Why is it a good time to consider short selling now?

-

Macro policies suppress risky assets: Previously, the market had some expectations for the Fed's December interest rate cut, but officials such as the president of the Boston Federal Reserve, Collins, made hawkish remarks, explicitly opposing the continuation of the rate cut in December, reducing the probability of a rate cut to only 40%. The cooling of the expectation for rate cuts pushed the US dollar to strengthen, while Bitcoin, as a typical risky asset, lost its appeal significantly under the backdrop of a strong US dollar, and lacked macro policy support for its price increase, providing a basis for short selling.

Macro policies suppress risky assets: Previously, the market had some expectations for the Fed's December interest rate cut, but officials such as the president of the Boston Federal Reserve, Collins, made hawkish remarks, explicitly opposing the continuation of the rate cut in December, reducing the probability of a rate cut to only 40%. The cooling of the expectation for rate cuts pushed the US dollar to strengthen, while Bitcoin, as a typical risky asset, lost its appeal significantly under the backdrop of a strong US dollar, and lacked macro policy support for its price increase, providing a basis for short selling.

Market enthusiasm has significantly cooled down: The institutional funds that previously drove the rise of Bitcoin are now withdrawing, and related funds have been flowing out of the market for several consecutive days, with a cumulative amount of 3.79 billion US dollars. Moreover, market trading volume is also decreasing, and the trading activity on major exchanges is not as active as before, indicating a decline in the enthusiasm of participants and a lack of momentum for the rise.

Policy risks persist: The regulatory rules for Bitcoin have been delayed for a long time, and related bills have been in deadlock in the parliament, and there is no clear direction in sight in the short term. This has made many large institutions reluctant to enter the market, resulting in a lack of market confidence. Meanwhile, although there are rumors of a rate cut by the Fed, officials have repeatedly stated that "it is not a certainty", this uncertainty makes high-risk assets like Bitcoin prone to decline.Bitcoin trading strategy

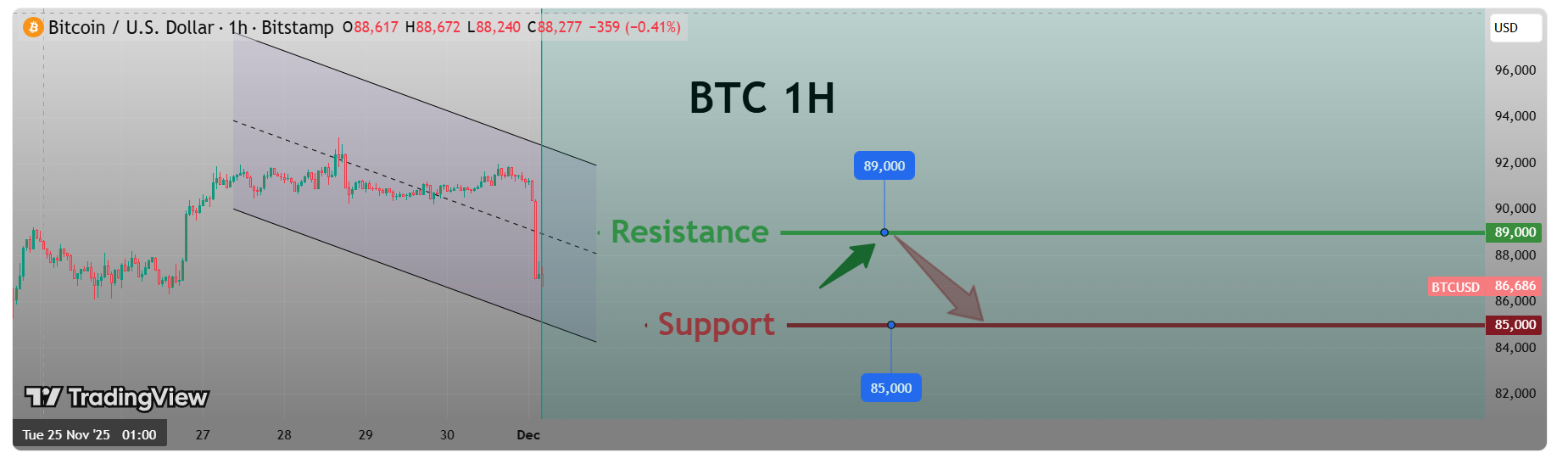

sell:88000-89000

tp:87000-85000

sl:90000 -

Momentum indicators point to exhaustion, making short setups appealing.

-

Volatility is rising—perfect environment for strategic short entries.