Institutions Are Back: Spot Bitcoin & Ether ETFs See Billions in Fresh Inflows

-

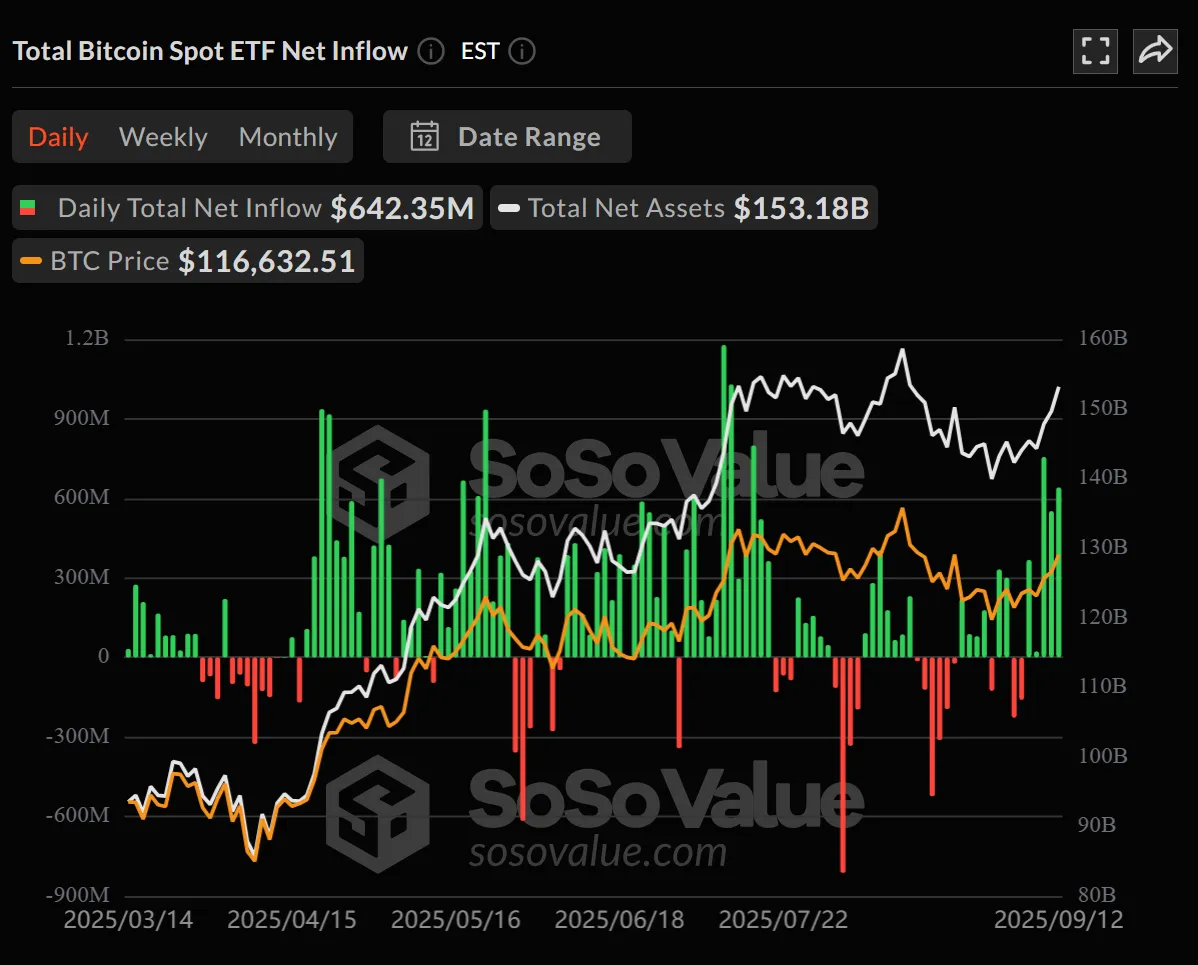

The past week delivered a major confidence signal for crypto markets: spot Bitcoin and Ether ETFs are attracting heavy institutional capital again.

Bitcoin ETF Momentum

Bitcoin ETF Momentum$642.35M net inflows on Friday alone — the fifth straight day of gains.

$2.34B net inflows over five days, bringing cumulative inflows to $56.83B.

Total Bitcoin ETF net assets: $153.18B (~6.6% of BTC market cap).

Leaders: Fidelity’s FBTC ($315.18M) and BlackRock’s IBIT ($264.71M).

Daily trading volume across all BTC spot ETFs: $3.89B.

After a slow start to the month, stabilizing macro conditions and growing institutional conviction are reigniting demand.

🪙 Ether ETF Surge

$405.55M net inflows Friday — fourth day in a row of gains.

Cumulative inflows: $13.36B.

Total Ether ETF net assets: $30.35B.

BlackRock’s ETHA ($165.56M) and Fidelity’s FETH ($168.23M) led the charge.

ETHA alone saw $1.86B in daily traded value.

Institutions are diversifying beyond Bitcoin and treating Ethereum as a core digital asset.

Bigger Picture: BlackRock Eyes ETF Tokenization

Bigger Picture: BlackRock Eyes ETF TokenizationBlackRock is now exploring on-chain tokenized ETFs to enable:

24/7 trading

Direct integration with DeFi

Real-time settlement and fractionalization

This is next-generation ETF infrastructure — and it shows the line between TradFi and DeFi is blurring fast.

Takeaways for Traders & Builders

Takeaways for Traders & BuildersLiquidity Boost: Billions in ETF inflows can tighten spreads and deepen order books across spot markets.

Price Catalyst: Sustained institutional accumulation often precedes major directional moves.

DeFi Bridge: Tokenized ETFs could soon be used as collateral in DeFi lending, staking, and structured products.

️ Bottom Line:

️ Bottom Line:

Institutions are not just back — they’re scaling up.

Bitcoin and Ethereum spot ETFs are quietly transforming from novelty to cornerstone financial products, while tokenization hints at the next wave of mainstream adoption.Would you stake tokenized ETFs directly in DeFi once BlackRock makes the leap?