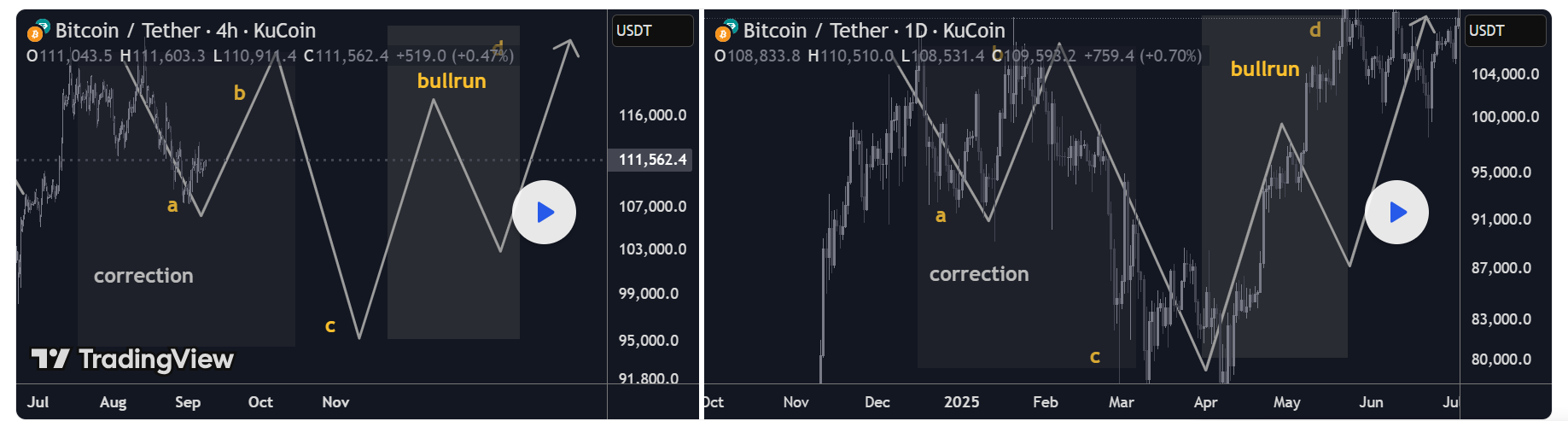

Bitcoin September 2025 Outlook: a/b/c price fractal structure

-

BTC enters September post-ATH with a seasonal headwind. Base case: a ~10% A-leg dip toward $108k, a B-bounce into ~$122k, then a C-flush near ~$94k—echoing April’s ABC rhythm. Once complete, the uptrend should re-assert into year-end.

BTC enters September post-ATH with a seasonal headwind. Base case: a ~10% A-leg dip toward $108k, a B-bounce into ~$122k, then a C-flush near ~$94k—echoing April’s ABC rhythm. Once complete, the uptrend should re-assert into year-end.

#Bitcoin #Seasonality #Crypto

#Bitcoin #Seasonality #Crypto🟠 Bitcoin September Outlook: Seasonality vs. Structure

After a fresh ATH, September’s historical bias skews mildly red. Base case is a ~10% A-leg dip that develops into an A/B/C correction before trend continuation. Think controlled pullback → consolidation → next markup.

️

️

️

️

️ Seasonality Snapshot (2015–2024)

️ Seasonality Snapshot (2015–2024)

• Mean (10-yr): −2.55% · Median: −4.52%

• Red months: 6/10

• Worst September: 2019 (−13.88%)

• Best September: 2024 (+7.39%)

• Last 3 yrs avg: +2.8% (2024 +7.39%, 2023 +3.99%, 2022 −3.09%)

• Last 5 yrs avg (2020–2024): −1.3%

Read: September has tended to be weak, but the last two years printed green. Seasonality is a headwind—not a handbrake. ️

️

🧩 Structure Thesis (Fractal Analog)

You’re looking for a repeat of April 2025’s A/B/C rhythm—scaled up:

• April 2025 reference: A ≈ $92k → B ≈ $106k → C ≈ $80k

• Now (projected):

o A ≈ $108k (≈ 10% pullback from recent highs)

o B ≈ $122k (relief rally / lower high)

o C ≈ $94k (final flush into demand, completing the correction) 🧱

Interpretation: A measured September fade aligns with the A-leg. A reflexive B-bounce can follow as funding resets and late longs get cleaned up, with a C-leg completing the pattern before the next expansion.

How Seasonality Supports the Call

How Seasonality Supports the Call

• Typical drag: Median −4.5% and multiple red Septembers justify a down-bias.

• Volatility window: The historical 21-point spread (best +7.39% vs worst −13.88%) means a 10% dip sits well within normal bounds.

• Cycle context: With a new ATH just printed, a shallow corrective phase is constructive—not bearish regime change.

🧭 Levels & Triggers

• Bias line: Momentum cools into $108k → watch for seller absorption and open interest reset.

• Relief cap: $122k acts as B-rally resistance; sustained closes above $122k would invalidate the ABC idea and argue for immediate continuation.

• Completion zone: $94k (C) is the buy-the-dip completion area; clean breaks below raise risk of a deeper time correction rather than a swift V-reversal. ️

️

🧪 What to Monitor (Confirmation/Invalidation)

• Liquidity & OI: De-leveraging into A, controlled OI rebuild into B, washout into C.

• Spot-ETF flows / stablecoin issuance: Weakening into A, stabilizing by late month supports B→C rhythm.

• Funding/basis: Overheated → normalize during A; negative spikes near C often mark capitulation.

• Breadth (alts): Underperform into A/C; broad risk-on breadth usually returns post-C.

Base Case Path (Textbook)

Base Case Path (Textbook)

September: drift to $108k (A) → bounce toward $122k (B) → final tag of ~$94k (C) → reset + markup into Q4.

(If price reclaims and holds above $122k early, treat that as trend continuation—not a correction.)

Risk Notes

Risk Notes

• Seasonality is a tendency, not a rule. Macro catalysts (CPI, policy, liquidity) can dominate calendar effects.

• This is market commentary, not financial advice. Manage risk and invalidation levels. ️

️