Accumulate at least 1% of all Bitcoin supply — that’s around 210,000 BTC, currently worth over $23B.

Grow Bitcoin per share for investors by leveraging capital markets and compounding BTC exposure over time.

In other words: AMBTS is positioning itself as a pure-play corporate Bitcoin accumulator.

Corporate Bitcoin Treasuries Are Booming

Corporate Bitcoin Treasuries Are BoomingThis isn’t happening in a vacuum. Ever since MicroStrategy (now “Strategy”) pioneered the corporate Bitcoin treasury model, companies across industries have been adding BTC to their balance sheets.

Some notable names beyond the usual suspects:

Tesla (EVs)

KULR Technology (thermal + battery safety)

Aker (Norwegian industrial investment)

Méliuz (Brazilian fintech)

MercadoLibre (LatAm e-commerce giant)

Samara (Malta investment manager)

Jasmine (Thai telecom)

Alliance Resource Partners (US coal producer)

Rumble (Canadian video platform)

Meanwhile, firms dedicated to Bitcoin accumulation keep scooping up supply, steadily reducing liquid BTC in circulation.

Global Bitcoin Accumulation Continues

Global Bitcoin Accumulation ContinuesThe Amdax move comes on the heels of other major treasury plays this month:

Metaplanet (Japan): Approved an ~$880M raise, with ~$835M earmarked for Bitcoin.

Sequans (France): Filed for a $200M equity raise to fuel BTC strategy.

Strategy (fka MicroStrategy): Michael Saylor teased yet another August Bitcoin buy — the firm already holds 632,457 BTC (~$69.5B), over 3% of all future supply.

Takeaway

TakeawayAmdax’s AMBTS isn’t just another treasury experiment — it’s aiming for a systemic position in Bitcoin’s supply dynamics. If successful, it could join Strategy in shaping how institutional capital interacts with BTC scarcity.

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?

Question for the community: Do you see dedicated Bitcoin treasuries as a bullish supply sink… or are they centralizing too much BTC in too few hands?@lingriiddd

Love seeing innovative players like Amdax step up. AMBTS looks set to join the big leagues with Strategy and others. If they hit their targets, it’s a bullish signal for Bitcoin scarcity and institutional confidence. -

@lingriiddd

This is a massive development. If AMBTS really pushes toward 1% of total BTC supply, that’s going to accelerate scarcity and could be a strong long-term bullish catalyst. Just like MicroStrategy, these dedicated treasuries reduce liquid supply and create upward pressure. The more companies treat BTC as a treasury reserve asset, the closer we get to true mainstream adoption. -

While bullish in the short term, I think moves like this raise real centralization concerns. If a handful of listed companies end up controlling 5–10% of all BTC, retail and small investors lose influence over the asset. Bitcoin was designed to be decentralized — so it’s worth asking if these mega-treasuries actually undermine that principle in the long run.