Gold’s Rally Exposed – Why Yesterday Changed the Game

-

1. Recap of Yesterday’s Key Move

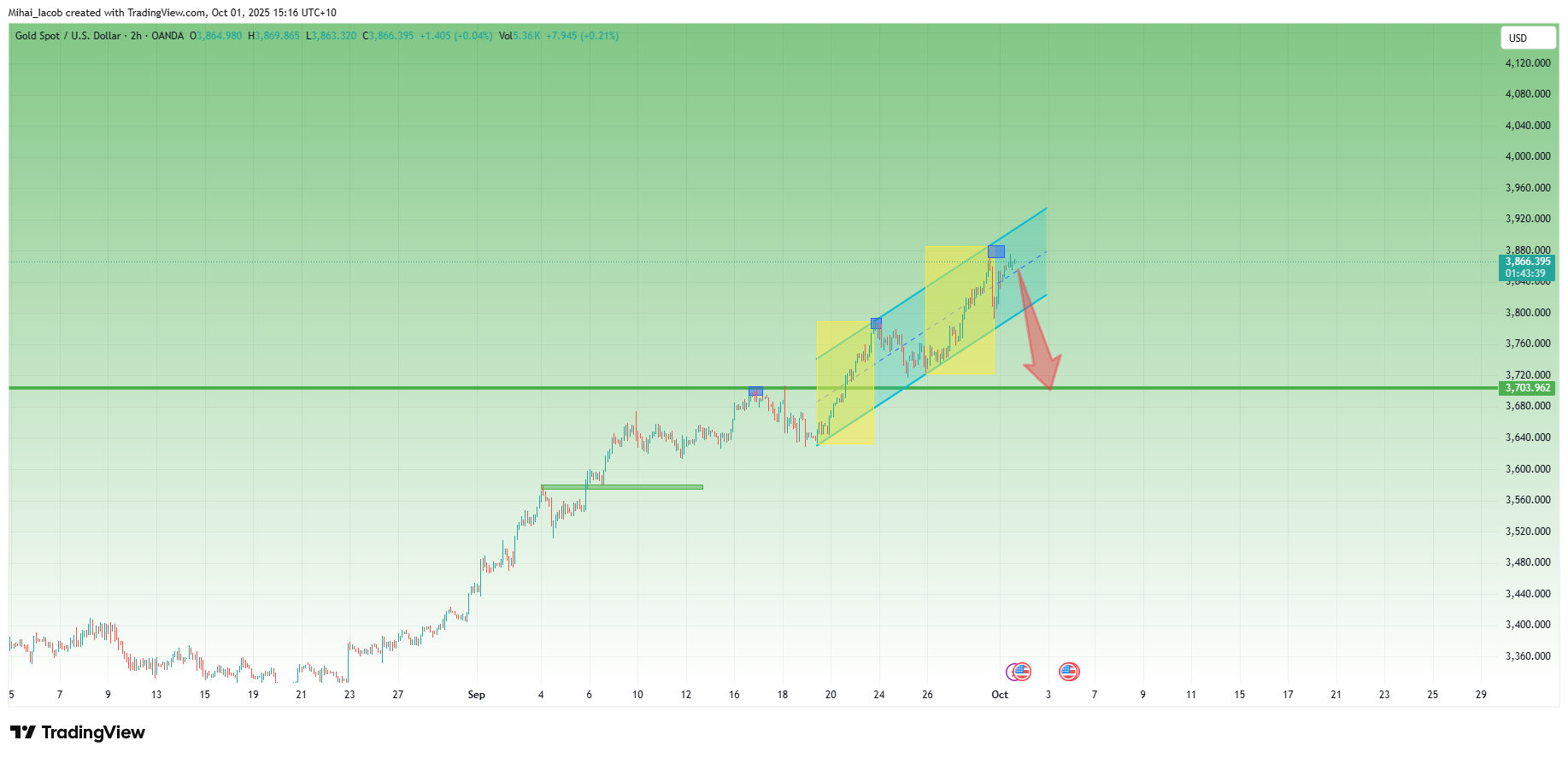

Yesterday was a decisive day for Gold traders, and it perfectly confirmed what I have been pointing out since Monday: at these elevated levels, Gold is extremely vulnerable.

After printing yet another All-Time High overnight, the yellow metal sold off aggressively for nearly 5 hours straight, with losses amounting to almost 800 pips.

Importantly, the bounce came exactly from the 23 September ATH level and by the end of the session, bulls managed to step in and regain control.

2. Overnight Price Action

Overnight, the asian session was once again bullish – Gold reached a fresh ATH at 3875, only to retreat slightly, which for now can be classified as nothing more than a shallow correction.

Despite the recovery, what matters is not the new high, but the fragility revealed during yesterday’s sell-off. Momentum looks stretched, and price action confirms the market’s increasing instability.

3. Technical Outlook

From a structural point of view:

• Price is still contained within the upper bullish channel.

• Bulls have also managed to reclaim the median line, suggesting they are still in control.

• However, the 800-pip collapse proved that even in such a strong uptrend, cracks are starting to show.

Key levels to watch:

• 3830 → if this level breaks, the market could trigger a waterfall of selling.

• 3785-3790 → support that held before, but I believe this time it won’t survive.

• 3700 → the logical corrective target if 3780 is breached.

4. Trading Mindset & Strategy

Yesterday, I couldn’t sell into the initial drop — and that’s fine. Such a move was more about timing luck than pure skill. No frustration, because the analysis was right: fragility is here.

From now on, my plan is clear:

• I’ll be looking for structured patterns with larger targets.

• Minimum: +1000 pips setups.

• Stretch target: +1500 pips.

5. Conclusion

Gold remains in bullish mode on the surface, but yesterday’s sell-off clearly revealed how fragile and overstretched the trend has become.If 3830 fails, that could be the decisive moment when bulls finally lose control and the long-awaited correction accelerates.

Until then, I will stay patient and disciplined, waiting for the market to provide a clean pattern with a strong risk/reward setup.