2026 Precious Metals ETF Playbook: GDX SIL PPLT Parabolic Rally

-

2026 Precious Metals Playbook: Why GDX, SIL & PPLT Could Go Parabolic

2026 Precious Metals Playbook: Why GDX, SIL & PPLT Could Go Parabolic

Gold’s 2025 melt-up has flipped the script: spot blew through records and major banks now float targets near $3,800 by late-2025 and ~$3,900 by mid-2026. With expected Fed cuts, a softer USD, and persistent central-bank buying, the macro setup could keep miners turbocharged into 2026.

Gold’s 2025 melt-up has flipped the script: spot blew through records and major banks now float targets near $3,800 by late-2025 and ~$3,900 by mid-2026. With expected Fed cuts, a softer USD, and persistent central-bank buying, the macro setup could keep miners turbocharged into 2026.

🧲 At the same time, robust demand (ETF inflows + central banks) even with real yields elevated shows that “fear and fiscal” have joined real rates as primary drivers. That’s the kind of buyer base that can underpin a blow-off leg higher in gold.

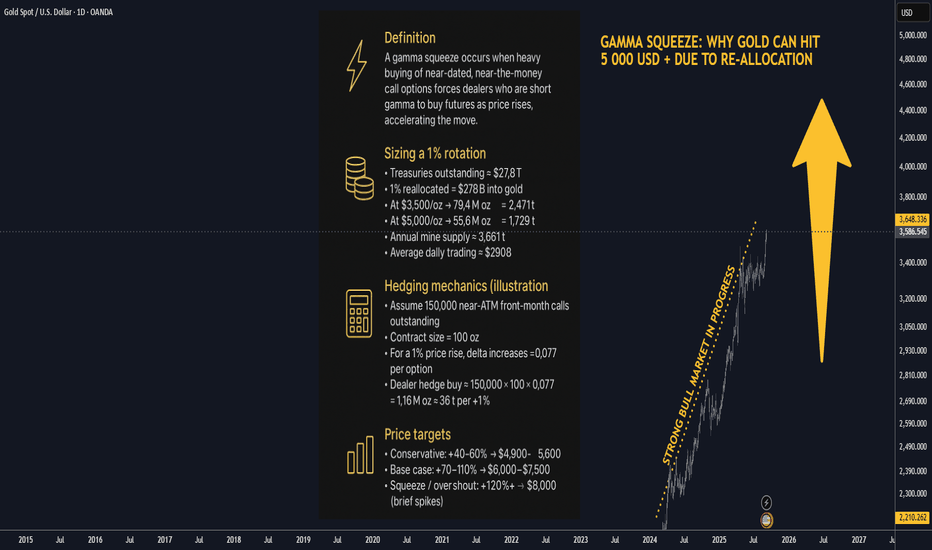

The gamma-squeeze setup is real in commodities too: heavy call buying can force dealers to chase deltas in futures, adding fuel to upside. If momentum reignites, gold’s second leg could shock even the bulls.

The gamma-squeeze setup is real in commodities too: heavy call buying can force dealers to chase deltas in futures, adding fuel to upside. If momentum reignites, gold’s second leg could shock even the bulls.

️Silver is riding a different (but rhyming) story: persistent structural deficits and 14-year-high prices, with industry demand led by solar PV, electronics, EVs—and increasingly high-end compute/AI infrastructure where silver-bearing solders, contacts, and power electronics are critical.

️Silver is riding a different (but rhyming) story: persistent structural deficits and 14-year-high prices, with industry demand led by solar PV, electronics, EVs—and increasingly high-end compute/AI infrastructure where silver-bearing solders, contacts, and power electronics are critical.

️Macro tailwinds for silver’s industrial side look alive into 2026: PV installations, grid storage rollouts, and electrification keep factory demand stout—even with ongoing thrifting. Sheer volume growth can still outmuscle intensity declines.

️Macro tailwinds for silver’s industrial side look alive into 2026: PV installations, grid storage rollouts, and electrification keep factory demand stout—even with ongoing thrifting. Sheer volume growth can still outmuscle intensity declines.

️Platinum’s bull case hinges on multi-year market deficits, entrenched autocatalyst substitution from palladium, and optionality from the early hydrogen economy. Supply hiccups in South Africa, paired with steady auto/industrial draws, can squeeze inventories quickly.

️Platinum’s bull case hinges on multi-year market deficits, entrenched autocatalyst substitution from palladium, and optionality from the early hydrogen economy. Supply hiccups in South Africa, paired with steady auto/industrial draws, can squeeze inventories quickly.

Aggressive 2026 Scenarios & Targets

Aggressive 2026 Scenarios & Targets

🧭 Premise: a “second-leg” melt-up where gold futures extend from ~$3,500 toward ~$7,000 (+100%) via treasury-to-hard-assets rotation and options-driven squeezes; silver plays catch-up with an industrial/safe-haven crescendo; platinum rides persistent deficits and auto/hydrogen demand.

GDX — VanEck Gold Miners ETF

Aggressive 2026 price target: $150–$220 (vs. ~$70 now).

Why it could happen:

• Margin math: with AISCs roughly anchored, every +$1000/oz in gold drops largely to miner margins, historically producing 2–3× sensitivity in equities vs. the metal.

Margin math: with AISCs roughly anchored, every +$1000/oz in gold drops largely to miner margins, historically producing 2–3× sensitivity in equities vs. the metal.

• Flow catalysts: ETF inflows, central-bank buying, CTA trend signals, and options gamma dynamics can stack.

Flow catalysts: ETF inflows, central-bank buying, CTA trend signals, and options gamma dynamics can stack.

• Treasury rotation: if real yields slide and fiscal angst lingers, the allocation shift into gold miners can snowball.

Treasury rotation: if real yields slide and fiscal angst lingers, the allocation shift into gold miners can snowball.

SIL — Global X Silver Miners ETF

Aggressive 2026 price target: $95–$130 (vs. ~$66 now).

Why it could happen:

• Industrial drumbeat: PV growth into 2026 + electrification keeps factory demand strong—even with thrifting.

Industrial drumbeat: PV growth into 2026 + electrification keeps factory demand strong—even with thrifting.

• 🧮 Deficit persistence: multiple years of market deficits tighten balances and prime upside tails.

• 🧠 AI halo effect: data-center buildouts and advanced packaging sustain electronics demand where silver’s conductivity wins, adding narrative firepower to price action.

PPLT — abrdn Physical Platinum SharesAggressive 2026 price target: $250–$375 (vs. ~$128 now).

Why it could happen:

• ️Deficits, again: without a step-change in mine supply, persistent market shortfalls can spark violent repricing.

️Deficits, again: without a step-change in mine supply, persistent market shortfalls can spark violent repricing.

• Sticky substitution: platinum that replaced palladium in gasoline autocats is embedded in designs—demand that doesn’t easily reverse.

Sticky substitution: platinum that replaced palladium in gasoline autocats is embedded in designs—demand that doesn’t easily reverse.

• Optionality: PEM electrolyzers/fuel cells (hydrogen) magnify the upside if policy or energy security tightens timelines.

Optionality: PEM electrolyzers/fuel cells (hydrogen) magnify the upside if policy or energy security tightens timelines.

🧭 2026 Primary Drivers to Track

️Monetary & macro: Fed path, USD, and real yields remain core—if they trend down, gold’s opportunity cost falls and risk-hedging bids rise.

️Monetary & macro: Fed path, USD, and real yields remain core—if they trend down, gold’s opportunity cost falls and risk-hedging bids rise.

Official sector: Central-bank purchases have become a structural pillar—watch for continuity (or pauses) in monthly updates.

Official sector: Central-bank purchases have become a structural pillar—watch for continuity (or pauses) in monthly updates.

Flows & positioning: ETF creations, futures options open interest, and CTA signals can amplify moves far beyond fundamentals (gamma-squeeze dynamics).

Flows & positioning: ETF creations, futures options open interest, and CTA signals can amplify moves far beyond fundamentals (gamma-squeeze dynamics).

Industrial pulse (silver): PV installations, EV production, grid/storage rollouts, and semiconductor packaging demand. Even with thrifting, sheer volume growth can drive sustained demand.

Other High-Octane Catalysts To Watch

Other High-Octane Catalysts To Watch

🧩 Policy whiplash: tariffs, clean-energy incentives, and regional manufacturing policies can shift where PV growth lands, but global additions remain robust into 2026.

Geopolitical risk: commodity sanctions, shipping disruptions, and elections tend to feed gold’s safe-haven bid and can intermittently kink PGM supply chains.

Geopolitical risk: commodity sanctions, shipping disruptions, and elections tend to feed gold’s safe-haven bid and can intermittently kink PGM supply chains.

️South Africa power stability: any setbacks could crimp platinum supply; under-investment keeps the system fragile even with recent improvements.

️South Africa power stability: any setbacks could crimp platinum supply; under-investment keeps the system fragile even with recent improvements.

🧱 Positioning Blueprint (conceptual, not advice)

🧮 In a $7k gold blue-sky, miners should outrun the metal (margin + duration), silver miners should over-beta gold if the PV/AI/EV demand boom continues, and platinum offers clean metal-beta through PPLT. Platinum miners could add torque but also carry South Africa–specific risks.

️Risks: inflation re-acceleration forcing hikes, a USD surge, ETF liquidation waves, PV-demand disappointments, or supply snap-backs could maul these targets; miners also carry idiosyncratic risks (cost inflation, permitting, geopolitics).

️Risks: inflation re-acceleration forcing hikes, a USD surge, ETF liquidation waves, PV-demand disappointments, or supply snap-backs could maul these targets; miners also carry idiosyncratic risks (cost inflation, permitting, geopolitics).

Targets (2026 “go-for-it” bull case)

Targets (2026 “go-for-it” bull case)

• GDX: $150–$220 on 2–3× torque to a gold melt-up, plus multiple expansion.

GDX: $150–$220 on 2–3× torque to a gold melt-up, plus multiple expansion.

• 🧪 SIL: $95–$130 if silver sprints on deficits + PV/AI/EV demand, with miners over-beta.

• 🧰 PPLT: $250–$375 with sustained platinum deficits and sticky auto substitution.