Arthur Hayes Warns of Tether Risk

-

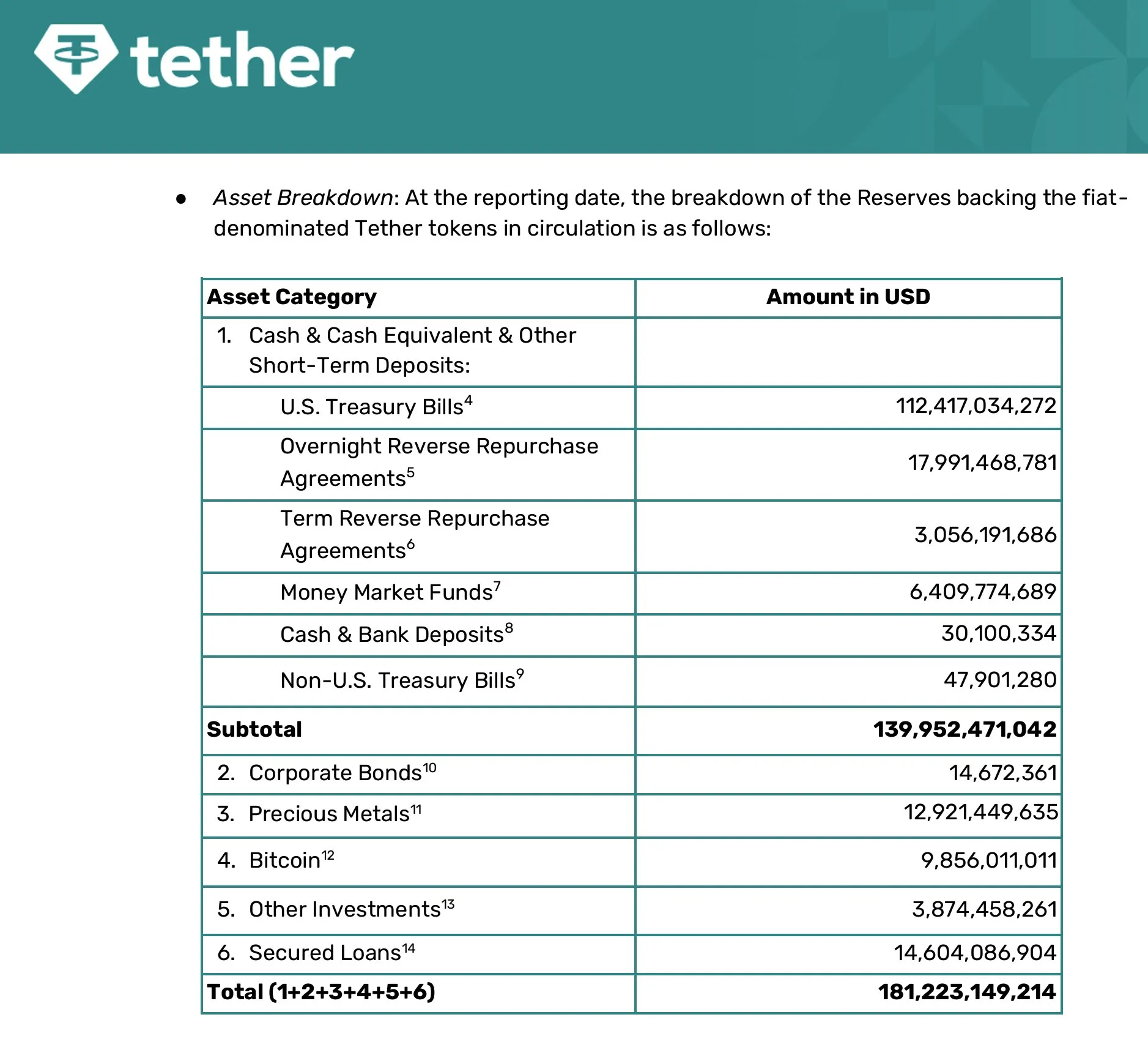

BitMEX co-founder Arthur Hayes flagged potential insolvency at Tether if Bitcoin and gold reserves drop 30%. He notes that Tether’s $12.9B in gold and $9.9B in BTC tie solvency to volatile assets rather than just US Treasuries. Hayes calls this a risky “interest rate trade,” where rate cuts could crush Treasury yields, leaving Tether’s thin equity layer exposed.

-

Hayes highlighting Tether risks adds weight to ongoing industry debates.

-

When veterans like Hayes speak, the market pays attention for a reason.

-

Hayes is just trying to make himself interesting all the time.

-

Tether’s balance sheet has always been a game of confidence.

-

If BTC drops 30%, the whole market has bigger problems than USDT.