📉 Bitcoin Starts September Weak — $100K Retest on the Horizon?

-

Bitcoin has kicked off September (historically its worst month) with fresh volatility, testing local lows and sparking a battle between dip buyers and short sellers.

Key Developments

Key DevelopmentsNew local lows: BTC dropped to $107,270, briefly rebounded toward $110K.

Short targets: Many traders eye a flush toward $100K–$94K (psychological level + CME gap).

ETF outflows: August saw $750M in net withdrawals from U.S. Bitcoin ETFs — the second-worst month on record.

Institutional slowdown: Buying has dropped to its weakest pace since April, even as demand still covers ~200% of daily miner supply.

Macro headwinds:

Labor Day holiday closed U.S. markets.

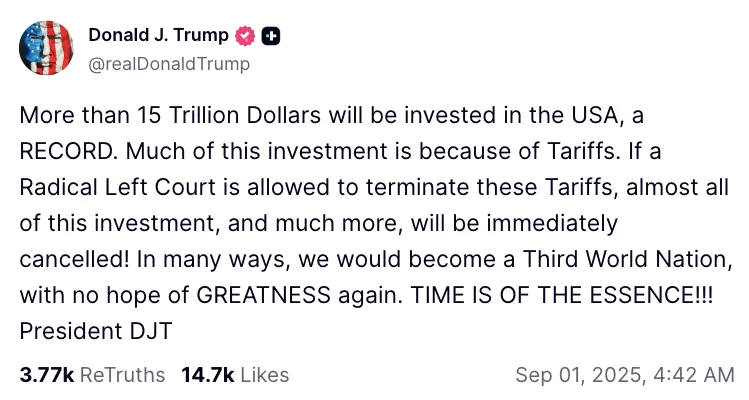

Tariff chaos after a federal court ruled Trump overstepped in imposing duties.

Fed expected to cut rates on Sept 17 (90% probability of a 0.25% cut).

🪙 Traders’ Playbook

CrypNuevo’s map:

$112K–$115K → short liquidations stacked.

$100K → key psychological support with long bids.

$94K → possible wick target to clear stops + close CME gap.

Liquidity zones: Order books show demand reappearing at $105K, $102.6K, and $100K.

Gold vs BTC

Gold vs BTCGold at $3,489/oz, close to ATH, fueled by inflation fears + rate cut bets.

Historically, September is gold’s second-strongest month — while Bitcoin usually struggles.

Peter Schiff (as always): “Gold breakout is very bearish for Bitcoin.”

️ Seasonality Check

️ Seasonality CheckAverage September return for BTC: –3.5%.

Even in bull markets, September rarely delivers fireworks.

This year marks the first post-halving “red” August, challenging the classic 4-year cycle thesis.

️ Big Picture

️ Big PictureBull case: ETF demand still > miner supply; any short squeeze above $112K–$115K could trigger fast upside.

Bear case: Seasonal weakness + institutional pullback + macro uncertainty could open the door to $100K or below.

Wild card: Fed’s September meeting. Liquidity injections from rate cuts could flip the narrative fast.

Question for the forum: With September’s track record, are you stacking bids at $100K–$94K or betting on a short squeeze back to $115K+ before the Fed?

Question for the forum: With September’s track record, are you stacking bids at $100K–$94K or betting on a short squeeze back to $115K+ before the Fed? -

The $94K CME gap is the elephant in the room. Historically those inefficiencies get closed, and September’s seasonality lines up too well. I’m stacking bids lower with patience — if we wick into $94K and recover, that’s the kind of shakeout that fuels the next leg.

-

I get the bear case, but the short squeeze potential above $112K–$115K is being underestimated. Order books are stacked with shorts in that zone, and one sharp move can cascade liquidations quickly. September might start red, but one Fed cut can flip the narrative overnight.

-

ETF flows are the tell for me. $750M out in August is ugly, but the fact demand still covers ~200% of miner supply shows there’s a floor forming. I don’t see a full-blown capitulation unless ETF demand collapses completely — dips into $100K could just be gifts.

The liquidity zones around $105K–$100K are key — I’m watching $100K closely for potential accumulation. A short squeeze above $112K–$115K could definitely trigger a fast move, but macro uncertainty makes me wary

The liquidity zones around $105K–$100K are key — I’m watching $100K closely for potential accumulation. A short squeeze above $112K–$115K could definitely trigger a fast move, but macro uncertainty makes me wary Dip buyers vs shorts at $100K–$94K — my plan: layer bids at $100K and ride any squeeze to $115K+ if momentum kicks in.

Dip buyers vs shorts at $100K–$94K — my plan: layer bids at $100K and ride any squeeze to $115K+ if momentum kicks in.