🧠 Ethereum 10×? At This Point, It’d Be Rude Not To 🚀

-

Alright anon, buckle up. This ain’t your 2017 ICO pump. ETH is quietly becoming the backend of TradFi, and a 10× move is starting to look... kinda conservative?

Big Banks Be Like: “Put It On-Chain”

Big Banks Be Like: “Put It On-Chain”JPMorgan and BofA didn’t come to LARP. They’re running 2025 dollar-token pilots on Ethereum. Even France joined the party — Societe Generale dropped a USD stable-coin on main-net like it’s no big deal.

The banks aren’t coming… they’re already here. Stable-Coins Are Eating Visa + Mastercard for Breakfast

Stable-Coins Are Eating Visa + Mastercard for Breakfast$27.6 TRILLION moved through stables in 2024. Yes, with a “T.” That’s more than Visa and Mastercard combined — and guess where most of that flowed?

Yup. Ethereum. 🧅

️ ETH Dominates the Stable-coin Game

️ ETH Dominates the Stable-coin GameOver 80% of all stable-coin traffic happens on Ethereum or its L2 homies. It’s like ETH built the freeway, and now everyone’s driving USDC Lambos on it.

Network effects = permanent.

ETF Floodgates: Open

ETF Floodgates: OpenETH ETFs dropped a casual $743 million inflow month in 2025. That’s not retail apes — that’s big boy money putting on suits and saying “number go up.”

ETH Supply? It’s Melting.

ETH Supply? It’s Melting.Post-Merge, Ethereum started eating itself. Over 332k ETH has been burned. Issuance? Negative. Inflation? < –1.3% per year.

ETH is literally disappearing while demand explodes. This is not a drill. 30 Million ETH Staked = 25% Off the Market

30 Million ETH Staked = 25% Off the MarketImagine throwing a house party and 25% of your chairs are staked in a corner, vibing. That’s the ETH float right now. And just as ETFs + banks are shopping for inventory? Tight squeeze, baby.

️ Real-World Assets Going Full-On Crypto

️ Real-World Assets Going Full-On CryptoTokenized bonds jumped 260% in 2024. TradFi’s out here minting real money on ERC standards. If it settles on Ethereum, it feeds the ETH machine.

🧾 Gas Fees? L2s Turned ETH Into a Dollar StoreRollups dropped gas to under $4. Stable-coin payments, micro-transactions, Degen coffee purchases — they’re all viable now. More usage = more burn. More burn = less ETH. You see where this goes.

127 Million Wallets = Mass Adoption Vibes

127 Million Wallets = Mass Adoption VibesActive wallets jumped 22% YoY to 127M. It’s not just your cousin doing yield farming anymore — it’s retail, devs, institutions, and probably your grandma too.

Ethereum = ESG Friendly AF

Ethereum = ESG Friendly AFWith PoS using >99% less energy than PoW, even Larry Fink can’t complain. ESG check

. TradFi ready

. TradFi ready  . Useless FUD removed

. Useless FUD removed  .

.

🧮 Bottom LineTradFi’s building on ETH. Stable-coins are already winning payments. ETFs are sucking up float. Supply’s getting torched. Real-world assets are tokenizing. Retail’s here. Institutions are here. L2s are scaling. ESG boxes are checked.

At this point...

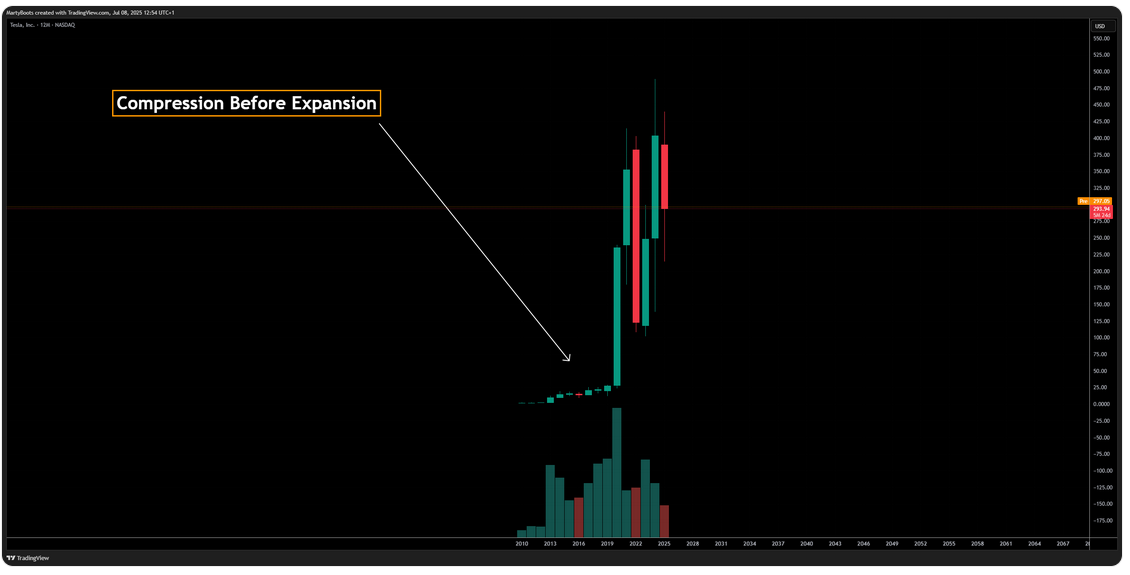

A 10× isn’t hopium. It’s just math. Charts if you're into that sort of thing:

Charts if you're into that sort of thing:TSLA comparison Total2 Market Cap Think Ethereum can pull off a 10×? Or is this copium in a trench coat? Drop your spiciest take below, smash that

Think Ethereum can pull off a 10×? Or is this copium in a trench coat? Drop your spiciest take below, smash that  if you learned something, and hit follow to ride the wave

if you learned something, and hit follow to ride the wave  .

.WAGMI. ETH up only. Let’s get this bread.

#crypto #ETH #BTC #web3 #trading #trade #cryptocurrency