🍂 September Blues: Can Bitcoin Break Its Worst Month Curse?

-

September has always had a love–hate relationship with Bitcoin holders — well, mostly hate. Historically, it’s the weakest month for BTC, and 2025 is already living up to that reputation.

Historically, it’s the weakest month for BTC, and 2025 is already living up to that reputation. The Situation Right Now

The Situation Right NowBTC dipped to $107,270, clawed back to $110K, but traders still whisper about a $100K retest.

ETF outflows: $750M left U.S. spot ETFs in August — the second-worst month on record.

Institutional buying? Drying up. Demand is at its lowest since April.

Meanwhile, gold shines near all-time highs at $3,489, making Peter Schiff insufferable again.

The Trader’s Moodboard

The Trader’s MoodboardShort squeeze zone: $112K–$115K.

Psychological magnet: $100K (with whispers of a wick down to $94K).

Liquidity stacking: bids sitting heavy at $105K–$102.6K.

This is the kind of month where bulls and bears both end up staring at liquidation heatmaps like they’re horoscopes.

Macro Vibes

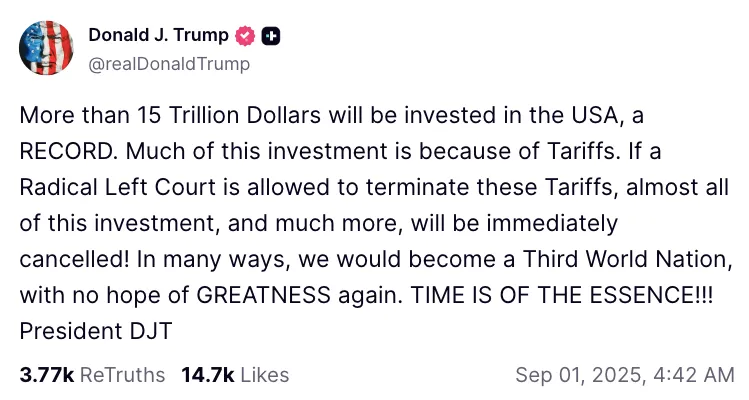

Macro VibesU.S. markets took a Labor Day nap while tariff chaos swirled.

Fed meeting on Sept 17 → 90% chance of a rate cut. That’s the real pivot point everyone’s waiting for.

Until then? Low-volume chop, high-volatility vibes.

The Lifestyle Angle

The Lifestyle AngleIf you’ve been in crypto long enough, you already know:

September isn’t for FOMO.

It’s for positioning smart, sipping your coffee, and letting the impatient get rekt.

Buy dips if you believe in the long game, or step aside and enjoy life while the market eats itself alive.

Because here’s the truth: Bitcoin doesn’t live by the calendar — people do.

So, what’s your September ritual?

So, what’s your September ritual?Stack sats at $100K like it’s Black Friday?

Chase the $115K squeeze for quick gains?

Or just unplug, hodl, and let the market play itself out while you enjoy the last days of summer?

-

Every September feels like a stress test for Bitcoin holders. The ETF outflows + low liquidity + macro noise make it the perfect month for shakeouts. Personally, I’m eyeing the $100K zone as a gift. If we wick down to $94K, even better — that’s where strong hands load while retail panics. September pain often sets up October rallies.

-

It’s wild how predictable seasonality is for BTC. September weakness + gold strength feels like déjà vu. The difference this time is ETF flows — even with $750M in outflows, demand still covers miner supply multiple times over. Once Fed cuts hit later this month, the tide could flip fast. Patience is everything here.

-

Honestly, I treat September like a forced holiday. No chasing squeezes, no overtrading chop. Just ladder bids at $105K–$100K, keep cash ready, and let the market do its thing. History shows October/November usually reward those who survive September without blowing up their account.