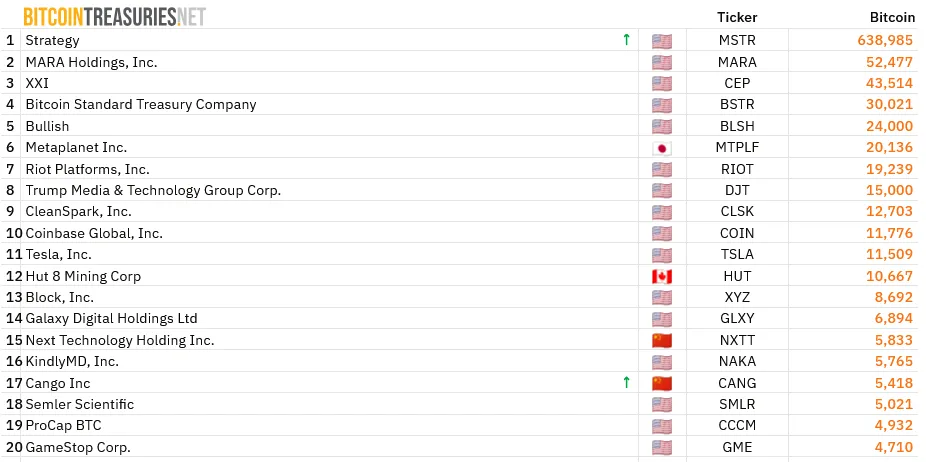

Corporate Bitcoin Adoption Surges Past 1 Million BTC

-

Public companies are accelerating Bitcoin accumulation.

There are now 190 listed firms holding BTC, up from fewer than 100 earlier this year.

There are now 190 listed firms holding BTC, up from fewer than 100 earlier this year.

Combined corporate holdings passed 1 million BTC this month — over 5% of supply.

Combined corporate holdings passed 1 million BTC this month — over 5% of supply.

Michael Saylor’s firm leads with nearly 639,000 BTC.

Michael Saylor’s firm leads with nearly 639,000 BTC.Next Technology Holding is the latest to expand its treasury strategy, planning a $500M stock offering to potentially buy more Bitcoin. It already holds 5,833 BTC and could surpass 8,000 BTC if markets remain stable.

Bitcoin is becoming more than an asset — it’s a balance sheet strategy.

-

Tilki’s Take: Bitcoin ain’t just a trade anymore—it’s corporate ammo.

Tilki’s Take: Bitcoin ain’t just a trade anymore—it’s corporate ammo.

This ain’t about “should we buy BTC?”

It’s about “how do we strengthen the balance sheet?”

Big players are stacking.

BTC’s turning into a treasury weapon.

And this wave? Just getting started.For example, Blackrock company has the largest bitcoin reserves.

Good work...

Thanks for sharing

-

these guys on the list will be very rich