📉 Bitcoin Starts September Weak — $100K Retest on the Horizon?

-

Bitcoin has kicked off September (historically its worst month) with fresh volatility, testing local lows and sparking a battle between dip buyers and short sellers.

Key Developments

Key DevelopmentsNew local lows: BTC dropped to $107,270, briefly rebounded toward $110K.

Short targets: Many traders eye a flush toward $100K–$94K (psychological level + CME gap).

ETF outflows: August saw $750M in net withdrawals from U.S. Bitcoin ETFs — the second-worst month on record.

Institutional slowdown: Buying has dropped to its weakest pace since April, even as demand still covers ~200% of daily miner supply.

Macro headwinds:

Labor Day holiday closed U.S. markets.

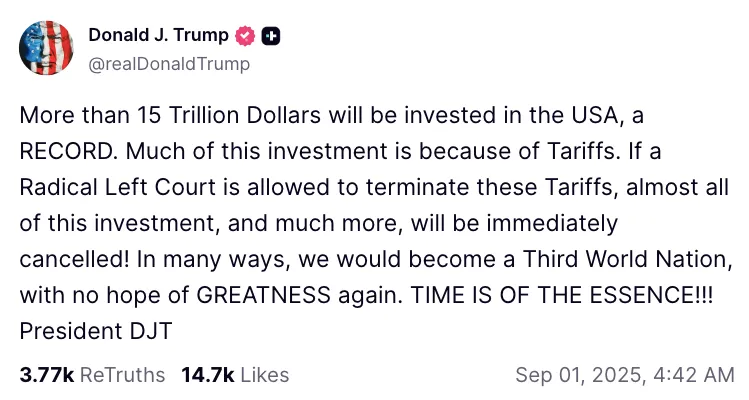

Tariff chaos after a federal court ruled Trump overstepped in imposing duties.

Fed expected to cut rates on Sept 17 (90% probability of a 0.25% cut).

🪙 Traders’ Playbook

CrypNuevo’s map:

$112K–$115K → short liquidations stacked.

$100K → key psychological support with long bids.

$94K → possible wick target to clear stops + close CME gap.

Liquidity zones: Order books show demand reappearing at $105K, $102.6K, and $100K.

Gold vs BTC

Gold vs BTCGold at $3,489/oz, close to ATH, fueled by inflation fears + rate cut bets.

Historically, September is gold’s second-strongest month — while Bitcoin usually struggles.

Peter Schiff (as always): “Gold breakout is very bearish for Bitcoin.”

️ Seasonality Check

️ Seasonality CheckAverage September return for BTC: –3.5%.

Even in bull markets, September rarely delivers fireworks.

This year marks the first post-halving “red” August, challenging the classic 4-year cycle thesis.

️ Big Picture

️ Big PictureBull case: ETF demand still > miner supply; any short squeeze above $112K–$115K could trigger fast upside.

Bear case: Seasonal weakness + institutional pullback + macro uncertainty could open the door to $100K or below.

Wild card: Fed’s September meeting. Liquidity injections from rate cuts could flip the narrative fast.

Question for the forum: With September’s track record, are you stacking bids at $100K–$94K or betting on a short squeeze back to $115K+ before the Fed?

Question for the forum: With September’s track record, are you stacking bids at $100K–$94K or betting on a short squeeze back to $115K+ before the Fed? -

This setup feels like classic September seasonality in play. Every cycle we get that “flush scare” before the next leg higher. Personally stacking bids in the $100K–$94K range — CME gaps have a way of getting filled, and I’d rather be patient than chase weak rallies.

-

ETF outflows + whale pressure + macro noise = perfect recipe for short-term pain. But bigger picture, demand still outpaces miner supply, and Fed cuts are coming. I’m not betting on a long squeeze yet, but any dip into $100K could be one of the last cheap entries of 2025.

-

Gold ripping to ATHs while BTC struggles is giving me 2019 vibes. But remember — once the Fed pivots, liquidity flows back into risk assets fast. For now, I’m hedged with some gold exposure, but keeping dry powder for BTC around $100K.