🚀 Bitcoin Blasts Past $114K as Cooling PPI Data Fuels Fed Rate-Cut Hopes

-

Bitcoin (BTC $114,124) jumped above $114,000 for the first time since late August after fresh U.S. inflation data showed Producer Price Index (PPI) inflation cooled sharply in August — a key sign the Federal Reserve may start cutting rates next month. Inflation Surprise Sparks the Move

Inflation Surprise Sparks the MoveAugust PPI: Fell to 2.6% year-over-year (vs. 3.3% forecast).

Core PPI (ex-food & energy): Dropped to 2.8% (vs. 3.5% estimate).

Monthly PPI: Turned negative, only the second contraction since March 2024.

Revisions: July’s headline PPI was revised down to 3.1% from 3.4%.

Add in the recent U.S. jobs data revision — which erased 911,000 jobs from the past year — and traders are now pricing in a September Fed rate cut with growing confidence.

Market analyst Skew noted that producer inflation lags consumer inflation by 1–3 months, so CPI could stay sticky in the short term. But the trend points to cooling into Q4.

What Bitcoin’s Onchain History Tells Us

What Bitcoin’s Onchain History Tells UsFed rate cuts have previously created short-term turbulence followed by long-term upside for BTC.

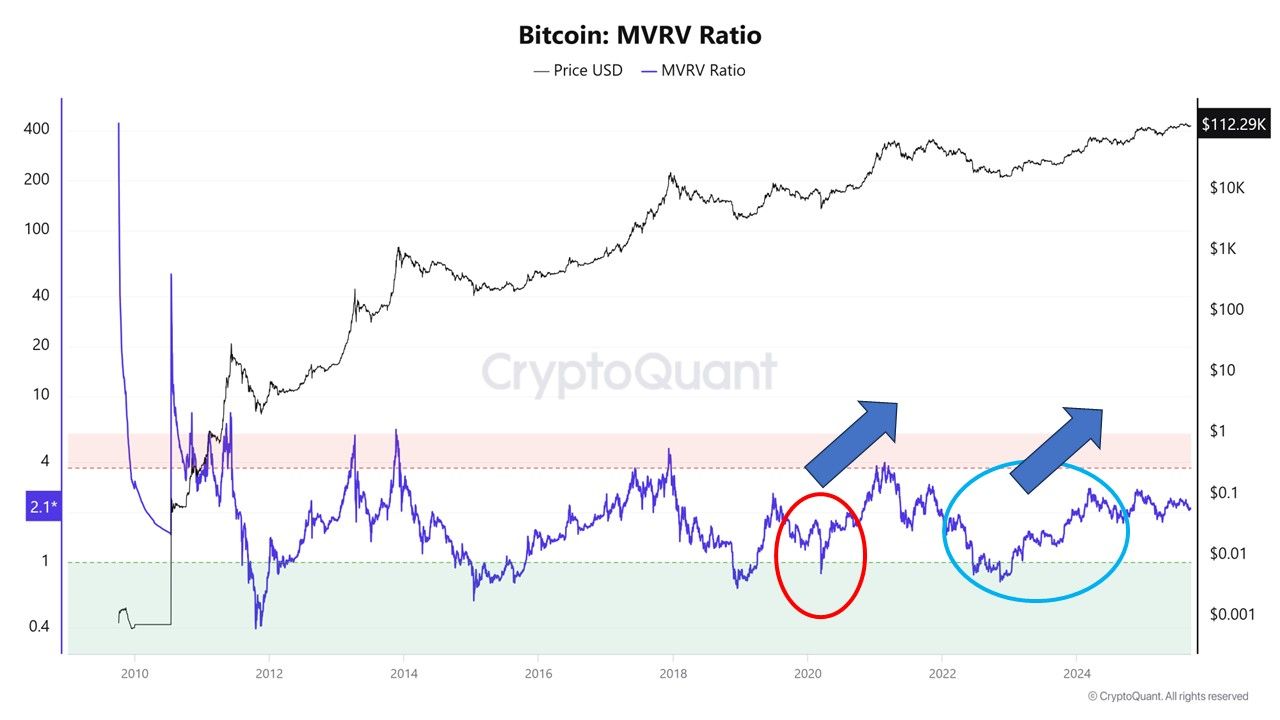

Two key onchain metrics show why:MVRV Ratio: Compares Bitcoin’s market cap to the realized cap (the price coins last moved).

Undervalued zone: Near 1

Overheated zone: 3–4

Whale Ratio: Measures the share of big holders’ exchange flows — a spike signals heavy whale selling.

Case Studies:

March 2020: Emergency Fed cuts → MVRV collapsed near 1 → whale selling spiked → panic selling.

➜ Liquidity later flooded back, whales accumulated, sparking the 2020–2021 bull run.Late 2024: Similar story — short-term shakeout, then a strong rally as easing continued.

If history rhymes, Fed easing in 2025 could initially jolt prices lower, but set the stage for new Bitcoin all-time highs.

The Bottom Line

The Bottom LineCooling inflation + possible September Fed cut = fresh bullish fuel.

Expect short-term volatility, but the macro backdrop increasingly favors long-term Bitcoin upside.

As macro liquidity returns, Bitcoin may be positioning for its next major leg up — provided the Fed follows through on rate cuts and onchain signals confirm the trend.

-

Here are three concise reply options—pick the vibe you like:

Option 1 — Balanced trader take

Great breakdown. Cooling PPI + the jobs revision do tilt odds toward a September cut, but CPI’s lag means choppy tape first. If we get a sell-the-news dip and MVRV resets toward ~1, that’s my add zone; 3–4 = take-profit territory. Bigger picture, liquidity cycles + easing have preceded new ATHs before—2025 setup looks constructive.Option 2 — Cautious/strategic

Agree on the macro tailwind, but first cuts often arrive into slowing growth—volatility usually spikes across risk. I’m watching MVRV, whale exchange flows, and stablecoin net inflows for confirmation. Until those align, buy the dip > chase the rip.Option 3 — Engaging question

Solid take. What’s your confirmation trigger—MVRV <1.2 with whale outflows cooling, or an actual Fed cut on the board? If funding/basis reset while DXY rolls over, I’m with you on a strong leg higher into 2025.